BCC placed great importance on Training and Development courses for entrants, as well as, existing employees at all levels to build their capability and undertake responsibilities in serving the banks customers and focus on quality relationships with clients for the growth of BCC’s business.

Training and development is incredibly vital for ensuring effectiveness of the employees in an organisation. Managing Human Resources in a banking organisation requires a deep understanding of compliance regulations and technical knowledge of banking products and services in a changing economy that constantly pressure banking business.

Mr Agha Hasan Abedi as President of United Bank Ltd which he founded before BCC, said in an interview in 1966, "While technical ability or technical knowledge is essential, development ability is the core of ability in banking. I think the professional ability for a banker is first to know his client and his financial situation and then to serve his banking requirements. If by professional knowledge you merely mean technical knowledge, you are perhaps taking it in a narrow sense. Of course, technical knowledge is essential, but its acquisition should not present any difficulty for people. What is really difficult is dealing with men, and that you can learn only by dealing with them. I am sure when you bring a client you do everything to satisfy him, and for that you would also acquire the necessary technical knowledge or the professional knowledge."

On technical training at the Staff College inaugurated by Mr Abedi as President of United Bank Limited to provide bank training in Pakistan applied equally to the training centres in BCC established later under Mr Abedi as President of BCC. In the 1966 interview he went on to say that "you get the opportunity of looking at the institution from a broader perspective and getting together with a large number of your colleagues."

BCC's worldwide training courses evolved with emphasis on improving the quality of human energy. As new BCC branches opened and the business of existing branches increased, the demand for the training facilities increased.

The respective centres had several types of training courses, a one-year training course for graduate management trainees and a shorter five to seven days training for the experienced officers of the bank. Guest speakers were invited, typically the serving Branch Managers of the bank and also speakers from the Central Bank, as well as trade bodies. The focus of training in BCC was performance and a service culture, called “One Stop Customer Service and Relationship Management”. These were some of the many hallmarks of the BCCI management culture.

First there was a regional training centre in Karachi, Pakistan. Then, in 1977, another was established in London, UK followed by Hong Kong, Cairo (Egypt), Lagos (Nigeria), and Harare (Zimbabwe), until there were six regional training and development centres around the world. These centres also held seminars on specific subjects.

A Bangladesh Training Development and Research Centre was established in Dhaka and a training centre in Shenzhen dedicated for the training of the state-owned Chinese banks, financial institutions, agencies and corporations.

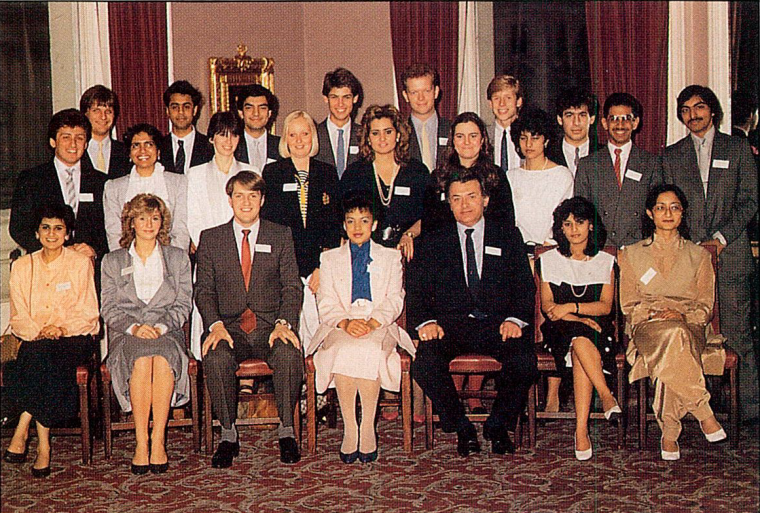

In 1984 BCC and the Pace University in New York entered into a joint venture for Pace to offer a new and unique International Management programme to train US graduates recruited by BCC locally and prepare them for the expansion of BCC's banking operations in USA.

In addition to the regional training centres, BCC had an International Management Development (IMD) division at BCC Central Office London with an office in Hong Kong to provide advanced training and conducting seminars to address prevailing market requirements. It included the function of increased awareness of BCC’s corporate identity, its culture and its Major Purpose.

The planning that went into the structuring of BCC's basic and advanced training courses and seminars were undertaken with the assistance of the IMD.

Regional Training and Development Centres (RTADs)

Training and Development

The ultimate aim of the BCC Regional Training and Development (RTAD) centres was to assist and be part of the growth of BCC. The training was always provided by practising bankers working at BCC with many years of experience behind them.

The term Training and Development reflected how this was being done. The training element related to the professional skills that a banker needed and development related to much broader questions of human personality. In BCC the two were not separated.

The RTAD centres provided a comprehensive training in the important aspects of banking, rather than a mere education. An underlying theme of the RTAD centres was to make employees aware of the possibility of self-development. The courses raised questions whose answers were intended to provide an agenda for life.

There was constant pressure on the training facilities for extra training as new BCC branches opened up and existing branches grew and offered new services.

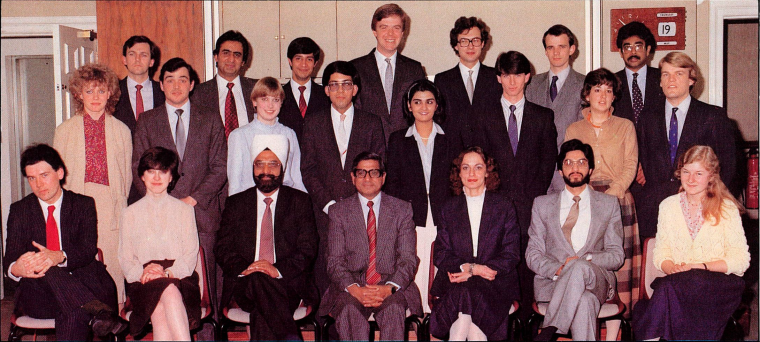

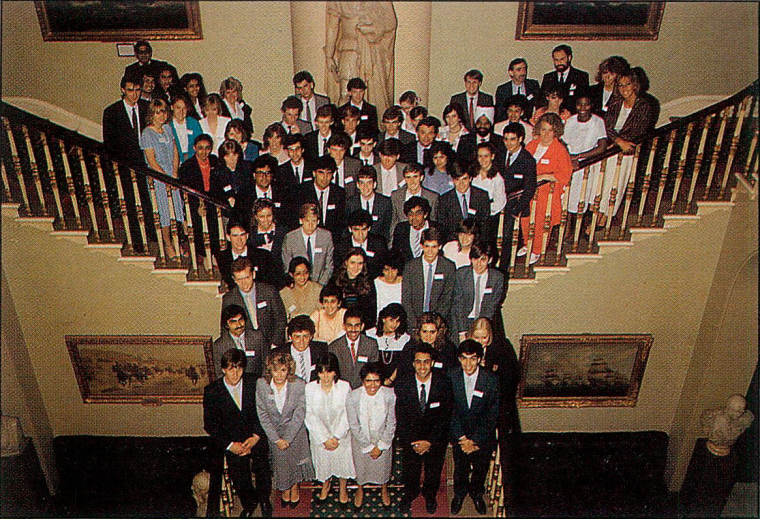

With BCC expanding its presence in the United States, Pace University New York in association with Human Resources in BCC central office London, launched a first six-month training programme for thirty BCC trainee officers who were fresh graduates in USA.

The spread of BCC training facilities around the world was unique in the banking profession. Most international banks with a large global presence centred their training in their country of origin. But BCC was a truly international bank and its training centres in different locations and programmes reflected this.

Training programme

A framework of core content of BCCI training programmes was initially developed with the assistance of the International Management Development division in central office London. These were adapted by the BCC Regional Training and Development Centres to address local requirements.

The RTAD centres assisted by the International Management Development also conducted management training programmes for officers from different countries and had the responsibility of also conveying a moral dimension to BCC employees.

New entrants

BCCI's aim was to provide a fully rounded training for all new entrants.

It was unusual for new entrants to the banking profession to receive such a comprehensive training in the initial stages of their induction. In most banks a new entrant learnt the skills that relate specifically to the job he or she would be doing. Only after some years with a bank would they get an idea of what was going on in the next department. BCC, however, aimed to provide a fully rounded training for all who joined BCCI.

First an orientation phase, lasting a few days, provided the new comers into the banking profession with an introduction to the banking world. This was followed by a skill-training programme, which lasted up to sixteen weeks and had five basic elements. These were:

- retail banking operations and computerised systems;

- trade banking, foreign exchange and marketing;

- bank lending and credit appraisal;

- profit management and accounts;

- management techniques and philosophy.

Trainee officers

One of the hallmarks of BCCI recognised by other banks was to first provide intensive in-house training programme lasting about a year dedicated for fresh graduates recruited in the officer grade. Among the areas that were expanded, and others included were:

- full range of foreign trade transactions, such as letters of credits (sight and usance), advising and confirmation, bill of exchange, banker's acceptance

- negotiable instruments

- bills for collection

- international trade law

- bank guarantees, bid bonds, performance bonds

- balance sheet analysis

- corporate credit

- country and credit risk involved in every transaction

- management of risk

- fraudulent customers

- foreign exchange arithmetic

- treasury management

- dealing room operations

- bank to bank reimbursement

- use of travellers cheques

The training programmes required trainee officers to also spend some time in-between sessions at branches to apply what that were taught and give feedback to the trainers before the end of programme.

On completion of training, the new officers would be assigned their work in BCC branches in the countries under the regional office.

Existing officers

Training programmes were also provided to officers already working at BCCI and requiring to update their knowledge in banking practices and to enhance their skills.

Moral dimension

To infuse leadership, marketing, and negotiation skills in BCCI employees, it was essential that front-line officers, branch managers and country heads, as well as, entrants who joined from other banks, whatever position they held in those banks, should identify with BCC's values and the Major Purpose articulated by the BCC President at meetings and conferences. The essence of these was to appreciate the importance of client relationships as key to business development and service before profit.

All the RTAD centres and the International Management Development division in Central Office London had the responsibility of also conveying a moral dimension to BCC employees in their relationships and conduct of banking.

Creativity was equally an integral part of all BCC training programmes. In BCCI creativity was the ability to think out of the box change one's perception on the sense of possibilities. It was seen as the flow of human energy meeting the challenges in a fast-changing world. The essence of life.

Regional Training and Development Centre in Karachi, Pakistan

BCC's first Regional Training and Development Centre was established in Karachi and initially provided training courses for new entrants from all regions. The next RTAD was set up in London followed by other centres.

The Karachi centre also held seminars for experienced international and local officers. The seminars, which were organised with the assistance of IMD, covered topics in the key areas of international trade finance and credit evaluation and risk asset.

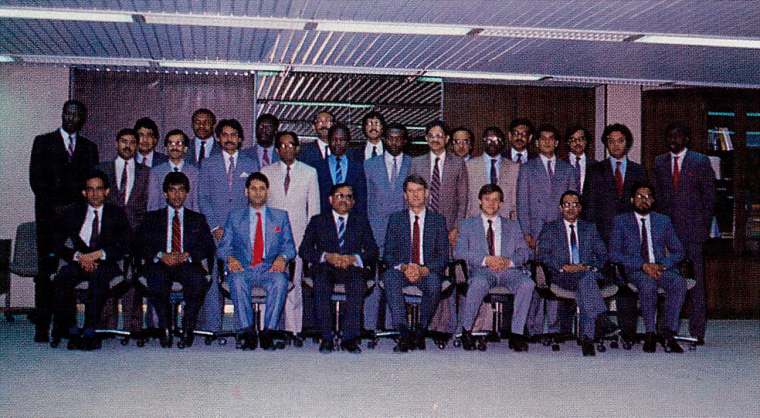

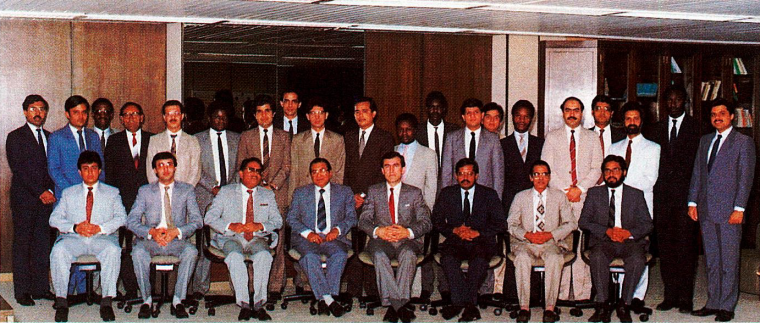

By the end of the first half of 1987, the list of delegates to the BCC seminars included officers from Bangladesh, Cyprus, France, Ivory Coast, Jordan, Kenya, Liberia, Nigeria, Oman, Pakistan, Senegal, Sierra Leone, Sri Lanka, Togo, Turkey, Zambia and Zimbabwe.

Regional Training and Development Centre in London, UK

The BCC Regional Training and Development Centre in London occupied one of the finest sites with uninterrupted views of Nelson's column and Trafalgar Square.

.png)

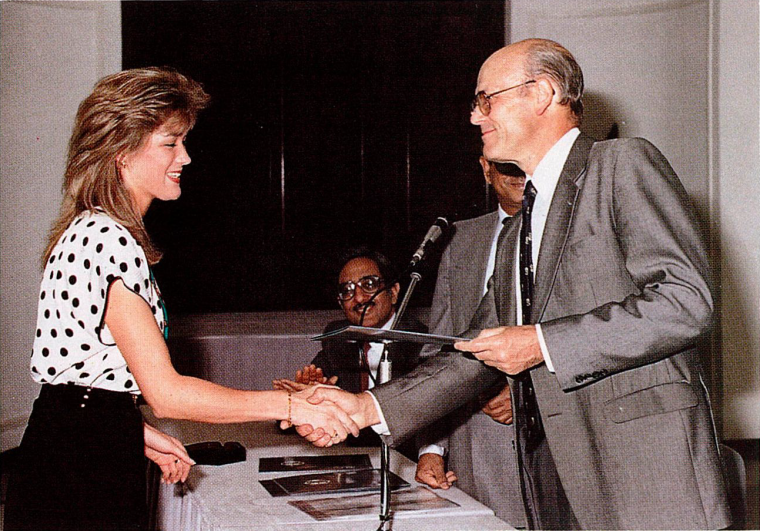

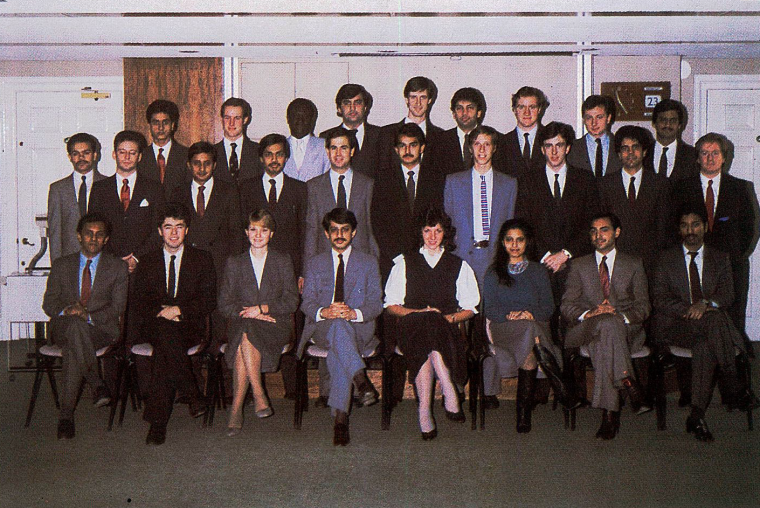

16 June1986, was a memorable occasion for BCC and its UK Training Centre. On that day 20 staff members who had attended the Centre's first Stage One course of the Chartered Institute of Bankers of England & Wales, UK received their certificates from the Institute's secretary-general, Mr Eric Glover, at a special reception held at BCCI 100 Leadenhall Street London EC3.

Page-32-01.png)

Mr Glover signed the certificates on behalf of the Institute, along with UK regional general manager Mr V. H. Abidi. In the course of his speech, the secretary-general said that the Institute's moderators, who re-examined all the examination papers, had spoken very highly of the standard of work shown. Moreover, out of the 21 candidates who had sat the examinations, no fewer than 20 had passed.

Regional Training and Development Centre in Cairo, Egypt

The BCC Regional Training and Development Centre in Cairo held regular course on all aspects of banking.

The Cairo centre also held seminars for officers with the assistance of IMD.

Regional Training and Development Centre in Hong Kong

The BCC training centre in Hong Kong was started in a basement office in the early 1980s by the then BCC Far East Regional General Manager, Mr Dildar Rizvi, to provide training primarily to officers working in Hong Kong and in other countries that were under the administration of BCC Far East Region. At the start the centre was a two-man training team staffed by Mr Rangam Mitra in charge and Mr Mehr Homji, they were both experienced bank officers who joined BCC from Grindlays Bank India. In 1982 Mr Mehboobur Rahman was transferred from BCCI Dhaka to the centre and he took over the responsibility of Mr Mehr Homji who moved to BCCI Human Resources in central office London.

With Mr Rangam Mitra and Mr Mehboobur Rahman working together, the team of two grew to around eight. Mr Mitra eventually moved to central office London and he was the personal assistant to the BCC President for a short time. Mr Kamath, also from Grindlays Bank India, took over Mr Mitra as in-charge of the BCC Hong Kong regional training centre.

The BCC training centre in Hong Kong was the busiest of all the BCC Regional Training and Development Centres. BCCI was expanding its branches in the Far East, and later took charge of training Chinese bankers from mainland China, initially in Hong Kong. It was a full-fledged training centre operating 365 days. It had two training rooms fully fitted with audio visuals. Later, BCC set up a dedicated training centre in Shenzhen to cater for the deluge of requests from Chinese banks and state-owned corporations to train many of their employees in mainland China. It was also practical for logistics and saving costs.

The Hong Kong training centre went into skill training for branch managers first, followed by short sporadic courses in different types of bank transactions while the trainers were gaining experience. Finally, the training was for BCC officers from different countries. The team in Hong Kong would be coordinating with London, London gave the format and the Hong Kong team had to localise - customise the content.

Management training was usually for a year. After completing a particular subject, officers were sent to branches for a short time to study operations and transactions first-hand and report back to the trainers before continuing with their technical training. At the same time, members of the training team would also visit branch managers to get independent feedback and understand training needs.

Some of the core subjects in banking operations covered by the training team were:

- retail banking, including 'know your customer' money laundering

- commercial banking

- corporate banking

- treasury management

- foreign exchange arithmetic

- foreign traded and trade finance

- travellers' cheques

- credit risk and credit evaluation

- country risk

- risk management

- banking regulation

Apart from the above, there were also short courses in

- negotiation skills

- relationship management

- leadership banking

- 'one stop' service and 'point of sale'

- quality

- time management

- crisis management

- correspondent banking

- English speaking for Chinese staff

The Hong Kong Monetary Authority, as well as other banks in region, always had a word of strong praise for the standard of BCCI training in Hong Kong, in the manner and the way the courses and programmes were designed and rolled out to the attending participants.

Mr Mehboobur Rahman, one of the leaders of the BCC training team in Hong Kong at a meeting in 2019 with former BCC colleagues vividly recollected the remarks about BCC made to him by an official of National Westminster Bank Hong Kong, a major retail and commercial bank with its head office in UK. They met at the prestigious Hong Kong Jockey Club after the controversial closure of BCC in 1991. He said, "Mehboob - let me tell you one thing, I have never seen a bank like BCCI. You people really brought a new dimension to banking which we could not offer - one stop service. Concept wise, in NatWest we also provided customer service, but we told our customers that for the next transaction to go to another desk. But here in BCC you kept the customer in one place - everything was done by one person."

BCCI Management Training & Development Centre in Shenzhen, China

The late 1970s and early 1980s involved the de-collectivisation of agriculture, the opening up of the country to foreign investment, and permission for entrepreneurs to start businesses. However, a large percentage of industries remained state-owned. BCCI established a training centre in Shenzhen to fulfil the trust placed on BCCI by the Peoples Bank of China (the central bank) and the need of the Chinese state-owned banks and industries understand international trade and banking with the opening of the Chinese economy and market reforms.

BCCI training for China was not a commercial venture for BCCI, it was in keeping with the BCC President's effort to enhance ability of the developing countries to conduct their international operations without having to rely only on the large Western banks that dominated the local banking scene since colonial times.

China's Central Bank approaches BCCI for training

In the 1980s, following discussion over an informal dinner with Mr Anwarul Amin, General Manager BCC China in Beijing, and the Deputy Governor, the People's Bank of China (central bank), Mr Amin was approached the very next morning by the central bank with a request to start training for the Central Bank which later extended to the Chinese banks and organisations. This was at the time when China had already introduced economic reforms and was gradually opening its economy. The state-owned banks, apart from the Bank of China, had little or no exposure in handling transactions involving foreign trade and other international banking transactions.

Before the opening of China, the transactions involving operation of international trade in China were primarily conducted by the Bank of China who had an extensive network of correspondent banks, through which they routed China’s international businesses. They had the monopoly of handling China's international trade business with the outside world, and they had little interest to train other Chinese banks and reduce their dependence Bank of China.

_0.jpg)

BCCI China training policy

BCCI’S vision and farsighted policy to penetrate the Chinese market benefited from the training provided to the People's Bank of China as well as to the state-owned banks and industrial and agricultural corporations. The policy not only trained hundreds of their officials but also to created goodwill that enabled BCCI representative offices in China to procure their international trade business for the vast network of BCCI branches around the world.

Among the banking courses that were in demand in China were International Trade Finance, Foreign Exchange and Remittances, Negotiable Instrument, Treasury Management and Dealing Room operation.

Courses and training for the officials of the Central Bank (Peoples Bank of China) were tailor-made for their requirements.

Training in Hong Kong

Initially, the training for Chinese bankers was provided at the BCCI Regional Training and Development Centre in Hong Kong. The training by BCC was an eye opener for the local Chinese banks and interest was expressed by state-owned corporations and enterprises. Demand for training began to far exceed BCC's expectations.

BCCI Training Centre in Shenzhen

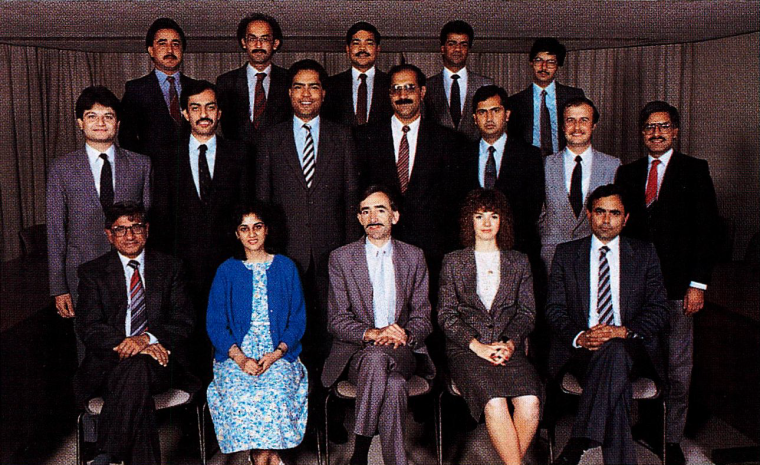

After a short time, the BCC Hong Kong training centre was unable accommodate the high number of requests for training from across China. In around 1988 the BCC Hong Kong training team of Mr Mehboobur Rahman and Mr Sirajuddin Aziz set up BCCI's training centre for on a separate floor in the same building as BCCI branch in the Shenzhen Special Economic Zone.

The primary resources persons and facilitators, for implementing the extensive BCCI China training policy were Mr. Mehboobur Rehman, who also headed the BCCI China Training Centre in Shenzhen, and Mr. Sirajuddin Aziz, were well-versed in International Banking Practices and excelled in their profession.

The recipients of BCCI training were all Chinese banks (e.g. Agricultural Bank of China, Industrial Bank of China, CITIC Industrial Bank etc), as well as the State-owned enterprises (e.g. Non Ferros Metallurgical Corporation etc) and large Chinese corporations having business relations and commitments with developing countries in Africa, Asia and Latin America.

Foreign field visits for the Chinese bankers under training were also organised by BCCI, to acquaint and familiarise them with real life and real time situations covering various international transaction scenarios, and also to give them an added international exposure as well as flavour, especially on the operations of an international dealing room in London as well as Hongkong.

Onsite Training to deliver Chinese banks' requirements

BCC also received requests for onsite training in cities like Beijing, Nanjing, Shanghai, Fujian and Xiamen. Mr Rehman recalled that on one occasion he to travelled to Mudanjiang in Heilongjiang, China’s northernmost province next to the Russian (former Soviet Union) border, to train some 60/70 Chinese bankers and officials of state-owned corporations in the region.

.jpg)

Chinese officials trained by BCCI

Until BCC's controversial closure in 1991 around 3,000 Chinese officials would have passed through the BCCI training centres in Hong Kong and Shenzhen. BCCI would certainly made an enormous contribution in equipping the Chinese banks and state-owned enterprises with technical knowledge and competency to handle international banking and trade on their own.

A further write-up on the BCC Shenzhen training centre is in the section on China.

Bangladesh Training Development and Research Centre in Dhaka, Bangladesh

Another milestone in BCC's history in Bangladesh was the opening of the Bangladesh Training Development and Research Centre in Dhaka on July 17, 1986.

The centre was proposed by Mr M A Rashid, the then General Manager for BCCI Bangladesh. It was set up with the assistance of Mr Mehboobur Rahman, who was instrumental with few others in establishing the BCC Regional Training and Development Centre in Hong Kong.

The Centre is the eighth of its kind in the BCC Group, and the second in the Far East region. As well as training and development of BCC employees working in Bangladesh and offices in South East Asia, it also carried out research and market surveys.

With the increasing volume of foreign trade business and international transactions handled in the three BCCI branches in Bangladesh, Mr Rashid wanted that the existing officers and recruitment of individuals as officers on probation should receive their training in Bangladesh to save costs that would be incurred in sending them for training at BCC training centre in Hong Kong. Both the centres catered to the training needs of their respective areas. Instructors were all practicing bankers and subject matter experts, and the courses developed were very practical for easy understanding by the management trainees, and the contents were relevant to everyday banking.

Instructors would frequently come from BCC Hongkong training centre to Dhaka, which gave the Dhaka training an added flavour, and similarly instructors from the Dhaka centre, would attend training programmes in Hong Kong, for grooming them as future trainers. Visiting senior executives from the BCC central office in London, as well as different Regional Offices during official visits to Dhaka were invited to address the participants and share their thoughts and experiences, on the culture of the BCC.

The Dhaka Centre had a separate arrangement dedicated for training and it was fully fitted with audio visuals. It was under the administrative control of the BCC General Manager Bangladesh however it liaised regularly with the BCC training team in Hong Kong.

The training revolved around the same theme and skills development programmes provided at the BCC Training and Development Centre in Hong Kong , first for the existing officers who had a lack of skills. Training was usually condensed to two days with instructors were flown in from Hong Kong, notably Mr Mehboober Rahman and Mr Sirajuddin Aziz who formed the lead team as they also did for providing training in mainland China (People's Republic of China).

The training areas included:

- handling foreign trade business, both import and export

- foreign exchange operations, SWAPS, hedging, forward, spot

- credit risk and analysis

- technical skills

- negotiating skills

Acknowledgment:

In-house Magazines

Mr Mehboobur Rahman, BCC Regional Training and Development Centre, Hong Kong and head of BCCI Training Centre, Shenzhen SEZ, China