Foreign exchange and inter-bank money market transactions in BCC were conducted mainly by the bank's dealings rooms. The overall liquidity and foreign exchange exposure of the BCC group was managed by the Central Treasury Division in Central Support Office (CSO) in London United Kingdom, moved later to Abu Dhabi, U.A.E.

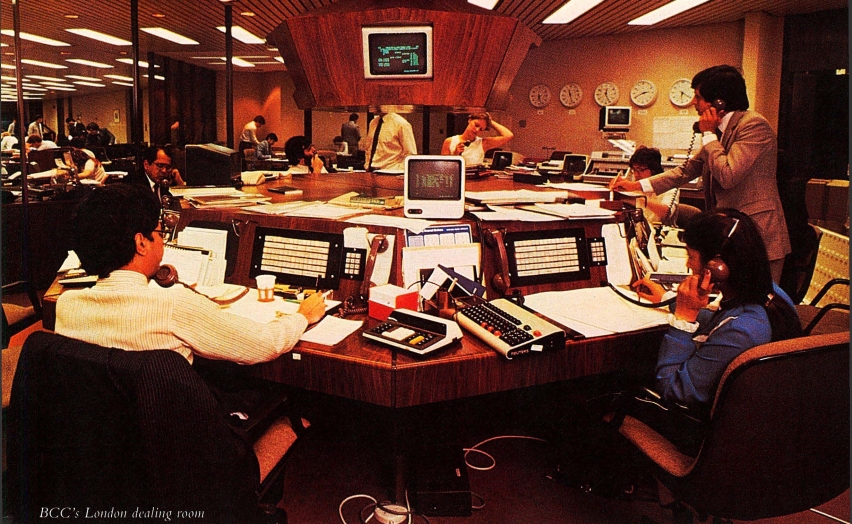

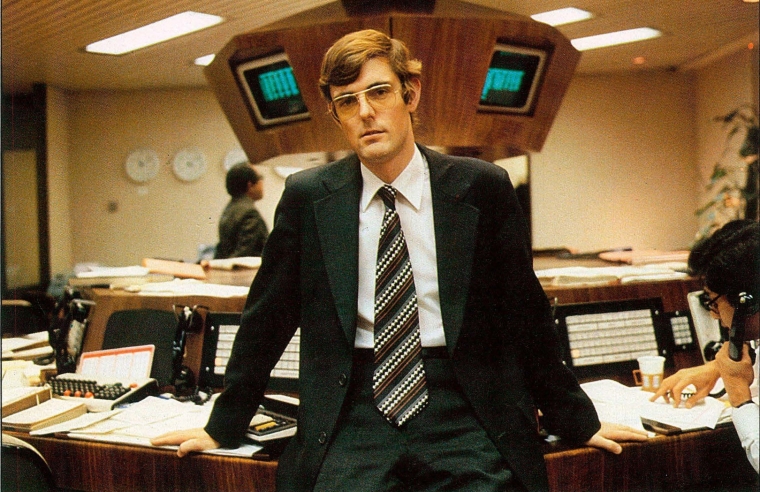

Dealing Rooms

BCC had a network of dealings rooms throughout Europe, the Middle East, the Americas and the Dar East. Dealers were principally based in:

- Abu Dhabi, United Arab Emirates

- Bahrain

- Cairo, Egypt

- Dubai, United Arab Emirates

- Frankfurt, Germany (West)

- Hong Kong

- Luxembourg

- Miami, U.S.A.

- New York, U.S.A.

- Paris, France

- Sydney, Australia

- Toronto, Canada

- Zurich, Switzerland

Dealing rooms at these locations facilitated foreign exchange transactions of BCC branches worldwide and gave corporate clients an efficient service for all their large foreign exchange requirements.

BCC dealings also provided the most up-to-date advice and guidance on any Middle East currency.

The bulk of BCC's foreign exchange transactions related to settlement in foreign currencies primarily for outward and inward remittances, and payments and receipts relating to foreign trade transactions.

The procedures involved the purchase or sale of leading foreign currencies at spot, forward and future exchange rates.

Fund Management

BCC dealing rooms were also involved in trading with other banks in the interbank money markets to manage liquidity. Smaller branches managed their liquidity locally. In banking practice this involved balancing the books of the bank or a branch daily by lending surplus funds and borrowing funds in case of shortfall, for period from overnight to several days. This was integral to managing liquidity risk.

BCC Central Treasury

The overall liquidity of the BCC group that included risk management was handled at a centralised level by BCC's Central Treasury under BCC Central Support Office (CSO) in London U.K., later in Abu Dhabi U.A.E.

Funds came in several forms: cash, bonds, currencies, financial derivatives like futures and options etc. The Central Treasury function ensured that the BCC group was financially secure and met its financial obligations on time. They regularly liaised with BCC branches and dealings rooms and managed any crisis.