Mr Agha Hasan Abedi, a banker from Pakistan, attained international recognition as the President and founder of Bank of Credit and Commerce International (BCCI). Perhaps what Mr Abedi’s detractors could not really accept was that, coming from a small Asian country, and establishing an international banking group with a major global presence, he overstepped assumed limits in the colonial mind-set in the West. He was a visionary who opened a window into the future and into the ‘Possible’, for aspiring bankers of the Third World.

Personal profile

Mr Agha Hasan Abedi was born on 14 May 1922 into a Muslim family in Lucknow, a large city in northern India during the British colonial rule. His father was in the service of the Raja Sir Mohammad Ali Mohammad Khan, Khan Bahadur, K.C.I.E. of Mahmudabad, a noted politician, and a large landowner (zamindar) who was born in the princely state of Sitapur, Uttar Pradesh which together with the region of Uttarkhand was known as the United Provinces in British India. Its city residence was in Lucknow, the capital of Uttar Pradesh.

In early 1900 the Raja of Mahmudabad first conceived of the idea of starting a new university at Lucknow in Uttar Pradesh. The university was founded in Legislation for establishing the University of Lucknow passed in 1920 and teaching in the faculties began in 1921. The Raja contributed Rupees one lakh (one hundred thousand) (then equivalent of US$2.5 million) towards the capital funds.

At the University in Lucknow, Mr Abedi obtained a law degree and a Master's degree in English Literature.

Lucknow, the capital of Uttar Pradesh, is still the finest example of “Ganga Jamuni Tehzeeb” a popular phrase to describe the fusion of Hindu-Muslim culture and traditions. The city became North India's cultural capital, and best remembered epicentre of Muslim culture and refined and extravagant lifestyles of the ruling Muslim ruling princes and landowners, who were also patrons of the arts.

This was the environment that left a lasting impression on young Mr Abedi, an atmosphere of spirituality and romance rather than commerce.

Mr Agha Hasan Abedi gets into banking

Rather than pursuing a legal career, Mr Abedi decided on a career in banking. In 1946, he is reported to have travelled to Bombay (now known as Mumbai), British India's financial capital with a letter from his father's employer, the Raja of Mahmudabad, addressed to the owners of Habib Bank. He secured employment as a management trainee officer with Habib Bank where he had to first undergo comprehensive training in bank operations.

Early in Mr Abedi's youth when his father was in service as estate manager for the Raja of Mahmudabad, he learnt the importance of cultivating and maintaining relationships with wealthy and influential people. This was to serve him well throughout his banking career which ended for health reasons in 1988 at Bank of Credit and Commerce International (BCCI), by then one of the largest international banks he founded in 1972.

Mr Abedi recounted that his daily work schedule which often included visiting other places and carrying with him account opening forms to recruit new customers. He always returned after a successful trip with all forms completed to open accounts with Habib Bank.

Marketing for Mr Abedi was not about selling banking products alone. It was about people and relationships. It was about human needs and satisfaction. It was about interaction and change. It was about unity and goodwill.

Mr Abedi's approach to clients was to provide them with a personalised service and to continually nurture relationships with his clients. Through these relationships he successfully mobilised deposits and business for Habib Bank.

For Mr Abedi, marketing when it is practiced well is holistic, treating suppliers and customers, products, services and markets, with integrity both in the sense of honesty and in the other sense of treating them as a whole.

He emphasised this marketing approach to all the staff in the two large commercial banks he founded after he left Habib Bank.

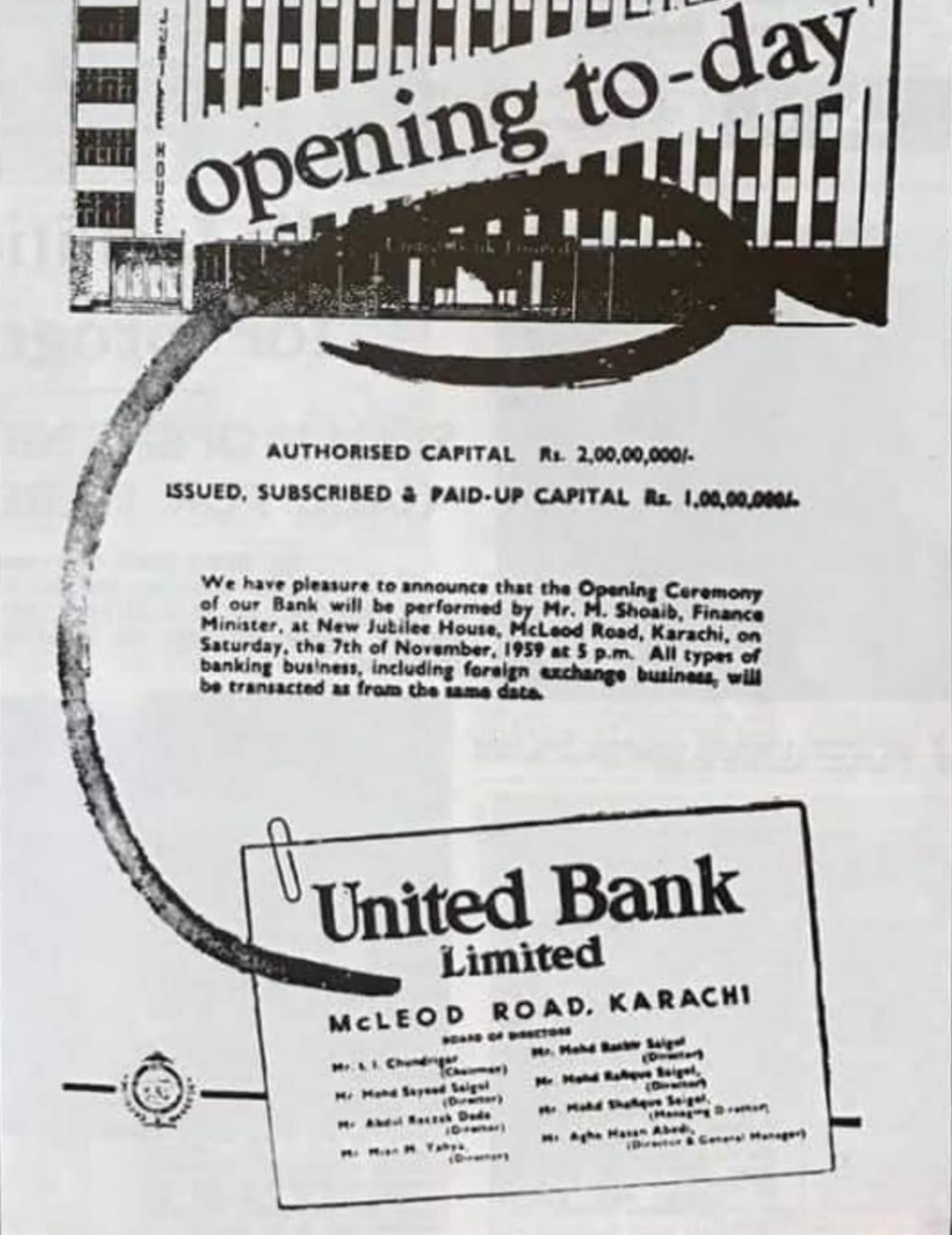

The first was United Bank Ltd established in Pakistan in 1959 to become the second largest private bank in the country before the bank was nationalised in 1972.

The second was Bank of Credit and Commerce International (BCCI) established outside Pakistan in 1972 when all banks in the country had already been nationalised, to become one of the largest international banks in the world according to geographical spread before the bank was shut down in 1991.

Move to Pakistan

In mid-August 1947 India was divided into two countries, India and Pakistan by the British colonial rulers when they were forced to quit India.

Habib Bank decided to move its headquarters in Bombay, India to Karachi, in western half of the newly created Pakistan which was secured as a homeland for Muslims who did not wish to remain in India.

A significantly large number of India's Muslim population still on Indian territory opted to move to Pakistan. Mr Abedi went also.

Mr Abedi worked at Habib Bank until 1958 and a year later he went on to establish United Bank in Karachi in Pakistan with the help of private investors. He was the President and Chairman of the Board until the bank along with the other privately owned banks in West Pakistan were taken over by the de facto government following the break-up of Pakistan in December 1971 after East Pakistan (now Bangladesh) became an independent country.

Move to United Kingdom

The Pakistan government take-over of the privately owned banks led Mr Abedi to conceive of establishing a multi-national bank with a global presence that could operate and expand outside the narrow confines of Pakistan's banking system.

As a result, Bank of Credit and Commerce International (BCCI) was established in September 1972 and registered in Luxembourg with its first branches in Luxemburg, London (United Kingdom) and Abu Dhabi (United Arab Emirates).

In 1973 Mr Abedi was able to come to London and formally took up the position as President of BCCI at the bank's Central Office, referred to as the Central Support Organisation (CSO).

As a person

Mr Abedi's extraordinary career as the founder of two major banks took him to the heights of achievement and he gained local and international recognition, yet he was known to be a humble and soft-spoken person whose discussions at the annual BCC conferences and global forums were also concerned with morals, submission to God, Humility and Service to Humanity.

Mr Abedi was, without doubt, viewed as a generous, caring and incredibly giving person; a person at the same time with great ambition and boundless energy whose vision was premised on building a globally engaged and globally relevant bank with a multi-national character, who dreamt big, who believed that every human activity has a moral basis, who believed in perfection, who confronted obstacles and did not give up on challenges he came across in life.

Mr Mohammad Ataullah, who was a senior manager in United Bank founded by Mr Abedi, and subsequently joined BCCI in the international officer cadre, recalled that while Mr Abedi was the President of the bank, he would advise the managers to read the book Jonathan Livingstone Seagull.

Jonathan is an ambitious seagull who has high dreams felt bored about the daily routine life. He believes in utilising life not only in search of food but for a higher meaning. He performs extremely difficult and dangerous exercises to break with tradition and free himself from the boring and rigid routine of the other seagulls in the Flock. He desires to go beyond the boundaries, to break all the records; he desires to change the status quo and to do what no seagull has ever dreamt of. Eventually he is banished by the Elder Gull of the Flock. From that point, Jonathan's spiritual life as a seagull starts. Although Jonathan faces many obstacles, he never gives up in order to achieve his dreams.

During Jonathan’s isolation after he was banished, till the momentous day he discovers himself carried up to a new design of survival, he meets a new mystical Flock of seagulls who hold the morals, objectives, and queries that Jonathan has taken all his life. In his new place, Jonathan experiences how a collection of people can consent for the development and promotion of every individual member of a group.

- Jonathan Livingston Seagull: Summary and Literary Analysis

- Jonathan Livingston Seagull: From the movie

- Jonathan Livingston Seagull: Quotes

- Jonathan Livingston Seagull a story

Like Jonathan the Seagull, there was a sense of youthful impatience in Mr Abedi to break the barriers to growth and self-development at Habib Bank where he started his banking career, and this led him to establish a new bank, United Bank. As President of the new bank he had freedom to exploit the capabilities of the staff, explore with them the hidden opportunities and play the 'Art of the Possible'.

As President of BCC

Mr Abedi as BCC President, travelled across the world with tireless energy motivating staff around the world to see the sense of possibilities, and cultivating and strengthening his personal relationships with important people that included high-ranking officials and heads of governments.

Mr Abedi enjoyed a special relationship with China that went beyond the area of banking. He fostered closer ties by facilitating China's business to expand with regular training programmes on international banking and foreign trade for Chinese banks and State corporations.

BCCI's presence in 73 countries at one time must have placed enormous burden and stress on Mr Abedi and put a huge strain on his health. But this never showed in him in the bank and before the public, he always appeared at ease with everyone and without pretension and appearing arrogant.

His approach in management

Mr Abedi achieved extraordinary results in a short time in the two banks that he established, United Bank Limited in Pakistan, later the Bank of Credit and Commerce International outside Pakistan.

Unity of moral and material

He was referred to by some as the man who added a touch of mysticism to banking.

Mr Abedi attempted to give precedence to nature over our own limited knowledge and wisdom and tried to align BCC with nature through humility, love and total submission to God. In doing he placed importance on the unity of the moral and material in BCC's dealings.

To Mr Abedi, the moral, which was equivalent to the laws and principles of Nature, governed all that was material. Hence, both must be acknowledged, treated and felt as inseparable. No corporation could assume its identity and its quality without becoming one with its moral substance.

In an interview on BCC that Mr Abedi gave in October 1982 to the MidEast Report, published in New York, USA, he explained, "We serve a purpose to society and then to humanity at large. We would like to serve God. We would like to obey His Will This is the distinction between us and other business institutions. We try to. serve society and humanity absolutely without any consideration for bias, caste, creed, colour, religion, or race".

Real Management

Mr Abedi evolved the concept of Real Management in BCC that called for joint personality of the management, multi-leadership and the Head Office assuming the support function, as against the control function. The practice of Real Management demolished the pyramid and replaced it by a balanced relationship between individual members of the management and between the units of operation in BCC.

It required decentralisation and relative autonomy which became feasible and beneficial only when it was balanced by the concept of joint personality and interfusion of energy psyche between units, regions and the Head Office and amongst individual members of the management, at all levels. There was no room for the creation of fiefdoms or entirely segregated units, unless they were interlinked and interrelated with each other and with totality.

The central message Mr Abedi conveyed to all the staff in BCC was that, more than just the banking aspect, he had founded BCC not only to make profit and to grow, but also there had been some more important objectives. He wanted BCC to serve a useful purpose, not only for the bank's shareholders, but also for the clients and all the bank's staff whom he affectionately addressed as the 'BCC Family'.

Giving

BCC was a commercial organisation. However, Mr Abedi talked about the moral objectives for the BCC group at management conferences. He expressed the need to help in some small way from the profits earned by BCC and felt it important to incorporate these objectives into the personal lives of the staff members (the BCCI family) by offering an amount to each staff member of every rank to give to a cause they considered worthwhile. This was just to bring out the desire of giving which he did not wish to become dormant in individuals.

Concern for the Third World

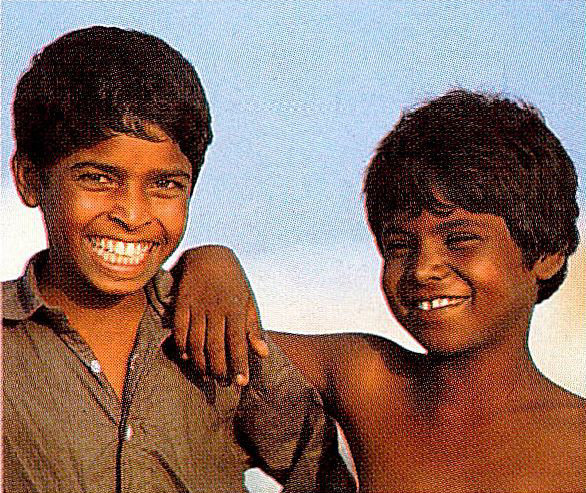

Mr Abedi strongly believed that the developing countries constituting the Third World had to have a sense of nationhood and develop a sense of self-reliance. They had natural resources, and, more important than that, they had the human resources. In his view, problems in the Third World countries could be resolved by themselves.

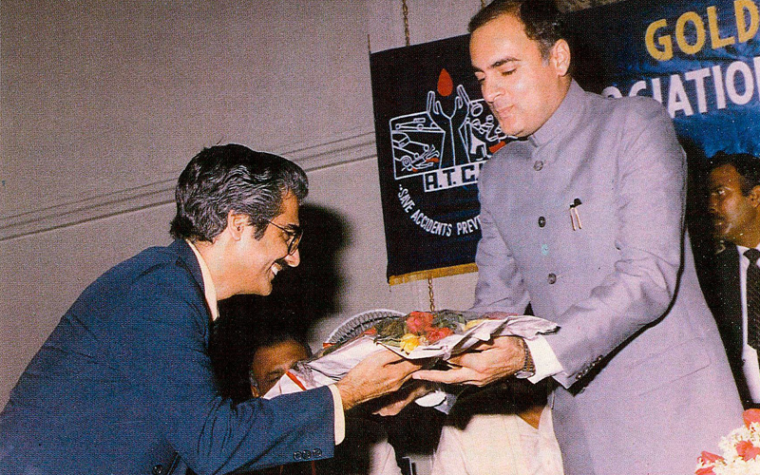

Mr Abedi's had a genuine concern for the Third World and this was reflected in providing funds from BCC to the Third World Foundation in London, United Kingdom to work for the intellectual, economic and social advancement of the people of the Third World, and the award of an Annual Third World Prize of US$100,000 to the individual or group who had made the year's most outstanding contribution to Third World development, especially in the economic, social, political or scientific fields.

He Mr Abedi was Chairman of the Board of Trustees of the Third World Foundation London and co-chairman of Global 2000 headed by Mr Jimmy Carter, former US President. Global 2000 was an initiative of the Carter Center founded by Mr Jimmy Carter and his wife, Rosalynn in 1982 in conjunction with Emory University in Atlanta, USA to advance "human rights and alleviating unnecessary human suffering. BCC contributed funding for the work of Global 2000 in China and in other developing countries.

Mr Abedi had also advocated the need for establishing setting up a Third World Bank to allow developing countries facing short-term liquidity and balance of payment difficulties to come out of the clutches of the IMF and World Bank. In fact, BCC extended short-term loans to certain developing countries to bridge over their liquidity crisis, and not having to depend on the World Bank/IMF.

Foundations

Mr Abedi set up BCCI Foundations in various countries that were funded by paying a portion of the BCC''s yearly profits. The payments amounted to millions of United States dollars and provided for health and education schemes.

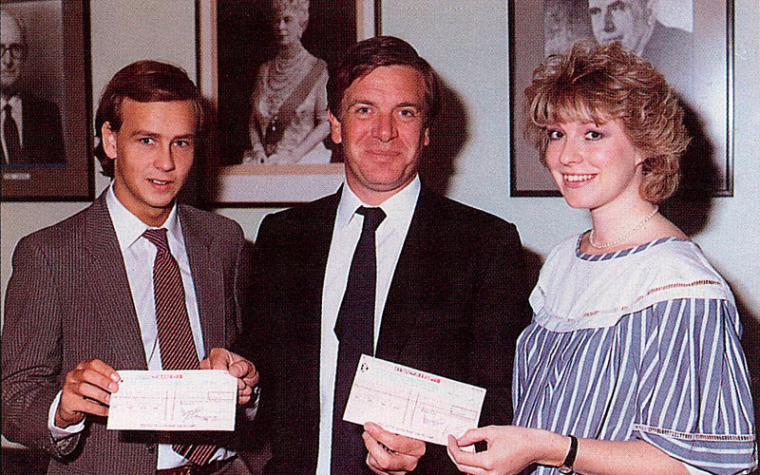

On education and scholarship, for example in the United Kingdom Mr Abedi alongwith Sir James Callaghan (elevated to Lord), former British Prime Minister, and others, was a trustee of the Cambridge Commonwealth Trust established in October 1982 to encourage students from Commonwealth countries to study at the University of Cambridge in UK. BCCI also funded a research unit established in 1985 by Lord Griffiths, who was at the time a senior policy adviser to former British Prime Minister Margaret Thatcher.

Concern for human survival

Mr Abedi was truly also a citizen of the world. At the conclusion of a symposium held at the United Nations in 1984, he addressed a distinguished audience of politicians, scientists, economists and businessmen and shared with them his thoughts in search for a new context on the vital issue of comprehensive security and common survival.

He urged that we must also consider the psychological dynamics of the arms race, which threatened the extinction of our civilisation and the virtual extermination of our species. Mr Abedi believed that humanity's greatest suffering was its moral and political schizophrenia.

Pope John Paul II, speaking in Hiroshima in 1981 referred to "conscious choice" that Mr Abedi believed is the key.

Mr Abedi stressed that we must not be sleepwalkers and quoted moving lines of the British poet, Arthur O'Shaugnessy "Would man but wake from out his haunted sleep Earth might be fair and all men glad and wise"

Mr Abedi proposed the establishment of a Foundation to create a new organisation which would be global in scope and universal in purpose. One of his ideas was to name the centre, The Centre for Comprehensive Security and Common Survival. The new Centre would be dedicated to spreading one simple truth around our global village: our trusteeship rather than ownership of the earth; the interdependence of all human people, whatever their nation, faith or ideology; the imminent threat of the extinction of life and the destruction of our shared habitat; the need for a new basis of cooperative relationships between governments and people; and most centrally of all, what Palme, the politician and statesman who served as Prime Minister of Sweden, called an idea of "common security" and what may be called ''comprehensive security''.

Mr Agha Hasan Abedi suffers sudden heart attack

Mr Abedi had a massive heart attack in February 1988 while he was on an official visit to Pakistan and suffered brain trauma and partial paralysis. He needed a heart transplant urgently, and it was his sincere admirers like former US President Jimmy Carter who ensured that Mr Abedi underwent a heart transplant operation without delay in London's private Cromwell Hospital that was set up by BCCI.

Mr Abedi's recovery was expected to take a very long time and it was uncertain whether he would ever be fit to return to work. His family decided to move him to Pakistan and live in their family home in Karachi until he recovered fully. However, Mr Abedi remained in his state of partial paralysis and with impaired speech until he passed away.

Relinquishes position as President of BCCI

Mr Agha Hasan Abedi formally resigned as BCC President in 1990 due to health and medical reasons. His resignation at the time was also prompted by a proposal for the restructuring the BCC Group of banks backed by the Abu Dhabi (UAE) majority shareholders of BCCI.

Mr Abedi, despite his health issues, accompanied the new BCCI management team to Abu Dhabi, United Arab Emirates to and made a personal appeal to Sheikh Zahed bin Sultan Al Nahyan, the Ruler of Abu Dhabi, to help the bank. Following Mr Abedi's personal appeal, Abu Dhabi extended a substantial financial package to BCCI and also increased their shareholding in the bank.

British Member of Parliament, Mr Keith Vaz, visit to Karachi, Pakistan and meeting with Mr Agha Hasan Abedi on 20 November 1991

Mr Keith Vaz, British MP, met with Mr Agha Hasan Abedi on 20 November 1991 at his home in Karachi, Pakistan. He was accompanied by Mr Raihan Mahmud and Mr Qaiser Malik, former managers of BCCI in UK and joint coordinators of the then Committee Representing the Employees and Creditors of BCCI (later the BCCI Campaign Committee), and Mr Joe Pratt employed as a young parliamentary apprentice by Mr Vaz. Also, present were Mr Abedi's wife, his daughter and Mr Nafees Zakaria, Pakistan protocol officer.

Mr Keith Vaz and his companions had earlier visited Abu Dhabi, United Arab Emirates and presented a letter to the Ruler of Abu Dhabi at the palace, on behalf of former BCCI employees and creditors.

A hand-written note of the meeting with Mr Abedi in Karachi was produced by Mr Vaz's young apprentice, Joe Pratt.

During the meeting that lasted for nearly one hour, Mr Abedi seated in a Victorian resting chair responded to questions by Mr Keith Vaz about what happened to the bank (BCCI), what he thought of what people and the media were saying about him, about his knowledge of fraudulent activity, what the bank meant for him, about the acquisition of First American Bank in USA, and other matters.

Mr Abedi also advised that he would be glad to meet and tell his side of the story to Lord Justice Bingham who was conducting a comprehensive inquiry into BCCI since inception and conduct of the Bank of England.

It was due to the efforts of Mr Keith Vaz MP that the UK government was forced to commission the inquiry following the dramatic closure of BCCI on 5 July 1991 by the Bank of England, supported by the government. He was the only Member of Parliament to genuinely sympathise with the plight of the former employees and creditors of the bank after he met a group of former UK employees on 5 July 1991 while waiting to receive a visitor in the Central Lobby of the UK Parliament.

Mr Abedi was not approached by Lord Justice Bingham to assist with the inquiry, and the Bank of England never contacted him about the allegations against BCCI.

Mr Abedi referred to Mr James Callaghan, former British Prime Minister, as the best friend he ever had, and to Sheikh Zayed as the only friend in the Abu Dhabi Royal Family

Joe Pratt also noted down his own impressions about Mr Abedi's home, and Mr Abedi himself. He found Mr Agha Hasan Abedi was "very alert and articulate", and despite his stroke and heart attack, and being moderately handicapped, had that "unique ability to be sincerely friendly, but not superficial, classy and not arrogant ... he was inspirational, with strong conviction, made people have a vision and believe that they could realise that vision".

Mr Agha Hasan Abedi passes away

On 5 August 1995 Mr Abedi died of a cardiac arrest in the Agha Khan University Hospital in Karachi, Pakistan.

When BCC was abruptly shut down on 5 July 1991 by western central banks there were allegations of wide-spread fraud against BCCI and the founder, Mr Agha Hasan Abedi.

There was no evidence that Mr Abedi or BCCI senior managers were involved in pilfering the bank and flaunting a false image of private wealth or financing an extravagant lifestyle.

Personal Charisma

By all accounts - ranging from statements made by important persons with whom he like Mr Jimmy Carter former US President to those who were at BCC at all levels - Mr Agha Hasan Abedi was a man of extraordinary personal charisma. That charisma was the bond that held BCC together as members of close-knit family.

Mr Abedi's had an extraordinary ability to motivate BCCI employees originating mostly from countries in the Third World to work exceptionally hard, the countries where the welfare of the people was being neglected by other banks from the West. This motivation was not exclusively in terms of profits and material gain in countries where the welfare of the people was neglected by colonial banks from the West, but to serve the poor, the underprivileged and the deprived in the cause of God.

Banking Profile

HABIB BANK LIMITED

Mr Agha Hasan Abedi decided on a career in banking after he obtained his Master's in English literature and a law degree from Lucknow University in British India. He joined Habib Bank in Bombay (now Mumbai) in 1946 as a senior selective service officer. At the time the bank was recruiting young trainee officers and Mr Abedi was among the first to be recruited.

Habib Bank origins date back to the 19th century. It started as family business known as Khoja Mithabhai Nathoo in 1841 in Bombay during British India to manufacture copper and brass utensils. In1891, a family member named Habib Esmail helped the business to become a major trading company dealing in brass, metal scraps and gold, and set up offices in Vienna (Austria) and Geneva (Switzerland), and also conduct business as a merchant bank.

In 1921, Mr Habib Esmail established Habib & Sons when his four sons joined the family business. Habib & Sons became Habib Bank Ltd which commenced operations in Bombay in 1941 as a public limited company with a capital of Indian Rupees 25,000 (eqv. £1,350 in 1940s).

The division of British India into two countries (India and Pakistan, with Pakistan in two parts) that took place in 1947, with Pakistan carved out as a homeland for Muslims who desired to have their own homeland. The Habib family owners of Habib Bank in Bombay (Mumbai) being Muslims, decided to move to Pakistan and established the bank's headquarters in Karachi, in West Pakistan. Karachi became the capital of the new country and also the commercial and business centre of the country.

By the mid-1900s, Karachi had already grown into an impressive trading post on the Arabian Sea. The British developed Karachi’s harbour and it became one of the busiest in India. The British also built a robust infrastructure (roads, bridges, hospitals, parks, railways, etc.); and introduced modern policing and city governing systems.

Habib Bank was Pakistan's first commercial bank with its head office on Macleod Road (now I. I. Chundrigar Road) Karachi, the financial and commercial centre of the city and of the country.

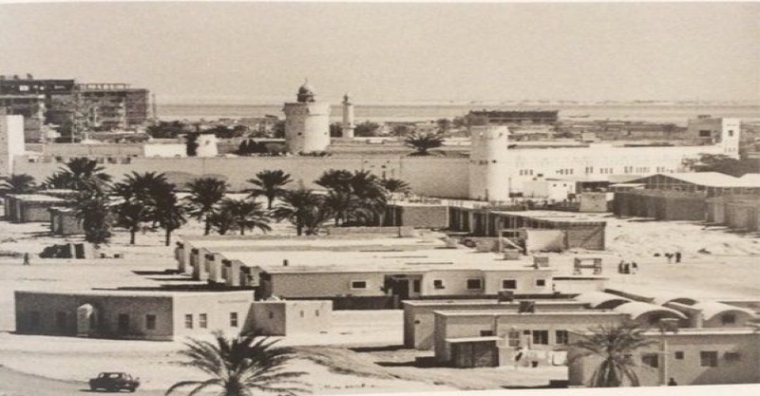

- Macleod Road Karachi in 1950

Mr Abedi in Habib Bank Pakistan

Habib Bank grew into a major financial institution in Pakistan that included Bangladesh (East Pakistan until December 1971). Mr Abedi climbed steadily through the ranks. Already he was demonstrating leadership qualities. During his 12 years with the bank, he held several managerial positions and then as executive responsible for business development at the head office. Mr Abedi developed important relationships in particular with Mian Yusuf Saigol while he was chief manager at the bank's branch in Lahore. The Saigols were of one of the families that came to dominate Pakistan's economy, and Mr Yusuf Saigol was instrumental in providing financial support to Mr Abedi to establish a new bank (United Bank) after he left Habib Bank.

The Habib family were from a very conservative background and this was reflected in their approach in business dealings. Their conservatism often clashed with the display of ambition and initiatives taken by Mr Abedi. He desired to demonstrate his skills and exploit every business opportunity to widen and increase the bank's client base. As would be reflected in later years in two major banks that Mr Abedi founded later, he had a flair for marketing with a persuasive ability to win over major clients and the skills to motivate those around him to work together.

Even in early days, Abedi created a niche for himself as a charismatic and dynamic banker, always thinking of new and innovative ways to banking and banking methodology which was alien to the region at the time. There was one instance where he would transport surplus cash from a small branch of Habib Bank to another one in Rawalpindi via horseback carriage called `taanga'. (Double Standards by Mubashir Malik, published 2016)

Another story about Mr Abedi relayed by the late Altaf Gauhar, renowned journalist and former Secretary of the State Bank of Pakistan, was that in 1957 there were hundreds of financial transactions that took place on a daily basis at the Karachi Municipal Corporation (KMC), yet there was no banking facility on the premises of the KMC. This triggered a sudden solution in the eyes of a young opportunistic Abedi whereby he approached Gauhar and offered his services from Habib Bank. When he was asked how long it would take for the branch to set up, the reply was 'tomorrow morning'. Lo and behold, the very next day saw the opening of Habib Bank in the KMC building foyer with a table, small safe, cloth and banner with a few chairs. Where the National Bank of Pakistan had demanded unrealistic terms for opening a branch, Abedi had spotted a potential opportunity and made it into a business relationship with the KMC. This was the beginning of a revolutionary and visionary career and a small glimpse into his wit and wisdom. (Double Standards by Mubashir Malik, published 2016)

Mr Abedi leaves Habib Bank

By the late 1950s Mr Abedi had reached a point of frustration that he felt no longer able to continue working at Habib Bank. The conservative Habib Bank family owners would appear to have grown uneasy in accepting Mr Abedi's ideas to relax the bank's lending policies to attract business for Habib Bank.

In 1958 Mr Abedi decided to leave Habib Bank in search for new horizons. A year later, with the backing of wealthy corporate clients he served in Habib Bank, he established a new bank in 1959 in Pakistan, the United Bank Limited.

It was rumoured that a reason for Mr Abedi’s departure from Habib Bank was the disapproval of the Habib family (the owners of Habib Bank) in Mr Abedi using his discretion to extend loans to (as part of his marketing efforts to attract new business. As chief manager at Habib Bank in Lahore, he is reported to have provided a sizable loan to the wealthy Saigol family without seeking prior authorisation of the Habib family. However, to Mr Abedi's credit and judgment, there were no reports that any of the borrowers failed to repay their loans to Habib Bank.

With the sound training Mr Abedi received in Habib Bank (then the largest private bank in Pakistan), his banking experience of nearly 12 years, and the close connections with wealthy business clients whom he served personally, he was becoming impatient to introduce his innovative ideas in a new bank and build a generation of young bankers working in a more open banking environment. A bank that would come to challenge the position that Habib Bank enjoyed as the largest bank in Pakistan.

UNITED BANK LIMITED, PAKISTAN

After leaving Habib Bank and a short period of isolation, Mr Abedi with his training and experience along with his networking skills at play together, secured the financial backing of the well-known Saigol family and other investors in Pakistan to establish a new bank in Pakistan in 1959, United Bank Limited. Mr Abedi was the first General Manager, in addition to being a Director and later designated President and Managing Director. He was also elected chairman of the Board while at the same time holding office of the President.

The Saigol family are one of the wealthiest families in Pakistan. They were an important client of Habib Bank through the close relationship developed by Mr Abedi.

In 1948, after the division of British India into India and Pakistan, the Saigols migrated from Calcutta, India and set up their business in Faisalabad, the textile city of Pakistan, under the banner of Kohinoor Industries Limited. The Saigol family own a group of companies and industries known as the Saigol Group, also known as the Kohinoor Group.

Mian Yusuf Saigol of the Saigol group was impressed when Abedi shared his proposal for establishing a new bank that would break the traditional limitations in Pakistani banking and make it the largest bank in Pakistan, and he agreed to invest the first Rs 25 million (eqv. US$5m at the time).

Mr Abedi's idea for the new bank

It is reported that the State Bank of Pakistan (the central bank) in granting permission to establish United Bank had concerns when Mr Abedi shared with them some of his progressive and innovative ideas for his new bank; the high salaries that would be paid to the employees, provision for generous facilities to them, modern open-plan offices, the extent of the automation that he would introduce in the banking operations, open a large number of international branches.

Establishment of United Bank Pakistan

The inauguration of United Bank’s first branch at Macleod Road (now I.I. Chundrigar Road) Karachi on 7 November 1959 marked the birth of the culture of personal banker, a culture of innovation and a culture of excellence. These were reflected in the modern look of the bank with open plan office spaces.

All the offices and branches of United Bank in both West Pakistan and East Pakistan (Bangladesh after December 1971), from the very beginning, always stood out as being distinctive and refreshing with marble floors and glass exteriors. The bank's well-dressed staff in suits also stood out in the marketplace.

Ruler of Abu Dhabi, United Arab Emirates

Mr Agha Hasan Abedi was one of the first to recognise the prospects presented by the Persian Gulf oil boom, and he pioneered strong economic partnership between Pakistan and the United Arab Emirates (UAE) in the private sector.

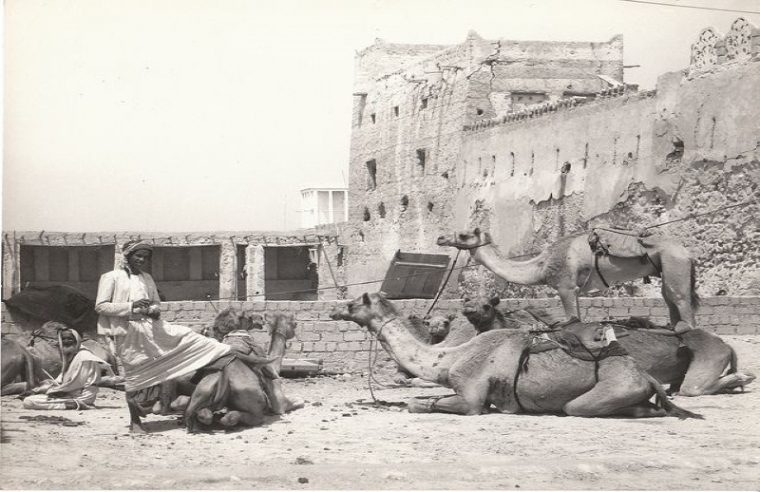

Oil exploration was already underway in the Middle East in the 1950s. The economy of the Arab states with elective monarchy was dependent on fishing and a declining pearl industry. In the early 1960s oil was discovered in the Middle East; the first was large oil and gas reserves in Abu Dhabi and next were small oil reserves in Dubai, a major trading hub for centuries even before oil was known to exist, and Sharjah which was historically one of the wealthiest places in this region with a settlement said to be in existence for over 5,000 years.

The first cargo of crude oil was exported from Abu Dhabi in 1962, and as oil revenues increased with growing oil production Sheikh Zayed became Mr Abedi's most prized high net worth client. Unlike other Arab states in the Middle East the ruling family owned all the land and natural resources of the Abu Dhabi state.

In the 1960s, there were no banks in Abu Dhabi and Dubai to serve the large Pakistan labour force working in these two states. The main bank in the region was the British Bank of the Middle East (BBME) that mainly provided banking services to the British expatriates and companies. Working and living conditions then were far from adequate.

In August 1966 Sheikh Zayed bin Sultan Al Nahyan was installed the ruler of Abu Dhabi by the British. However, they failed to pay attention to his desire to be taken seriously as an important world leader. By contrast, Mr Abedi viewed Sheikh Zayed to be a potentially important resource.

Mr Abedi began to cultivate a relationship with Sheikh Zayed, who had led a simple life of an Arab Bedouin. Through the late 1920s and 1930s, his thirst for knowledge took him into the desert, living alongside Bedouin tribesmen when he was initiated into the sport of falconry, which became a lifelong passion.

Mr Abedi made the decision to fly to Abu Dhabi in late 1966 soon after Sheikh Zayed became the ruler of Abu Dhabi and he secured permission to open a branch of United Bank to extend banking services for the large number of Pakistan workers and send back their savings to their families and dependants in Pakistan. About a year later, Mr Ashraf Nawabi, a colleague deputed by Mr Abedi, would develop a close relationship with His Highness Sheikh Rashid Al Maktoum, Ruler of Dubai and this led to United Bank opening a branch in Dubai to serve the equally large Pakistani labour force there.

The relationship with Mr Abedi and Sheikh Zayed grew closer during Sheikh Zayed's regular visits to Pakistan for long hunting trips with falcons in Pakistan’s sprawling deserts. Mr Abedi would ensure that United Bank catered for all the needs of Sheikh Zayed and his entourage during these hunting trips. When Sheikh Zayed decided to build his palaces in Pakistan and visit on holidays, Mr Abedi coordinated the building works and arranged for a grand reception at the airport, meetings with the Pakistan's leadership, and the upkeep of the palaces. The relationship between Mr Abedi and Sheikh Zayed would prove to be vital when United Bank was nationalised by the Pakistan government and Mr Abedi needed to raise capital to establish the Bank of Credit and Commerce International (BCCI) in 1972.

Importance of training for bank employees

Mr Abedi firmly believed that training was essential to equip bankers with technical knowledge and also to maintain the trust of customers of any bank. As President of United Bank, he was behind the formation of the first Staff College in Karachi to provide training to employees of all banks in Pakistan. Mr Abedi inaugurated the Staff College in 1964. In the opinion of Mr Abedi, the Staff College served a very good purpose. Besides the technical training received, the participants had the opportunity of looking at their institution from a broader perspective and got together with a large number of their colleagues. He did not believe in making people human machines like traditional bankers; he wanted them to grow as men of knowledge while also having knowledge about machines (he meant technical knowledge), which was the essential, development ability and the core of ability in banking.

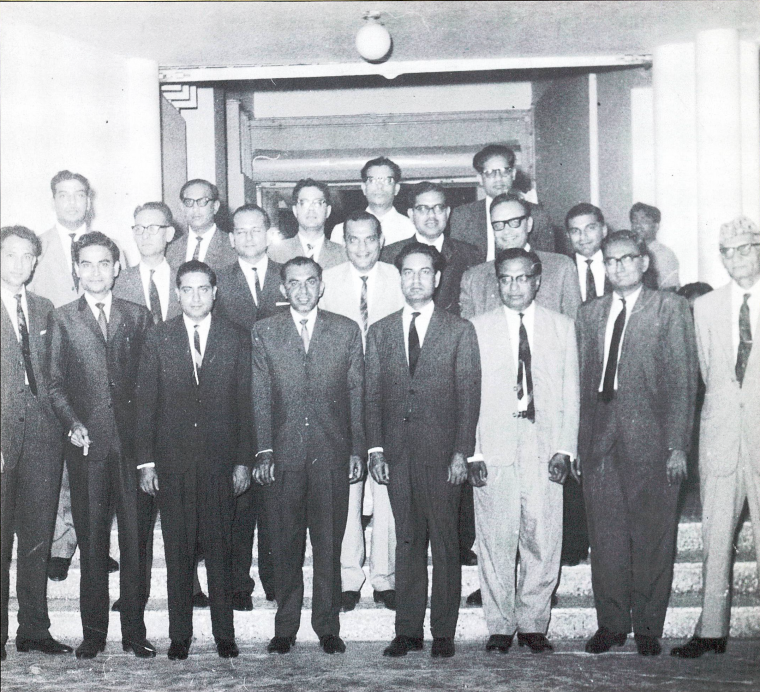

As part of the bank's growth and expanding network, fresh graduates were recruited regularly by United Bank in the officer grade, and some were the future managers. They first completed their training in banking at the Staff College while existing officers in all cadres attended refresher courses and seminars.

Progress of United Bank under Mr Abedi

Many experienced and senior bank officers and managers moved from Habib Bank to United Bank to work with Mr Abedi and they helped to set up the operations of the new United Bank with remarkable success.

United Bank, with Mr Abedi as President, introduced a number of modern practices in the banking sector in Pakistan. They were Pakistan's first bank to focus on opening branches outside the country to handle international business and short-term foreign trade transactions that were highly profitable and self-liquidating. This was in keeping with Mr Abedi's innovative ideas that he shared with the State Bank of Pakistan (central bank) before the banking licence was granted to establish United Bank Limited.

Apart from inaugurating the first Staff College for training bank employees in Pakistan, Mr Abedi also built a marketing culture in United Bank requiring officers and branch managers to also share a marketing responsibility and take ownership for the business growth and success of the bank. Mr Abedi required them to be smartly dressed in business suits and leave their office desks to personally call on prospective and existing important corporate clients at their place of business to discuss and review their business requirements. This was an innovation in banking when in traditional banks it was common for business clients to visit the banks.

By 1967, what had begun with Mr Abedi handling Sheikh Zayed's falconry and bustard-hunting trips in Pakistan and offering services to Pakistani workers in Abu Dhabi through United Bank, wound up with Sheikh Zayed entrusting the investment of a large part of his wealth to Mr Abedi. This relationship had greater significance for United Bank when in 1968 the British announced their withdrawal from the Arabian Gulf and Sheikh Zayed stepped to action to quickly establish closer ties among the other states (emirates) in the region. Together with the Ruler of Dubai, Sheikh Rashid bin Saeed Al Maktoum, Sheikh Zayed called for a Federation that led to the founding of the United Arab Emirates (UAE), a federation of seven Arab states (emirates). He served as President of the UAE since the formation of the Federation on 2 December 1971.

Important initiatives at United Bank under Mr Abedi

- In 1960 United Bank launched a saving scheme for school going children in Pakistan.

- In 1961 United Bank was the first Pakistani bank to have an overseas branch in William Street in the banking district of London, United Kingdom. The bank went on to open its branch in Abu Dhabi, United Arab Emirates and establish a wholly-owned banking subsidiary in Switzerland in 1967, a branch in Bahrain in 1969, and a branch in Doha, Qatar in 1970.

- In 1967 United Bank introduced computer banking in Pakistan with the first IBM 360-40 computers.

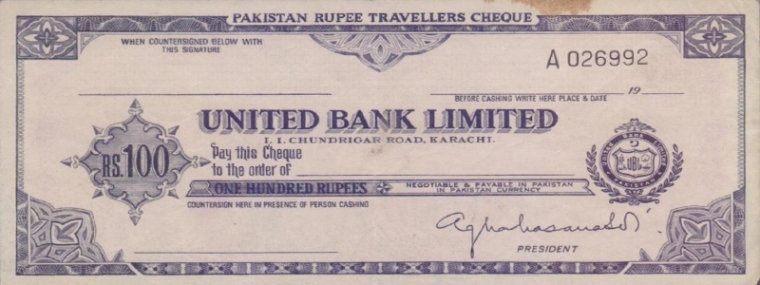

- In 1971 United Bank launched three online branches in Karachi, Pakistan, and introduced the Pakistan Rupee Travellers Cheques, the first credit card and the UNICARD.

Management approach

Mr Abedi believed much before he founded BCCI in 1972 that every person should have the fullest opportunity and freedom to assume responsibilities on the one hand and to take the pressures of work on the other hand to whatever extent he may like. Where people are allowed to develop uninhibited by pressure of delegated authority and by sheer merit and ability. In this concept of management, there were two central points, namely that each person in the institution should move around objectives rather than dances to the tune of authority so that the character of the institution would not be enfeebled "be enfeebled by the peevishness or bogged down by the ego or neurosis of one man", and through the collective skills and merits of its staff the spectrum of a joint personality would evolve. Bank officers and branch managers should also have an instinct for marketing and reach beyond their limited vision of the importance of client relationships and appreciate the full potential of the market-place.

Leaving United Bank Limited

United Bank was already poised to become the largest bank in Pakistan, but political conditions in the country after the independence of East Pakistan as Bangladesh in December 1971 were making it apparent to Mr. Abedi that the remaining part of Pakistan known as West Pakistan could not form the basis for a bank of the size and international presence which he had visualised.

The political and deteriorating economic conditions in (West Pakistan) after 1971 forced the government in de facto the new Pakistan, to intervene and bring stability in the financial sector. It was followed by the nationalisation of 15 private banks and the Government took control of the shipping and oil industries placing almost all financial institutions and major industries in the hands of the Pakistan Government. This was in line with the threats made by Mr Zulfikar Ali Bhutto before he became the new President Martial Law Administrator of Pakistan on 21 December 1971 after the loss of East Pakistan.

As a result of privately owned banks coming under government control, there were constraints on Mr Abedi's progressive management style and fulfilling his ambition for the growth of United Bank under government control. The heads of the private banks, including Mr Abedi, were kept under house arrest. From that time on, Mr Abedi began devoting most of his time on plans to implement his vision for a first global multi-national commercial bank incorporated outside Pakistan. It is said that when Mr Bhutto learnt about Mr Abedi's ideas, he ordered Mr Abedi's passport to be seized and prevented him from leaving the country.

Mr Abedi was to eventually obtain the release of his passport and he left for London few months after Bank of Credit and Commerce International was established in 1972.

United Bank privately owned again

Privatisation deliberations in Pakistan started in 1988. Two banks Muslim Commercial Bank (MCB) and Allied Bank Limited (ABL) were privatised in the decade of 1990 to 2002. United Bank Limited (UBL) returned to the private sector in 2002. The drive for innovation and modernisation that Mr Abedi, the founder, inspired was still intact.

In 2020, United Bank led the banking and financial services sector in Pakistan, with a customer base of reportedly over 4 million, the bank had Pakistan’s widest network of over 40,000 customer touchpoints; this includes more than 1,400 branches, above 37,000 Omni Agents and over 1,400 ATMs. The bank has a presence in four continents. The bank in its pioneering role continues in online banking with its UBL Omni platform on which customers across the world have 24/7 access to their accounts.

In 2017 the bank was declared Pakistan’s ‘Best Bank for Corporate Finance & Capital Market Development’ at the Pakistan Banking Awards 2017.

In 2016 the bank had won the 'Innovation Award' at the Mastercard Forum in Budapest, Hungary.

BANK OF CREDIT AND COMMERCE INTERNATIONAL (BCCI)

After banking was nationalised in Pakistan, and with it the United Bank Ltd, Mr Agha Hasan Abedi formed the Bank of Credit and Commerce International (BCCI) with the Bank of America NT & SA, a major bank in U.S.A., as a key shareholder. BCCI became part of the BCC group of banks known as BCCI Holdings (Luxembourg) SA, along with other subsidiary and affiliated banks that BCCI established around the world.

Mr Abedi's vision was to set up an international bank that would be different from the large established international banks from the West whose "real motive is simple and selfish. Set up offices in different countries, secure the business of their national companies based in that country – US, British, French, whatever…then serve some high net worth business men is such countries (who find it a matter of prestige to be having a Foreign Bank as “their banker”) and then take all their local profits back home to distribute it to their shareholders" (The Rise And Fall Of The Largest 3RD World Bank by Masihur Rahman).

.png) With the close relations Mr Abedi built while he was President of United Bank Limited Pakistan, with Sheikh Zayed bin Sultan Al Nahyan, the Ruler of Abu Dhabi, and President of United Arab Emirates, he secured part of the initial capital of US$2.5 million from the Abu Dhabi Royal family to establish BCCI. It was still early days of the oil boom in the Middle East and major banks like the Bank of America were hesitant to commit to establishing a direct presence. In such a situation Mr Abed persuaded Bank of America, Los Angeles, USA to also be a shareholder and benefit from the business BCCI's branch network generated in the United Arab Emirates and other countries in the region.

With the close relations Mr Abedi built while he was President of United Bank Limited Pakistan, with Sheikh Zayed bin Sultan Al Nahyan, the Ruler of Abu Dhabi, and President of United Arab Emirates, he secured part of the initial capital of US$2.5 million from the Abu Dhabi Royal family to establish BCCI. It was still early days of the oil boom in the Middle East and major banks like the Bank of America were hesitant to commit to establishing a direct presence. In such a situation Mr Abed persuaded Bank of America, Los Angeles, USA to also be a shareholder and benefit from the business BCCI's branch network generated in the United Arab Emirates and other countries in the region.

BCCI was registered in Luxembourg in 1972 and started operations with branches in Luxembourg, Abu Dhabi (United Arab Emirates) and London (United Kingdom). London was to be the location for the bank's Central Office (also known as the Central Support Organisation, CSO in short) that carried out all the functions of the Head Office.

Over the years BCCI expanded it banking operations through its growing network of branches and establishing subsidiary and affiliate banks around the world, and collectively was known as the BCC Group, BCC in short. In addition, BCC established a number of associated companies where BCC did not have a licence to open a bank.

BCC entered the global market establishing a presence in 73 countries at one time, making BCC the third largest bank in the world by country coverage, and the world's seventh largest private bank by deposits.

Mr Abedi was President of BCC from 1972 but in 1990 he resigned for health reasons following a massive heart attack and undergoing a heart transplant operation in London in 1988 that left him partly paralysed.

Mr Abedi was taken by his family to live and be cared for in Karachi, Pakistan where he died of cardiac arrest (heart failure) in 1995.

BCCI shut down

BCC was shut down abruptly on 5th July 1991 by the regulators principally in USA and UK, under a cloud of allegations and a criminal culture from top to bottom. The controversy surrounding the closure BCC continues, with theories about political motivations and the colonial mind-set of regulators in the West that felt threatened by the rise of bank dominated by Arab shareholders and the success of bankers whose origins were the Third World.

The BCC story made international headlines on the abrupt shut down of the BCC Group and spawned several books without the authors meeting their moral obligations to conduct independent research and investigate the facts in the allegations against BCC before publishing their books. The glaring media reporting in the Western press repeating wild allegations against BCC was perhaps intended to justify the abrupt shut down of BCC, the largest and one of fastest growing international bank representing the Third World, and to leave the public with a final impression of a corrupt and bankrupt bank that was formed to engage in criminal activities and to defraud the bank's depositors.

No serious research analysis was carried out to establish the truth, considering that the Liquidators of BCCI have paid depositors almost all the monies they had with BCC worldwide, and in few cases they paid more. The depositors in the U.S.A. did not lose any money.

There is also no documented case involving monies siphoned off from BCC by the President Mr Agha Hasan Abedi, and other management executives to enrich themselves or their families.

Acknowledgement:

In-house Magazines

Searches online