The opening of the representative office of Bank of Credit and Commerce International (BCC) in Lisbon, Portugal, the world's premier trading port at one time, represented a long term strategic move to explore the country's trade connections with its former colonies in Africa, Latin America and Far East, in particular Angola and Brazil.

Country information

Portugal, officially the Portuguese Republic, Portuguese República Portuguesa, is situated in the far south-west of Europe bordered by Spain, and looks onto the Atlantic Ocean. The capital is Lisbon.

Lisbon was the capital of Portugal, and one of Europe's oldest and most charming cities, and the world's premier trading port throughout the 14th and 15th centuries.

History

History

Portugal was once continental Europe’s greatest power.

Its history is the combination of the story of Iberian tribes of southwestern Europe, Celtic peoples of western Europe, the Roman Empire, Germanic kingdoms of northwestern and central Europe, Muslim invasions and the consequent Christian Reconquista (battles by Christian states to expel the Moors whose main power base was in Spain from where they controlled Portugal), and finally, of the Exploration of the World when the Europeans began exploring the world by sea in search of new trading routes, wealth, and knowledge.

Much of the Iberian Peninsula of which Portugal was a part, was under the control of the Muslim Moors for nearly 600 years (711-1294) left a lasting legacy on the Portuguese language, agriculture, and architecture, in the form of aqueducts, mosaic tiles (the famous ‘azulejos'), calcada pavements, as well as in art, food and culture.

The Christians reconquered the lands from the Moors.

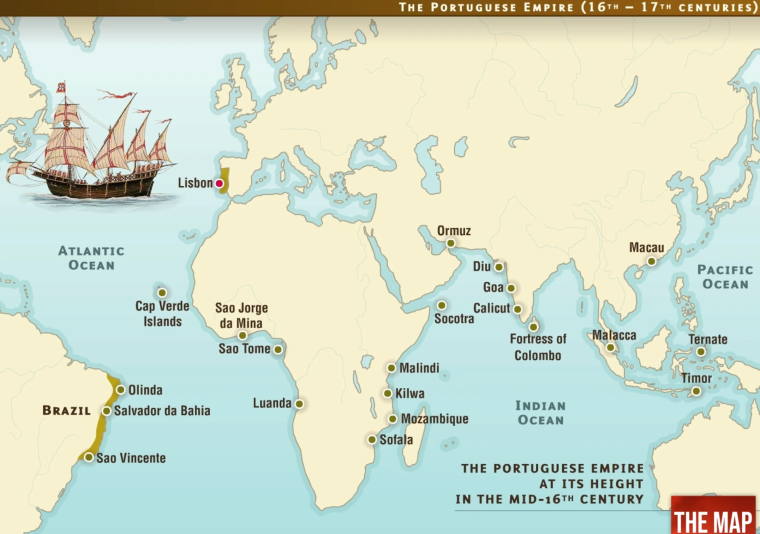

As far back as the 14th century Prince Henry (Henrique), better known as Prince Henry the Navigator, sailed from Portugal, establishing long term trading agreements with large parts of Africa, India, China and even Brazil.

Prince Henry's expeditions was reported to have started the process of European colonisation and the transatlantic slave trade.

The decline of colonialism and the ravages wrought in Europe by the army of Napoleon Boneparte of the French Republic and Portugal was occupied during the Naploeonic wars.

The country's economic and political background was rebuilt, as the government prepared to take Portugal into the European Economic Community (EEC) in 1984.

Population and language

In 1982 the estimated population was 9.9 million, when BCCI came to Portugal.

Portuguese was the official language of Portugal. It was also spoken language in Brazil, Angola, Cabo Verde, Guinea-Bissau, Mozambique, São Tomé and Príncipe and East Timor occupying half the island of Timor in Indonesia. It was also used in Macau (China), territory under Portuguese administration until 1999, and in Goa (India).

English was widely spoken.

Economy in the 1980s

The structure was a mixed economy, with a large agricultural labour force, but with manufacturing making up about one-third of the gross domestic product. Tourism was important.

Many Portuguese migrated to other European countries because of lack of opportunity. Their remittances to their home country helped Portugal’s foreign exchange position.

The main exports were textile yarns and fabrics, clothing, chemicals, wines and spirits, electrical machinery, fruit and vegetables. The main imports were crude oil, machinery, food, chemicals, motor vehicles, textile fibres.

BCCI in Portugal

Lisbon, as Portugal’s capital and port city, was the centre of the country’s trade and commerce. Bank of Credit and Commerce International SA (BCCI) opened a representative office in 1982.

Following the trend towards new trade and development, the banking system in Portugal had also experienced a renaissance and BCCI played a part in facilitating business of Portugal's own nationalised banking establishments with the territories with Portuguese influences, such as Macao and Brazil where BCCI had branches.

The country’s accession to the European Economic Community (EEC) was the beginning of the privatisation process, the Portuguese banking system underwent significant changes from the middle of the 1980s onwards and the reprivatisation of most banks took place after the end of the 1980s.

Under Portugal's nationalised banking system prevailing in the early 1980s, BCCI opened a Representative Office in Lisbon in 1982.

Mr Lloyd George da Silva of BCCI Paris was the first to be nominated to manage BCCI's Representative Office in Lisbon.

In a simple but historically significant ceremony in April 1982, Mr Iqbal Rizvi, senior executive at BCCI’s central office in London, explained the bank's objectives, and the role it could play in Portugal's growing economy.

BCCI Lisbon Representative Office was located at:

Rua Castilho 39-11-F

1200 Lisbon

Tel: (3511) 65736

Telex: 533 596 BANKOMP

Stemming from the Moorish influence on Portugal, strong links bound the country to the Middle East and North Africa where the Portuguese held a physical presence for over 400 years. These powerful ties were not overlooked by the Lisbon Representative Office in promoting BCCI’s strengths in benefiting from soliciting foreign trade business of the Portuguese banks for BCC’s expanding network primarily in the developing countries.

BCCI closure

On 5 July 1991 the Bank of England and other central bank regulators in the west decided to freeze BCCI Group's assets and abruptly shut down BCCI's operations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

BCCI Lisbon representative office did not provide any banking services in Portugal and would have ceased its activities after the announcement of BCCI's closure.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)