Since 1950, Management or Executive Development has been a prominent area of personnel or human resources management. In the traditional definition, management development is a systematic process of management training and growth by which the participants gain and apply knowledge, skills, insights, and attitudes to manage managers, workers and work organisations effectively.

Unlike traditional banks BCC desired to motivate its staff, as members of the BCC family, with experience of banking operations to contribute to business development and earnings, by trying to create a climate of complete freedom and openness, where people can grow uninhibited by pressure of delegated authority and by sheer merit and ability, without compromise in operational efficiency and accuracy.

Through the use of the foundation provided by the BCC Regional Training and Development Centres, a long-term International Management Development (IMD) process was launched in 1980 by the Staff and Establishment Division at BCC Central Office London to assist the Regions. One of the immediate aims of this process was to provide an intensive need-based training in all major professional skill areas required by an international banker, thereby enhancing the ability of each profitman and profitwomen to produce a continuously rising profit - both in the financial sense for the Bank and a personal sense through enhanced job satisfaction.

To put it another way, the objective was to continue improving the technological foundation of the BCC profit urge. It was proposed to direct BCC’s management development effort into two dimensions the Technological and the Qualitative.

The strategy of consolidation and quality in BCC enfolded innumerable dimensions. The seven major dimensions that the IMD consciously fulfilled in an enhanced manner were:

- Higher capital asset ratio/leverage

- Higher liquidity

- High quality of assets

- Better liability rationalisation, deposit structure and profit

- High operational efficiency and management capability

- High service standards

- Optimum budgetary control

Taking into account the backlog of training needs in 1980, and BCC’s ever-increasing network, with 1,600 officers in 237 offices in 47 countries, they were to be trained in 50 skill areas. The ultimate aim was 100% of line officers trained in 100% of the areas; from 15 June 1981 the first objective was effective training for 100% of those involved with 60% of BCC’s asset-business - international trade finance.

The challenging task of preparing 15 standard training manuals covering over 50 different skill areas was undertaken by the IMD to ensure that should a professional manager retire or leave BCC the benefit of his or her experience would remain with the organisation.

By provision of world-wide standard manuals and materials, the training programmes for BCC were given a formal logically progressive structure by the IMD enabling participating officers to assimilate, through practical situations, work-experience at a far faster rate than by sitting in an office.

Without exception, everyone has a creative ability. BCC was keen to encourage everyone to develop their creative thinking on productive lines. Brainstorming was a technique also applied for doing just that.

To sum-up, the purpose of the IMD project was "to contribute to others' performance" by acting as an 'information transfer medium', supplementing the efforts of all managers by endeavouring as an organised unit to transfer information, knowledge, wisdom, attitude and virtues from one mind to another. This was achieved by pooling and then disseminating the available information acquired from within and without.

.png)

As IMD headed by Mr Abijit Banerjee evolved, the number of its key functions increased. Their primary aim to create a comprehensive training technology which, in the context of BCC's training philosophy, was not confined to the material technology of books and visual aids. It included the mechanics of human interaction by which the experience and understanding of one person became part of the heritage of the House of BCC that required performance, ability and motivation.

Before joining BCC, Mr Banerjee was a senior officer with Grindlays Bank, the historic British overseas bank established in London in 1828 as Leslie & Grindlay, agents and bankers to the British army and business community in India. Banking operations expanded to include the Indian subcontinent the Middle East, Southeast Asia and English-speaking Africa. Grindlays was taken over by Australia and New Zealand Banking Group in 1984 and renamed ANZ Grindlays Bank, later acquired ANZ Grindlays in 2000.

BCC's goal was to achieve excellence in management and the team in IMD was enhanced with the joining of Mr Tom Thiss, a management consultant. He worked as an independent consultant and trainer in thirty-nine countries and six continents, including a residency in London from 1983 to 1989. He taught in the business community for over thirty years. He managed The Ridge Consulting Group in USA, offering initiatives to professionals including social styles, negotiating skills, stress management, team building, adventure-based ‘ropes’ courses, life/work planning, and a variety of organisational transformation interventions.

- Managing People for Maximising Performance: A One Day International Development Seminar by Tom Thiss

No amount of material technology could compensate for a failure in human technology. Therefore, another of the IMD's important functions was to increase awareness of what BCC was all about - its corporate identity, its culture and its Major Purpose through the practice of Real Management.

The important role of bankers is to help business driven by their self-interest. For BCC it was also a case of doing good for others and recognition of human values. It is not shown on the bank’s balance sheet, but it influenced appreciably the growth, progress, profits and the shared values. IMD programmes had the capacity for self-discovery and to motivate the participating BCC employees to understand the BCC’s values such as Serving Humanity and Giving.

IMD London had a centre in BCC Far East Regional Office Hong Kong.

The IMD also had a research function. It was always on the look-out for any innovations that might contribute to the success of BCC.

International Management Development Seminars

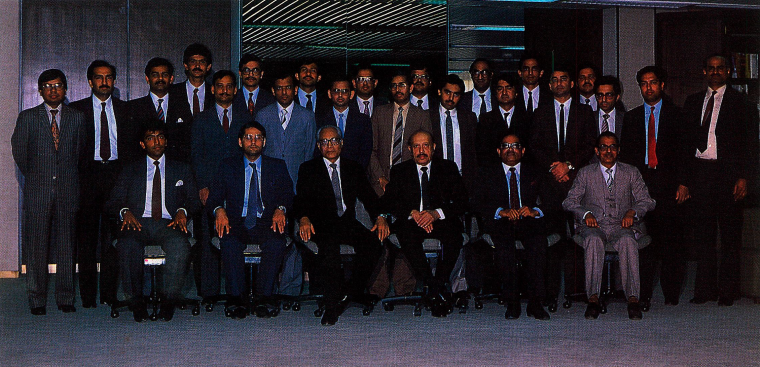

IMD held international seminars in London for BCCI middle and senior management, which were subsequently extended to other BCCI centres.

The first of the International Management Development seminars of 1981 was held in London on 15 June in the Piccadilly Hotel, London attended by thirty officers from BCCI branches from around the world.

The inaugural speech was given by Mr Swaleh Naqvi, chief executive officer, who first explained the purpose of BCC, the purpose of Profitman and the reason why the BCC family came into existence and how it would continue to flourish.

While the IMD seminars provided an opportunity to focus on a particular subject matter in detail, these also developed a higher level of thinking among the BCCI staff participants.

Acknowledgement:

In-house Magazines