Monaco was and still is among the most luxurious tourist resorts in the world with Monte-Carlo the home to the famous Monte Carlo Casino that attracted wealthy Arab clients of Bank of Credit and Commerce International (BCCI.

Country information

Monaco was a principality bordering France on the Mediterranean coast and a city state that formed an enclave within France, and was also near the border to Italy.

Monaco (officially the Principality of Monaco) was the smallest sovereign state in the world apart from the Vatical enclave within Italy.

History

Monaco was founded in 1215 as a colony of Genoa, Monaco has been ruled by the Grimaldi family from 1297. It became a constitutional monarchy in 1911.

Monaco was founded in 1215 as a colony of Genoa, Monaco has been ruled by the Grimaldi family from 1297. It became a constitutional monarchy in 1911.

Economic development took place in the late 19th century with a railroad linkup to France and the opening of a casino in Monte-Carlo.

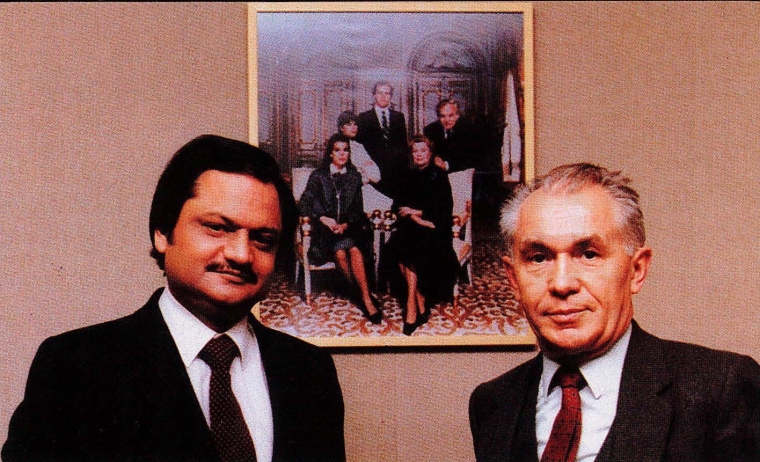

Prince Rainier who became monarch in 1950, married Hollywood actress Grace Kelly in 1956, that brought glamor to the tiny Mediterranean state and put Monaco on the international stage.

Since then, the principality's mild climate, splendid scenery and gambling facilities made Monaco world famous as a tourist and recreation centre and a haven for really rich people.

The principality was also a growing banking centre.

Population and language

When BCCI opened its Monte Carlo branch in the late 1980s, the population of Monaco was around 34,000 residents. The largest number were French citizens, with a smaller number of Italian, Swiss, and Belgian.

The official language was French.

In addition, there were several other languages spoken, including Italian, English, and Monégasque, the national language of their ancestors, the Monégasque people.

Economy

The economy of Monaco was reliant on attracting tourists to its casino and banking. Monaco.

The state had no income tax and low business taxes and thrived as a tax haven (but not a tax-free shelter) both for individuals who established residence and for foreign companies that set up businesses and offices.

BCCI in Monaco

Monaco was already recognised as one of the most expensive and wealthiest places in the world.

The banking industry in Monaco was known for its high degree of secrecy and anonymity as well as its attractive interest rates frequently higher than those provided by banks outside Monaco. It was also regarded as a leading location for offshore banking, luring wealthy people and businesses from around the world.

Many banks had branches in Monte-Carlo; commercial banks like Credit Suisse Monaco, private banks like Edmond de Rothschild providing specialised financial services like wealth management, private banking, and investment services to high net worth individuals, few offshore banks that offering financial services to non-residents.

It was not surprising that Bank of Credit and Commerce (Overseas) Ltd (BCCI) with its large global presence opened a branch in Monte-Carlo to cater mainly for non-resident Arab clients from the Middle East and Gulf countries and other High Net Worth Individuals visiting the world-famous casino (Place due Casino) in Monte Carlo, and its luxurious beaches and boating facilities.

Monte Carlo branch was located at:

33 Boulevard Princesses Charlotte

Monte Carlo MC 98000

Telephone: (3393) 251 232

Fax: (339) 330 1495

Telex: 469183 BCCI MC

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west decided to abruptly freez BCCI Group's assets and shut down BCCI's operating branches worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

BCCI Monte-Carlo branch in Monaco was reportedly closed from 8 July 1991. No further information is available.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)