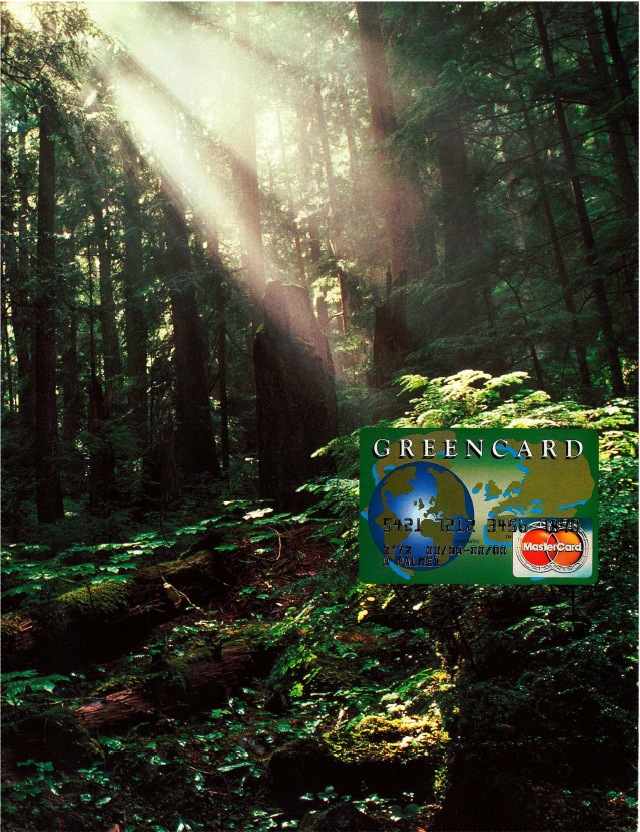

TO HELP ENSURE THERE IS A TOMORROW

BCC's GreenCard was launched in October 1989 with the aim of raising a substantial cash sum for environmental projects. The bank opened a trust fund to administer the money with an initial donation of £50,000, and contributing 30p for every £100 spent by GreenCard holders using the card to make purchases.

BCC expected the fund to benefit by around £2 million during the first three years. The trust was chaired by John Humphries, a noted personality in the environmental world, who would invite people of suitable experience to become trustees. Among the first to accept an invitation were television presenter Anne Diamond, actor Derek Nimmo, and Royal Geographical Society director Dr John Hemming.

The trust fund would scout for projects -initially in the UK - that would benefit the environment, and make financial assistance available where appropriate.

People who already held other credit cards could still apply for the BCC GreenCard, and they did not have to bank with BCC to be eligible. They did, however, have to be residents of the United Kingdom. GreenCard was part of the MasterCard network, and could be used in exactly the same way as any other credit card. It was accepted in 300,000 outlets in the UK and 6 million worldwide. There were, however, important differences between the GreenCard and other cards.

COMPETITIVE RATES

First, interest rates on outstanding balances were very competitive. Even GreenCard's standard 1.996 (APR 25.396) compared favourably with the 2.296 (APR 29.896) charged by the major issuers. Moreover, successful applicants were offered the option of paying an annual charge of £6 in return for an interest rate of 1.796 (APR 22.496).

An added benefit to holders of the GreenCard was attractive merchandise insurance cover. This safegarded customers' purchases made with the card up to a value of £2,000 per item for a period of six months - a substantially better deal than that offered by any other organisation.