France’s trade and monetary relations with is former African colonies made Paris a financial hub for Francophone Africa. With Paris also a major industrial country, it was essential for Bank of Credit and Commerce International (BCCI) to have a presence primarily to serve its branches in Francophone Africa and also develop a client base in France.

Country Information

France, officially the French Republic, in Western Europe, was bordered on the northeast by Belgium and Luxembourg, on the east by Germany, Switzerland and Italy, on the south by the Mediterranean Sea, Spain and Andorra, on the west by the Bay of Biscay in the Atlantic Ocean, and on the northwest by the English Channel that separates France from the United Kingdom.

Monaco was an independent enclave on the south coast, while the island of Corsica in the Mediterranean was considered an integral part of France.

The extended territory of France referred collectively to all land under France’ sovereignty outside mainland France (the French Overseas Territories) included French Guiana in South America, Saint Pierre and Miquelon in the North Atlantic off the coast of Canada’s island of Newfoundland, The French West Indies located in the Antilles islands of the Caribbean in the west Atlantic Ocean, and many islands in the Pacific Ocean and the Indian Ocean.

Paris was the capital of France, and one of the world’s preeminent cultural and commercial centres, and a financial hub of its former French colonies in Africa – Francophone Africa.

History

The original inhabitants of France were a Celtic people known as the Gauls. It is believed that the Celts were a collection of tribes which originated in central Europe.

At one time, France became part of the Roman Empire. Later, it was con-quered by a Germanic tribe known as the Franks in the late 5th century AD. It was from the Franks that France gets its name.

France was known for many things in history, including being the centre of European culture for centuries, the French Revolution (1789-1790) inspiring the growth of revolutionary movements, the Enlightenment during the 18th century contributing to reformism and new philosophical ideas, and the birthplace of the French language.

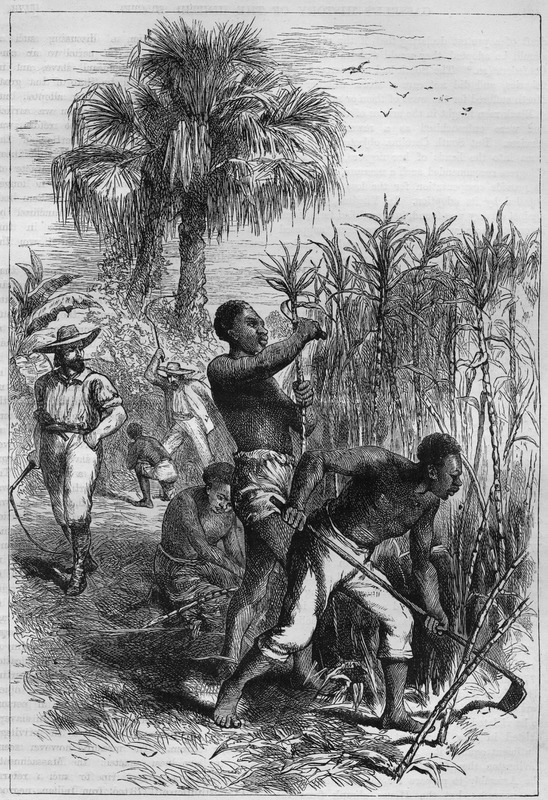

The French were one of the largest slave traders, and reportedly transported nearly 1.4 million captives from Africa to work mostly in France’s colonies in the Caribbean, under very harsh conditions.

A major goal of the French was the Mission civilisatrice. 'Civilising' the populations of Africa, through the spreading of the French language and Catholicism. Mr Jules Ferry, who was Prime Minister of France from 1880 to 1881 and 1883 to 1885 and a promoter colonial expansion, stated in 1884: "The higher races have a right over the lower races, they have a duty to civilise the inferior races”.

France sent small number of its citizens to settle in its empire, with the notable exception of Algeria, where the French took power with the invasion of Algiers, the capital, in 1830s.

In 1792, France abolished the absolute monarchy that had ruled the country for nearly 950 years and was declared a Republic. The last, the Fifth Republic, was promulgated on 28 September 1958.

In 1792, France abolished the absolute monarchy that had ruled the country for nearly 950 years and was declared a Republic. The last, the Fifth Republic, was promulgated on 28 September 1958.

The French African colonies secured their independence beginning in 1959.

Population and language

When the Bank of Credit and Commerce International (BCCI) was established in France, the country’s population was in the region of 55 million.

The main ethnic groups in France were the Celtic and Frankish peoples. Minor ethnic groups included generations of migrants that arrived from French colonies, like Algeria, Morocco, Tunisia, Mali, Senegal Democratic Republic of the Congo, Caribbean (African), and Vietnam, Laos, Cambodia (Indochinese).

French was the official language.

Economy and foreign trade

From an economy based on inefficient agriculture and small-scale family enterprise, France had moved forward after the Second World War (1939-1947) to join the ranks of the most advanced industrial countries.

After colonialisation ended in 1960, France remained a major trading partner with its former African colonies who continued to be dependent on France. Through a shared currency: the CFA-franc, the foreign reserves of the participating countries were held at the French Treasury in Paris.

France’s key industries were machinery, chemicals, automobiles, metallurgy, aircraft, electronics, textiles, food processing, and tourism.

Foreign trade in 1982:

Main exports: machinery, non-electric, motor vehicles, chemicals, food, iron and steel, electrical machinery.

Imports: crude oil, machinery, food, chemicals, motor vehicles, iron and steel, textile yarns and fabrics, non-ferrous metals, instruments, petroleum products.

BCCI in France

Following the independence of its African colonies beginning in 1959, France remained a major trading partner the new French-speaking countries.

Another development was feature was the franc zone, a currency union that fixed the currencies of most of these countries to the French France. The close monetary cooperation resulted in close informal, family-like relation-ships between French and African leaders.

Bank of Credit and Commerce International (BCCI) had branches in three locations.

In addition, the BCCI Regional Office was in Paris delegated by BCCI’s Central Office in London, with the responsibility for first oversight of the BCCI team and business in French-speaking African countries, Francophone Africa.

BCCI's Regional Office was involved in the following matters:

- Learning the French language by BCCI officers assigned to work in France and Francophone Africa for the first time. This involved attending language classes or living with a French family.

- Providing training and development for BCCI family members in Francophone Africa.

- Holding regional marketing and management meetings and conferences.

- Attending to important officials and leaders visiting France from African and Middle East countries.

PARIS

BCCI Paris branch along with the BCCI Regional Office was a central component of BCCI Francophone Africa operations.

Apart from the Paris branch’s local operations in France, it assisted on transactions of BCCI branches in Francophone Africa. It encompassed dealings such as foreign exchange, investments, letters of credit, short-term finance of foreign trade, handling remittances, issuing guarantees, and serving other needs of the French multi-national companies to establish stronger relationships with them.

BCCI’s foreign trade experience was highly respected and enjoyed an enviable reputation across the African continent.

The branch was located at:

125 Avenue des Champs-Elysees

75008 Paris

Telephone: (331) 4069 7200

Fax: (331) 4720 5643

Telex: 611710 BCCI P

BCCI’s Hospitality

.jpg)

The People's Bank of China (the central bank of China) sent a management delegation of four officials to Paris in 1987 for a study tour arranged by BCCI representative office in Beijing, China. The four officials, all from the central bank’s Shenzhen branch, were Mr Luo Xian Rong, general manager, Mr Wu Wen Fa, manager, foreign exchange administration department, Mr Han Long Nian, deputy manager, finance administration department, and Mr Li Nan Feng, office manager.

During their stay the officials visited BCCI Paris branch and met people from the Association Francaise des Banques, the Bank of France (Central Bank of France), the French stock exchange and various French companies working in China. They also held detailed discussions on investment possibilities in China, fund repatriation problems, local regulations and other topics.

BCCI arranged presentations for the Central Bank of China officials that included the French banking system, by Mr Charles Cornut, banking affairs manager of the AFB; the ruling system of the Bank of France; and the stock exchange and financial market, by Mr Marc Outin from the foreign affairs department of the Paris Stockbrokers' Association.

On return to China Mr Luo Xian Rong, general manager of the central bank, wrote to express the appreciation of the team.. He said that the deep understanding and friendly relationship between the People's Bank of China and BCC had been strengthened by a better understanding of BCCI's business expansion and management system, and of its support of the foreign trade of Third World countries and the modernisation of China's economy.

MARSEILLES

Marseilles was the second largest city in France and by far the largest port.

The city’s population was a mixture of French, Spanish and Portuguese nationals, and mainly Algerian, Tunisian, and Moroccan immigrants.

From its early days, Marseilles s prospered from busi¬ness with Italy, the Middle East, Africa and the Far East.

For the reasons stated, and because of Marseilles' unique position in France by the port, and importance much more as a centre of trade and commerce, that BCCI opened its second branch in the city in November 1980.

.jpg)

The branch was located at:

26 Place Castellane

13006 Marseilles

Telephone: (33) 9137 4418

Fax: (33) 9137 2740

Telex: 430785 BCCI M

.jpg)

Marseilles had a heavy industry and shipping that were the main activities in the city, with over 13,000 separate industrial firms, and a thriving dockside.

Because of Marseilles' excellent and long-established contacts with the Middle East and Africa, BCCI Marseilles was able to offer unrivalled facilities to companies trading with those areas, in addition to offering immigrants a speedy remittance service to their home countries.

CANNES

Located on the French Riviera with luxury seaside resorts, the city of Cannes was known for its association with the rich and famous, its luxury hotels and restaurants, and for several conferences and the annual Cannes Film Festival.

The branch was located at:

Gray D'Albion,

17 La Croisette

F 06400 Cannes

Telephone: (3393) 9338 2343

Fax: (3393) 461391

Telex: 298 6620 F

Central to the activities of BCCI’s branch in Cannes was attending mainly to important officials, high net worth individuals and leaders from Africa and Middle East, visiting France's luxury seaside resorts around Cannes.

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west de-cided to freeze BCCI Group's assets and abruptly shut down BCCI's oper-ations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private in-vestors or another bank.

BCCI branches in France were closed and placed in liquidation. No fur-ther information is available.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hard-est on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)