BCCI joined hands with the Zimbabwe government in 1980 to launch a joint venture commercial bank in the newly independent African country. Bank of Credit and Commerce (Zimbabwe) Ltd was the country's first bank after its independence.

Country information

Zimbabwe, officially Republic of Zimbabwe, formerly Southern Rhodesia (1911-1964), Rhodesia (1964-1979), Zimbabwe Rhodesia (1979-1980), is a landlocked country of southern Africa. It is bordered by four countries, on the north by Zambia, on the northeast and northeast and east by Mozambique, on the southwest and west by Botswana and on the south by South Africa.

.jpg)

History

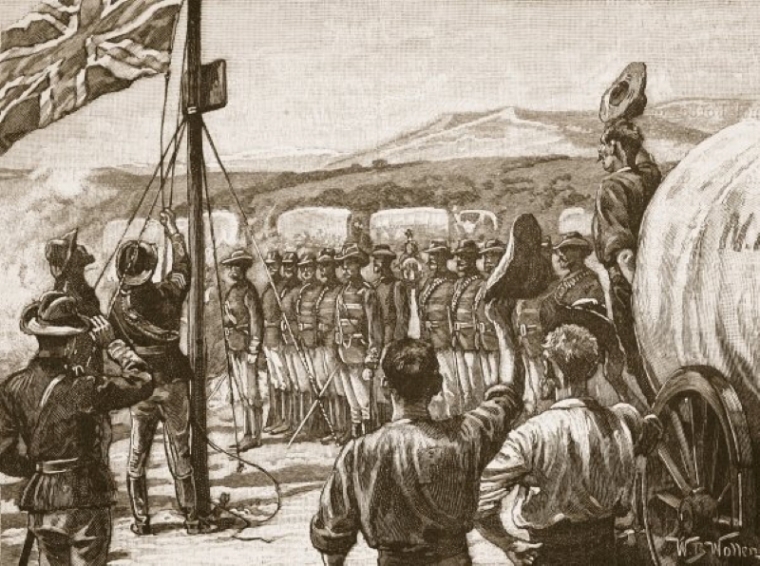

From 1885, Europeans colonists led by Cecil Rhodes of the British South African Company arrived and sought to exploit the rich natural resources of the region. Rhodes obtained concession for local mining rights from the King of the Ndebele peoples and used this concession obtain to grant a Royal Charter to the company over Matabeleland, and its subject states.

Rhodes defeated Ndebele in the First Matabele War between 1893 and 1894 in modern-day Zimbabwe and Rhodes went on establish company rule over the territory with the British maintaining control over labour as well as over the rich mineral resources.

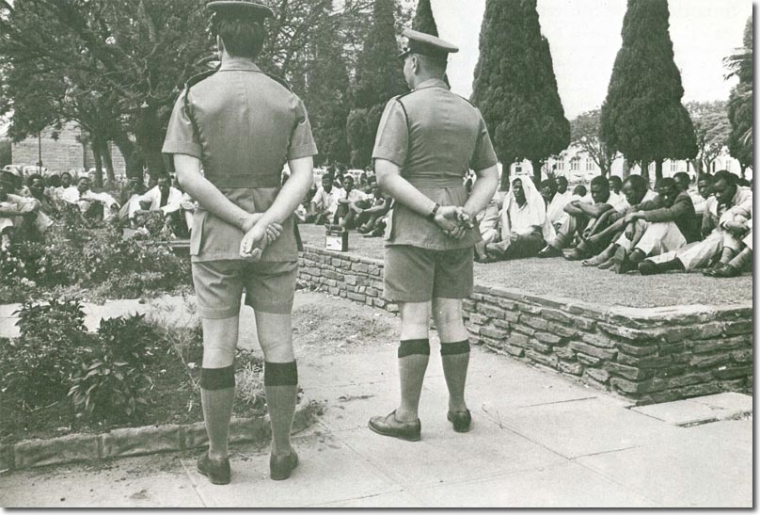

The territory was made open to white settlers to establish mines, primarily to extract the diamond ores present. They were also given considerable administrative powers, including a franchise that, while on the surface non-racial, ensured "a predominantly European electorate"

On 11 November 1965, the white-minority government made a Unilateral Declaration of Independence as Rhodesia.

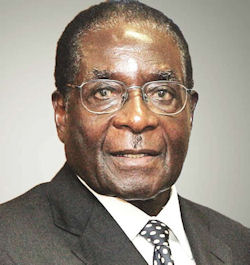

After a 15-year guerrilla war with black Africa nationalist forces fighting the white minority for majority rule. The war was led by Robert Mugabe of the Zimbabwe African National Union (ZANU), a militant organisation (ZANU), and Joshua Nkomo of the Zimbabwe African People's Union (ZAPU), a political party militant organisation and political party. They were backed by the leaders of independent Zambia and Mozambique.

The rule of the white minority Rhodesia government was finally ended after Mr Robert Mugabe's Zimbabwe African National Union - Patriotic Front Party secured a landslide victory during the elections held in February 1980. Rhodesia became independent as Zimbabwe on 18 April 1980 with African majority rule.

The rule of the white minority Rhodesia government was finally ended after Mr Robert Mugabe's Zimbabwe African National Union - Patriotic Front Party secured a landslide victory during the elections held in February 1980. Rhodesia became independent as Zimbabwe on 18 April 1980 with African majority rule.

Salisbury, the national capital, and the commercial capital of Rhodesia retained its name after Zimbabwe’s independence. Salisbury was renamed Harare in 1982 on the second anniversary of the country’s independence.

There are major areas of water like Lake Kariba, and Victoria Falls that has claim as the largest waterfalls in the world based on a width of 5,604 ft. and height of 354 ft.

There are several national parks that protect the beautiful natural landscapes and the great diversity of wild flora and fauna of the country.

Population and language

In 1981 the population of Zimbabwe was around 7.5 million.

The majority population are Africans.

A small number of descendants of the early white European settlers live mostly in towns and cities, and Asian immigrants are predominantly concerned with trade.

Zimbabwe’s 2013 constitution gave official status to 16 languages, with English, Shona and Ndebele the most widely in use.

Economy

Zimbabwe is endowed with wealth mineral deposits. It has among its deposits gold, platinum, chrome, nickel, copper coal, asbestos, diamonds, gold, platinum, and iron ore that are very significant to its economy. Mining is major contributor to foreign exchange earnings.

More than one-half of the total labour force is engaged directly in agricultural activities that include cultivation of tobacco, sugar, and cotton for export. The most important food crop is corn (maize), which is grown throughout the country. Other exports include meat and clothing.

Zimbabwe’s major imports are oil, heavy and light machinery, vehicles, steel, electrical goods and consumer commodities.

BCCI in Zimbabwe

Bank of Credit and Commerce (Zimbabwe) Ltd (BCC Zimbabwe) was the first bank that was granted a banking licence in independent Zimbabwe and stated operations in early 1981 from Lusaka, the capital.

There were already four commercial banks owned by foreign interests operating in the country.

Barclays Bank and Standard Chartered Bank were controlling 90% of the deposit liabilities in the commercial banking sector. The other two banks were Zimbank, formerly Rhobank, (South Africa), and National Grindlays Bank (British).

.jpg)

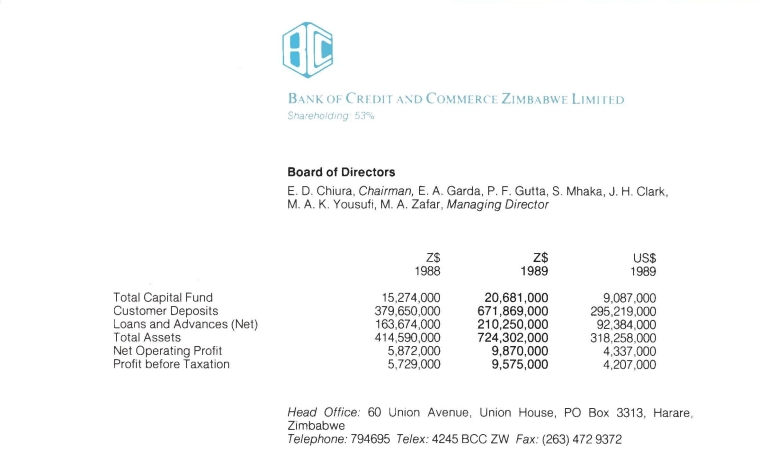

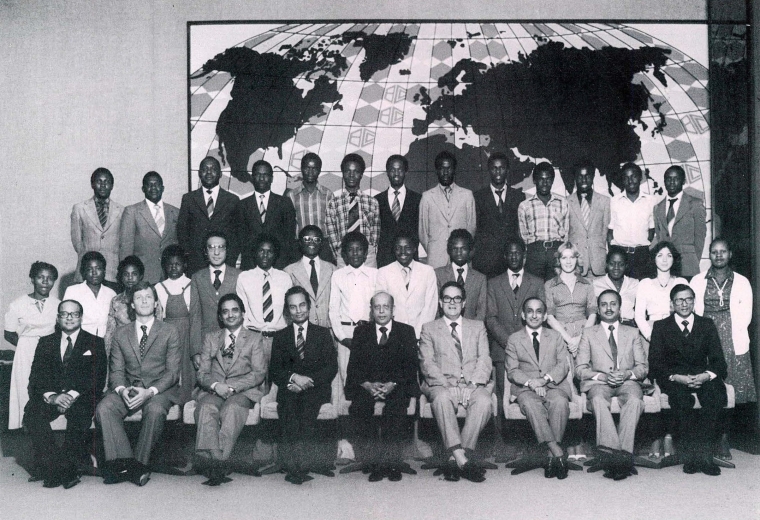

In 1980, the Reserve Bank of Zimbabwe (central bank) approved a government joint venture with BCC, to establish Bank of Credit and Commerce (Zimbabwe) Limited (BCC Zimbabwe), in which the Zimbabwe government had a 47% interestand BCCI Holdings (Luxembourg) SA (BCCI) held 53% controlling interest. The authorised, issued, and fully paid-up capital was Z$6 million.

BCCI was responsible for the management, banking operations, business development and training the local staff.

_0.jpg)

A joint agreement between BCCI and the Zimbabwe government was signed in October in Salisbury. The signing was attended by the Zimbabwe Deputy Prime Minister and Minister of Foreign Affairs, the Honourable Simon Nzenda, and government ministers: Information, Broadcasting and Tourism, Dr Nathan Shamuyarira; Economic Planning Development, Dr Bernard Chizdero; Health, Dr Herbert Ushewokudze; Lands, Resettlement, and Rural Development, Dr Sidney Sekeremayi; Transport, Ernest Kandungure; Justice and Constitutional Affairs, Simbi Mubako; State and Prime Minister' Office, Emmerson Munangagwa; Posts and Communication George Silundika; and Commerce and Industry, David Smith.

At the signing ceremony, Mr Garda said that the agreement underlined BCC's confidence in the government, people and future of Zimbabwe, and reflected the mutual determination of BCCI and the Zimbabwe government to create a commercial bank whose scope and range of services and general assistance would be accessible to all Zimbabweans, whether individuals, private enterprises, or commercial and industrial organisations all sizes.

BCC Zimbabwe encouraged business enterprise in rural as well as urban areas, and the new bank also actively pursued a policy of training its Zimbabwe local bank employees in all aspects of banking practice BCC's , objective "service to humanity" and equip them for management positions in the bank.

″They look after the small man and they’ve always been good to me,″ said Axel Hlatwayo, a retired railway worker in Harare, Zimbabwe, who opened a small store with a BCCI loan that matched his $8,000 deposit." All the big banks turned him down. (apnews.com, abidjan: 1 August 1992)

Mr Enos D Chiura, a well-respected local businessman, was the first chairman and a director of BCC Zimbabwe. He was Advisory member of the International Executive Service Corps., Harare, since 1985; member Cambridge Livingstone Trust, Harare, since 1979; Zimbabwe Cambridge Trust founded by BCC, since 1987.

Mr E A Garda was seconded as the first Managing Director and Chief Executive from BCC Central Office London, United Kingdom.

Official inauguration of opening of BCC Zimbabwe

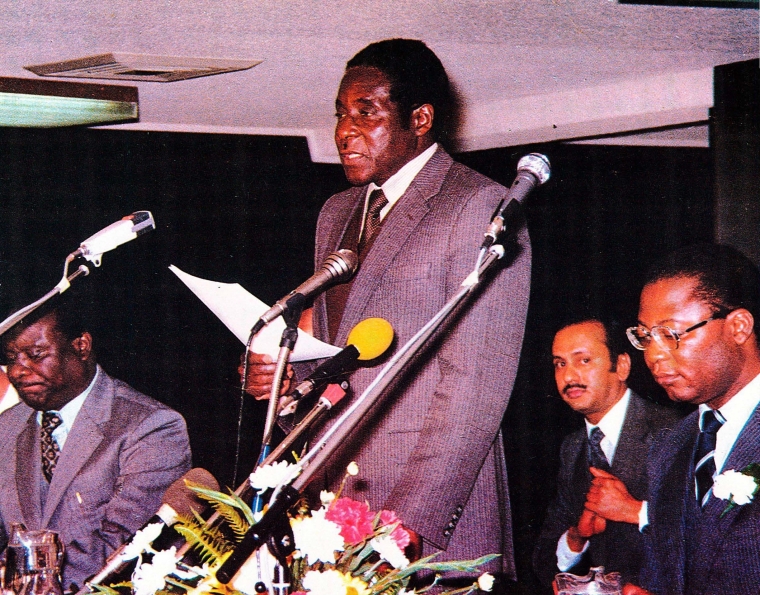

BCC Zimbabwe opening was officially inaugurated by the country’s Prime Minister Mr Robert Mugabe, in a ceremony held on 16 July 1981 in the country’s capital, Salisbury (renamed Harare).

At the inauguration ceremony, Prime Minister Mugabe welcomed BCCI President Mr Agha Hasan Abedi and the officers who had helped to establish the new bank.

Prime Minister Mr Mugabe said "I would like to express my Government's appreciation of the co-operative attitude of BCCI in regard to the establishment of BCC Zimbabwe. The emergence of this new bank will give a fillip to our current economic reconstruction and development efforts. It will certainly significantly expand the scope of the banking services available to our people. This is as it should be, for with the attainment of genuine independence and the consequent achievement of peace and normality in our country, ours has once again become a dynamic and rapidly growing economy."

Zimbabwe Prime Minister went on to say "The opening of this bank represents a major milestone in the evolution of our state and the consolidation of our independence. It represents the fulfilment of some of our aspirations in regard to the re-organisation and management of the economy. Banking is at the very centre of all modern economic activity. It constitutes and sustains the international economic relations of our day.

"It is a matter of great joy and satisfaction to me to witness and participate in the official inauguration of a bank in which the Government has a 47 percent interest, and the Bank of Credit and Commerce International 53 per cent. This joint venture is an excellent example of how the State wishes to proceed in ensuring its participation in certain crucial areas of our economic sectors which, hitherto, have been the monopoly of private enterprise.”

Prime Minister Mr Robert Mugabe concluded by praising BCC Zimbabwe for its Zimbabwean outlook and orientation, exemplified by its provision of the necessary training, expertise and experience for young Zimbabweans, so helping them to take their rightful place in the world of banking, in service to their country and people.

US$10 million fund for Zimbabwe

At the inauguration ceremony of BCC Zimbabwe, BCC President Mr Agha Hasan Abedi affirmed that he felt BCC belonged to Zimbabwe, to the Third World, and to all the deprived peoples of the world. "It is our major objective, to whatever extent, to build a road between the South and the North -or rather the 'haves and have nots' in our own small way."

Mr Abedi also said that BCC intended to establish a foundation in Zimbabwe for the welfare of its people. BCC would contribute an initial US$1 million, and build up a fund of US$10 million from contributions made by BCC and BCC Zimbabwe.

BCC Zimbabwe branches

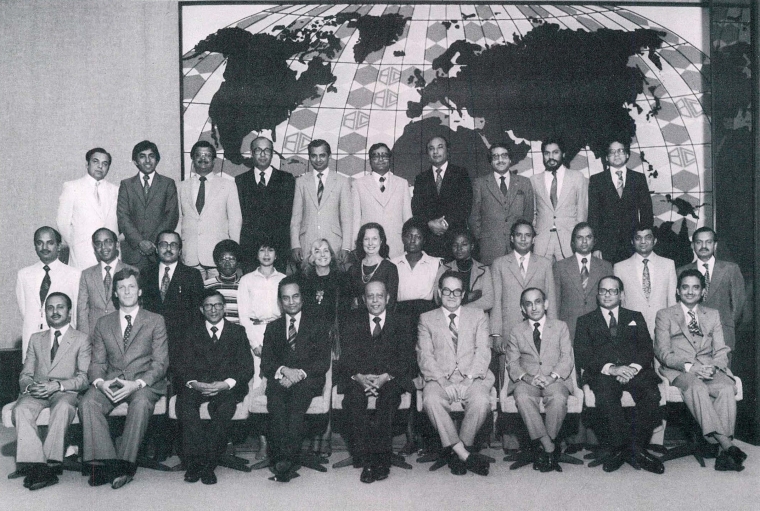

Some seven young Zimbabweans in the first batch sponsored by BCCI completed their training at the BCCI Training Academy in London United Kingdom. More trainees followed to ensure their full involvement in the policy-making, managerial and technical aspects of this - and indeed any other banking operations.

Harare (formerly Salisbury)

Harare was Zimbabwe capital and the country's leading financial, commercial, and communications centre, as well as an international trade centre for tobacco, maize, cotton, and citrus fruits. Manufacturing, including textiles, steel, and chemicals, are also economically significant, as is the trade of precious minerals such as gold, diamonds, chrome and platinum.

BCC's main branch in Zimbabwe branch was located at:

Union House

60 Union Avenue

P.O. Box 3313

Harare

Tel: (2630) 794 625/9

Fax: (2630) 472 9372

Telex: 4245 BCCZW

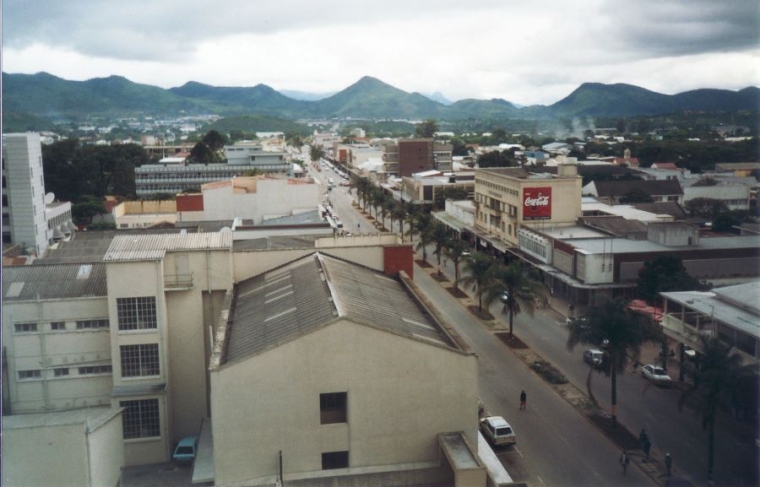

Bulawayo

Bulawayo was the second largest city in Zimbabwe, referred to the City of Kings

Historically, Bulawayo has been the principal industrial centre of Zimbabwe; its factories produced cars and car products, building materials, electronic products, textiles, furniture, and food products.

Bulawayo also served as the hub to the country’s rail network with the National Railways of Zimbabwe headquartered there because of its strategic position near Botswana and South Africa.

Bulawayo branch was located at:

81A Main Street

P.O. Box 576, Bulawayo

Tel: (2639) 76201/5, 76236

Telex: 33452 BCCZW

.jpg)

SERVING ZIMBABWE

When Mr Damle was appointed manager of the branch in BCC Zimbabwe Bulawayo, he brought with him a wealth of experience in international banking. "My family tradition is banking," he said, "and by becoming a banker myself, I am happy to continue that tradition. I joined BCC in 1981 and felt at home here very quickly. The tradition of service and humility that I grew up with in Southern India helped me to understand the BCC ethos. Raising the standard of professionalism and service in ourselves and in others is a continuous process. It can only succeed if we treat our colleagues as trusted friends."

“Our commitment to Zimbabwe can be stated very simply: we are working to raise the standard of living here. We cannot do this by sitting in our offices and waiting for the people to come to us. We must go to them. We must talk to them and show them the value of thrift and saving. We take every opportunity that we can of explaining our services to district councils, professional bodies, manufacturing firms, businesses and individuals.”

“We have found that we must have a flexible attitude to our clients. They are often creating new businesses where none existed before and they need a highly creative service from us. Of course, we are not only involved with new businesses. We try to keep a healthy balance in our portfolio and we number among our clients multinationals, government bodies, individuals and large businesses, as well as emergent businesses."

“Such an attitude creates a welcoming atmosphere in the Bulawayo branch. Clients are made to feel very much at home and there have been some spectacular marketing successes in recent months. A large pension fund shifted its resources to the Bulawayo branch after nine months' careful and patient work by Mr Damle and his colleagues. ''We had to demonstrate both our global resources and our ability to react swiftly at branch level," he says. "We are learning to think in global terms and to carry this perspective with us always. This is how we will continue to grow in the future."

Chitungwiza

Chitungwiza was an urban centre and town of Harare Province in Zimbabwe.

Chitungwiza branch was located at:

Jenje Road, Seke North

P.O. Box 60

Chitungwiza

Tel: (26370) 23944/5/6

Gokwe

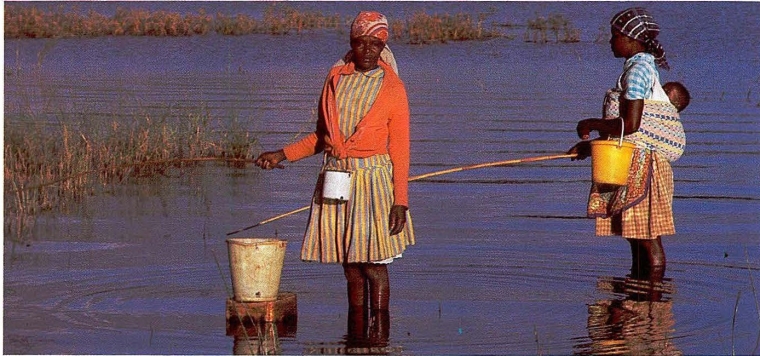

Gokwe Centre was a rural town in the Midlands province in Zimbabwe. The Gokwe district was known for its intensive agricultural production which included cotton, horticulture, grains and livestock.

Industry in Gokwe was dominated by small scale formal and informal entrepreneurs.

BCC Zimbabwe branch in Gokwe, its seventh branch, was opened on 7 August 1987.

The branch was established to serve around the 300,000 population in an agriculturally rich area that grows some of the best cotton in Zimbabwe. It is the first commercial bank to open in the district, whose farmers previously had to make a 140km journey to Kwekwe to bank their money, often being robbed on the way.

Mr Tranos Makombe, the Midlands Province Governor, speaking in the absence of Mr Morton Malianga, Deputy Minister of Finance, Economic Planning and Development, said "Much time for travelling to Kwekwe has now been saved and can be used for more fruitful work in your fields or in other business at home. The initiative which BCC Zimbabwe has taken in bringing the banking infrastructure to Gokwe growth point and to other places is appreciated by the Government”.

The official opening of Gokwe branch was attended by Mr Naison Mawande, the new Permanent Secretary in the Ministry of Labour, Manpower Planning and Social Welfare, Mr Owen Tshabangu, Registrar of Banks, Financial Institutions and Building Societies, and Dr Leonard Tzumba, Governor of the Reserve Bank, Mr Tranos Makombe, the Midlands Province Governor, as well as by local politicians and businessmen.

Gokwe branch was located at:

PO Box 160

Gokwe

Tel: (26370) 23585/6

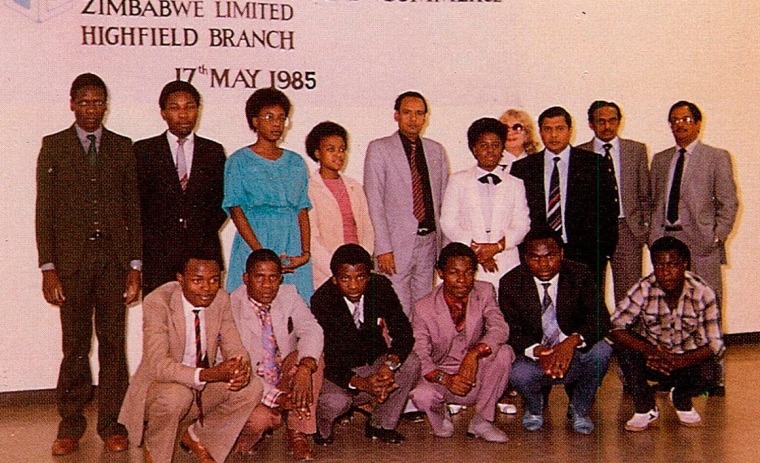

Highfield

Highfield was the second oldest high-density suburb of Harare, Zimbabwe.

Highfield was established to accommodate workers employed in the nearby industrial zones of Southerton and Workington and as domestic labour to European households in the city's northern and western suburbs.

BCC Zimbabwe opened a branch in Highfield on 17 May 1984 to reinforce BCC’s commitment to serving the ordinary people in the developing countries that comprised the Third World.

Highfield branch was located at:

Machipisa Centre

PO Box 70

Highfield

Tel: (2630) 62348/9

Telex: 22422 BCC ZW

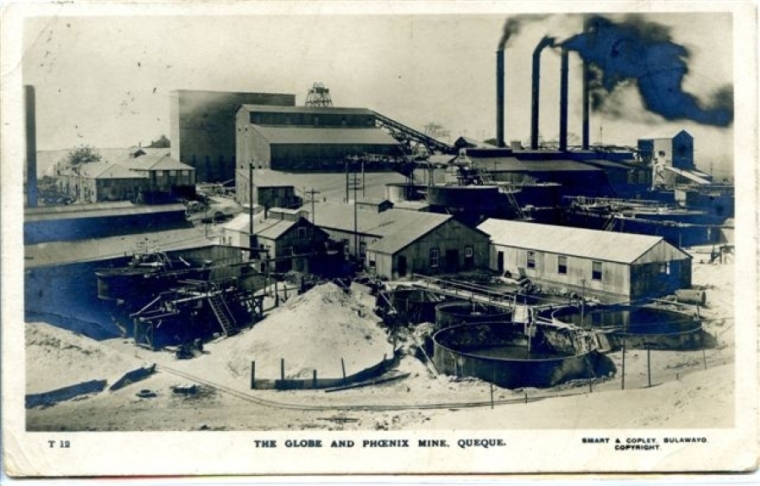

Kwekwe

Kwekwe, known until 1983 as Que Que, is a city in the Midlands province in central Zimbabwe, and the country’s richest city in terms of minerals.

The city was originally a gold mining camp and the reason the city was established.

Kwekwe and its neighbouring city of Redcliff, also in the Midlands province, are the centre of Zimbabwe’s steel industry. They are the headquarters of the country's largest steelworks, the largest ferrochrome producer, and one of the biggest power generating plants.

Kwekwe branch was located at:

18 Second Avenue

PO Box 526

Kwekwe

Tel: (26355) 2086/7

Mutare

Mutare was one of the most populous cities in Zimbabwe and the largest city in Eastern Zimbabwe.

Located near the border with Mozambique, Mutare has long been a centre of trade and a key terminus on way to the port of Beira in Mozambique with highways linking the coast with the capital Harare and the interior. Traditional industries include timber, papermaking, commerce, food processing, telecommunications, and transportation

Mutare branch was located at:

106 Main Street

PO Box 776

Mutare

Tel: (26320) 64728, 64755, 60211

Telex: 81102 BCC ZW

BCC President Mr Agha Hasan Abedi, and Zimbabwe Prime Minister Mr Robert Mugabe

Without doubt there was a special relationship between Mr Abedi and Mr Mugabe, who was likely to have been introduced to Mr Abedi by Dr Kenneth Kuanda, the first President of Zambia.

Dr Kuanda was firmly opposed to the Central African Federation (CAF), which came into being in 1953 as an attempt by Britain to unite the three territories of Northern (now independent Zambia) and Southern Rhodesia (mow independent Zimbabwe) and Nyasaland in what would have become dominated by a white minority rule. After gaining independence of Zambia, he went on to assist Mr Robert Mugabe in securing the independence of Zimbabwe.

South-South Cooperation

Mr Abedi visited Harare on the occasion of the South-South Cooperation - Experience and Prospects conference 1985, the first to be held in Africa, that was jointly sponsored by Third World Foundation (funded by BCC), and University of Zimbabwe. At a banquet in honour of Mr Robert Mugabe, Primate Minister of Zimbabwe, he is quoted as saying that South-South cooperation was probably the only significant recourse for the Third World in its efforts to reduce its dependency on the North, promote its economic development and organise a degree of countervailing power vis-a-vis the North. Cooperation between developing countries is "of vital importance to the socio-economic well-being and even the very survival of ... the Third World".

- Inaugural Speech by Mr Robert G Mugabe, Prime Minister, Zimbabwe

- Speech at the Banquet by Mr Agha Abedi, Chairman, Third World Foundation

Mr Robert Mugabe, Prime Minister of Zimbabwe, was invited by the Third World Foundation to present the 1988 Third World Prize awarded to Gro Harlem Brundtland, Prime Minister of Norway, to acknowledge the special leadership role that she had played in making the international community realise that poverty is the ultimate polluter and the poor people are the principal victims of environmental damage, and most prone to disasters of global warming resulting from energy use of the developed world.

Financial Highlights 1989

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west decided to freeze BCCI Group's assets and abruptly shut down BCCI's operations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

The Government of Zimbabwe, which held 47% shareholding in BCC Zimbabwe, acquired 100% shareholding in the BCC joint venture bank to avert closure and loss to depositors and businesses. Following takeover by the government, BCC Zimbabwe later acquired a new identity as Commercial Bank of Zimbabwe Limited, renamed CBZ Bank Limited in 2004.

As of December 2017, the bank was reported to be the largest financial services provider in Zimbabwe, ahead of Barclays, Standard Chartered and other banks.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)