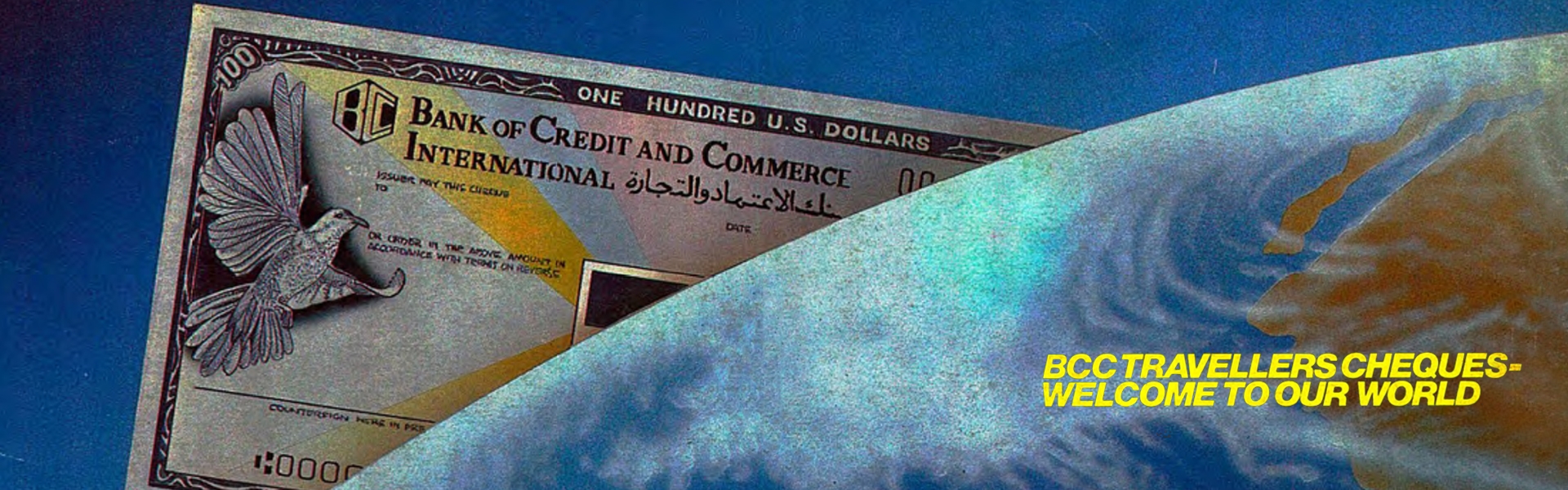

Bank of Credit Commerce International (BCCI) entered one of the largest and most exciting markets in the consumer banking world on 1 December 1981, with the token issue of BCCI's first travellers cheque bearing the logo of VISA International. This marked the bank's entrance to a sector which was then worth about $40 billion a year and growing.

Travellers Cheques are a form of "Guaranteed" bankers cheques sold to the public and payable on demand to the purchaser by most banks. The paying bank seeks reimbursement of the amount paid from the issuing bank.

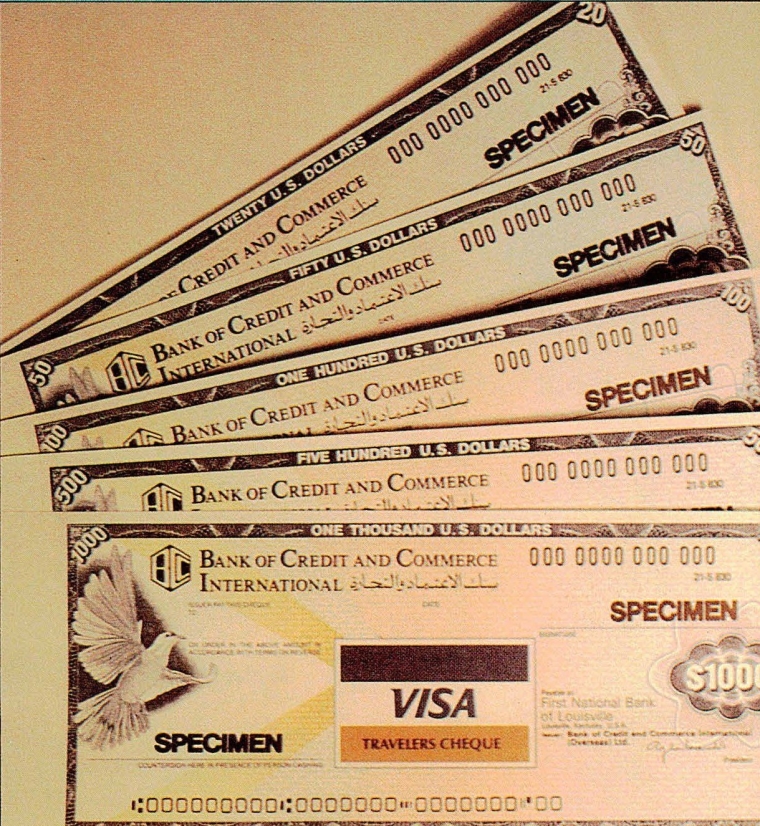

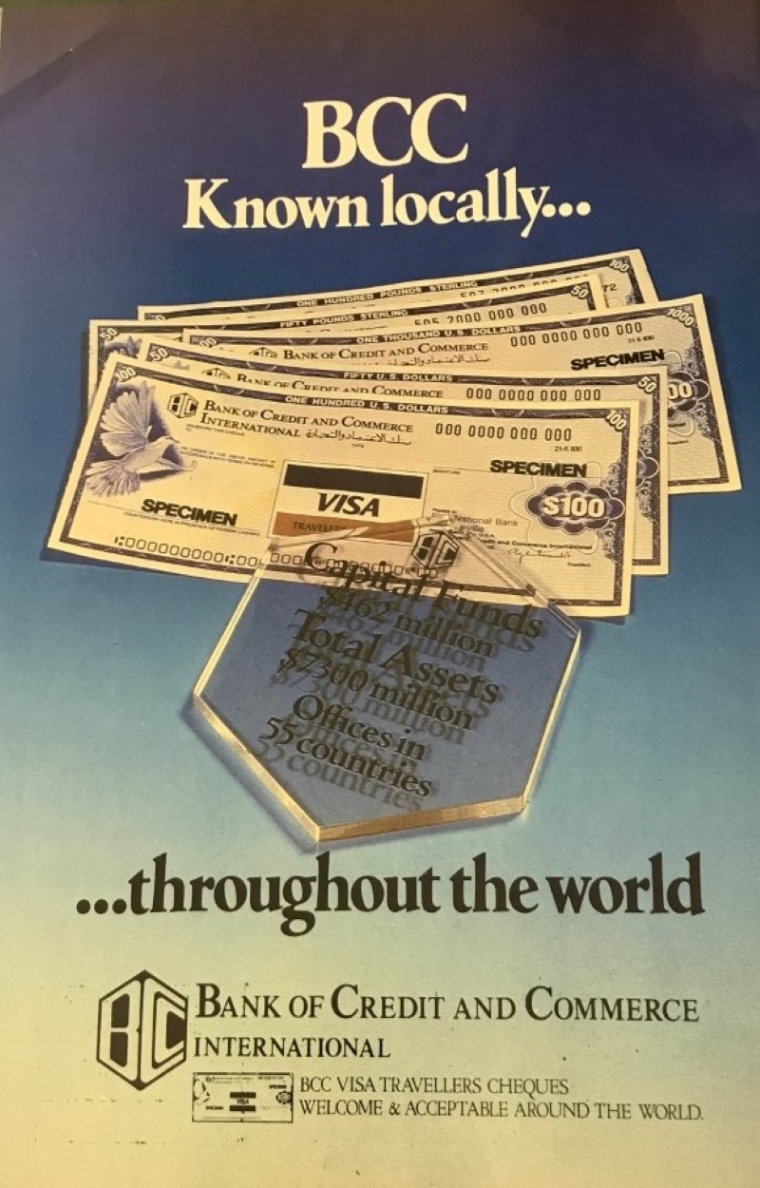

BCC Travellers Cheques were issued under the charter of Visa and ensured immediate acceptability around the world. The first travellers cheques issued by BCC were in US dollars in the denominations of 20, 50, 100, and 1000. This was followed by the issue of BCC Travellers cheques in Pound Sterling.

Popularity of travellers cheques

Travellers cheques are one of the oldest forms of instruments that have helped people take their money with them during their travels, whether on holiday or business. They are preprinted cheques in different currencies, for fixed amounts.

They could be held for any period of time and easily encashed at any location.

Unused Travellers Cheques could be kept for future travels but could be redeemed in cash or credited to a bank account at any time. This is because travellers cheques never expire and offere protection from theft and loss.

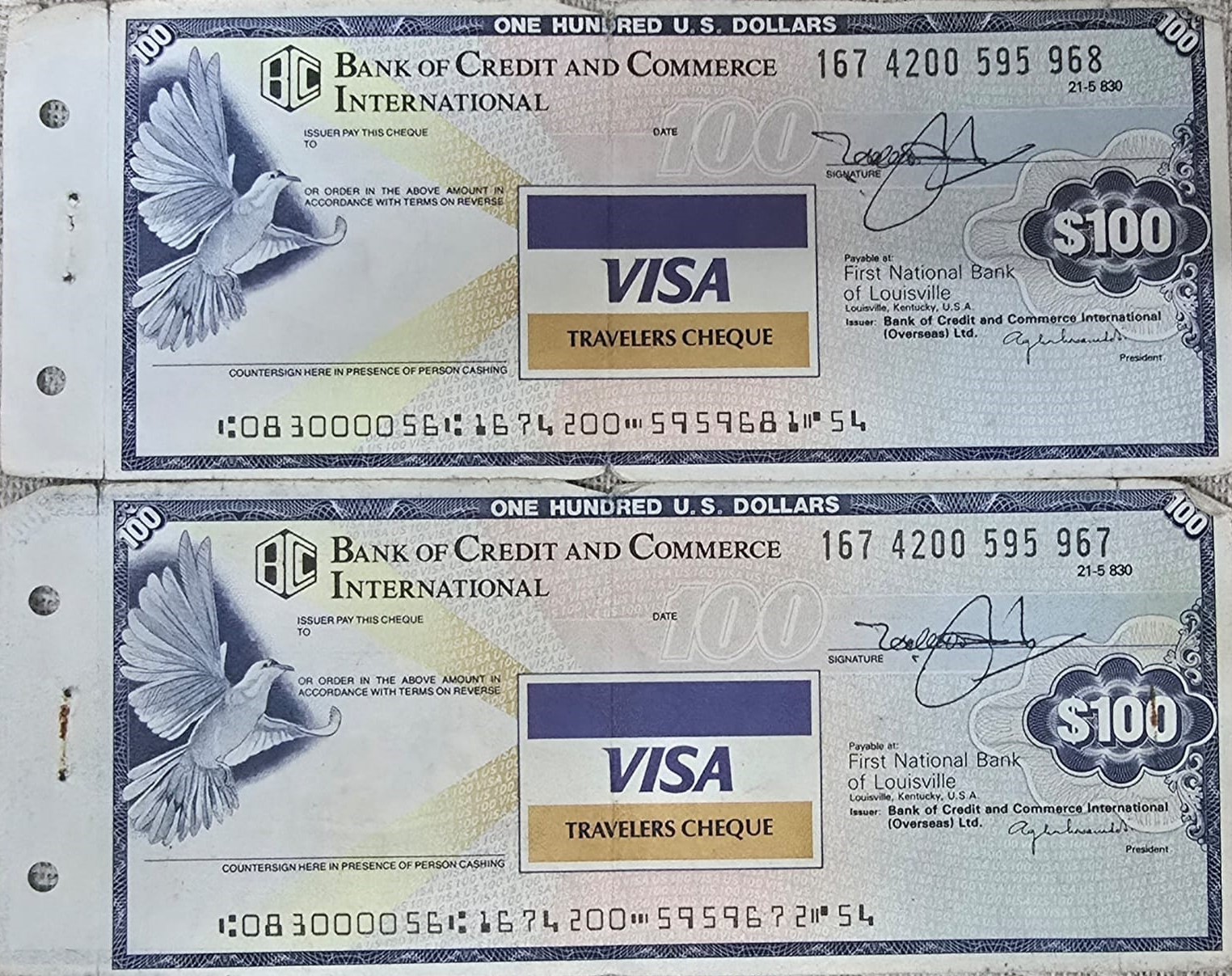

When a person purchases travellers cheques, they are required to sign each cheque (usually on the top left-hand corner). When these are used, the holders must countersign each one a second time in the presence of the person accepting/encashing them. This is so that the two signatures on each cheque can be compared and agreed before payment, and the identity of the holders verified.

Greatest financial benefit for banks issuing Travellers Cheques

The banks issuing their own travellers cheques earned fees at the time of issue, however, the greater benefit was the income earned from investing the sizeable funds accumulated for the bulk of unused travellers cheques that were still being held with the purchasers/holders.

The issuing banks earned interest for the period the cheques that were uncashed, while not paying any interest to the cheque holder, making them effectively interest-free deposits held by the banks to meet payments of unused travellers cheques.

There are cases where unused travellers cheques were retained for long periods, and some were only discovered after the death of holder.

With the forecast on growth of sales of travellers cheques, bankers were confident that this expansion would continue and may accelerate rather than falter with the growth of international travel. More banks than ever were issuing these cheques because they were seen as a strong source of rising profitability.

BCC issues travellers cheques

In the early years, BCC had arrangements with American Express, Thomas Cook and National Westminster Bank Limited to sell travellers cheques issued by them.

In 1981, BCC Travellers Cheques, in association with VISA International, entered the lucrative travellers cheques market.

On 1 May 1983, BCC introduced a new scheme providing free-accident cover for purchasers of its travellers cheques. This gave BCC a distinct advantage over its rival in the highly competitive and lucrative travellers cheques market dominated by Thomas Cook a British company that was forerunner of establishing tourism systems and a package holiday phenomenon, VISA International and American Express.

BCC Travellers Cheques – A New Periphery A New Thrust

BCC was constantly developing new services to meet the demands of its expanding customer base. The decision to launch of BCC’s own travellers cheques in 1981 enabled BCC to offer these worldwide to its customers and non-customers international travellers through sale points at its branches.

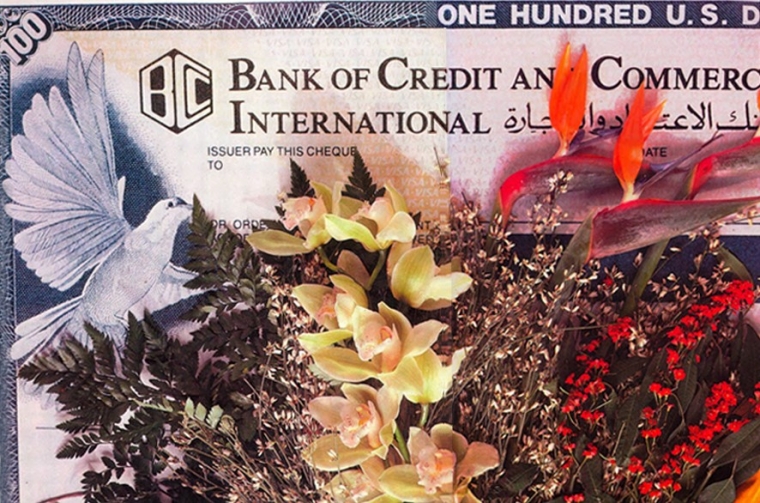

BCC travellers cheques were attractively designed and came in two sets, one in Arabic and the other in English.

BCC US dollar travellers cheques

The denominations BCC travellers cheques in US dollars were $20, $50, $100, $500. The Arabic sets also include cheques of $1,000.

The BCC travellers cheques were backed by VISA, which guaranteed universal acceptability of BCC cheques at all of their points around the world.

BCC travellers cheques were available in two forms: prepacked, which allowed for greater speed for the customer buying and cashing cheques, or loose, if the customer preferred to handle the cheques one at a time. There was a very quick and fool proof system for refunds in case the cheques were stolen or lost. This meant that BCC travellers cheques could be safer than cash: they were just as acceptable all around the world and the purchaser could get a refund if they were lost.

BCC pound sterling US travellers cheques

The introduction of BCC sterling travellers cheques had been brought forward from its original date because of the enthusiasm that greeted sales of dollar travellers cheques. As their sales were monitored in the branches, it was concluded at BCC that sterling travellers cheques would complement the dollar travellers cheques and not detract from their sales in any way.

The occasion on the signing of the first pound ceremony by the BCC President was a recognition of the success of the travellers cheque programme to date, and initiated a new stage in its development.

The sale of sterling travellers cheques was centred on the UK but they had a strong international dimension too. Sterling was the second largest currency for travellers cheques worldwide, after the US dollar. In 1982 it had about 16 per cent of the total market, a fact underlined by the popularity of sterling travellers cheques in many English-speaking countries. London, an international city for tourism and one of the world’s leading financial centre constantly attracted visitors and businessmen for whom it was convenient to have sterling travellers cheques. These were available in five denominations: £10, £20, £50, £100 and £500; all, like the dollar cheques, were backed by VISA.

VISA Alliance

BCC began its association with VISA International in 1977 when it helped launch BCC credit card. VISA was already a major issuer of travellers cheques.

In November 1979 VISA began its travellers cheque operation. In the few years after it entered the market VISA saw many travellers cheques programmes launched by different banks.

.jpg)

Mr K S Khrishnan, from the Systems and Operations Division at CSO, was in-charge of the launch of the BCC travellers cheques.

According to Mr Krishnan,

''There are two reasons why we have been able to move with such speed on this project; One is that we have had a lot of cooperation from Visa International. They are based in San Francisco, but we have been dealing with their London office.

The other reason for the success of this project lies in the nature of BCC. I have been working with BCC for four years and find it very different from anything I had known before. I used to work for one of the major banks in India, and I went along to BCC to find out about this new bank that had appeared in the community. They told me that although they do not attach great importance to job titles, this does not mean any lessening of individual responsibility. They also told me that any new ideas have the full support of management. I felt at home straight away. It is an exhilarating place to work. I spent my first year with BCC studying systems in many of the bank's different locations around the world. This has proved very helpful, and I have now been based in London for three years.

Within BCC there is freedom to operate. You feel you can produce something worthwhile. There is a lot of opportunity for growth and I grow with my bank. There is also a genuine concern for individuals and their families in this bank. The atmosphere is superb. Decisions can be taken very quickly. These are all reasons why we have been able to launch our travellers cheques within three months of starting the project.

I have talked to several of my colleagues; I have talked to several managers. We are determined to create a world record in the first year sales.”

A world first: BCC travellers cheques with free accident cover

On 1 May BCC was placed at a clear advantage over its rivals to market BCC travellers cheques in highly competitive and lucrative travellers cheques market.

BCC provided free accident cover with its trevellers cheques. A WORLD FIRST.

Anyone between the ages of 14 and 75 who purchased BCC travellers cheques was automatically insured for up to $275,000 against any accident that results in the loss of a limb or an eye, or in death.

The insurance was absolutely free. There was no extra charge to BCC customers, apart from the 1 % commission that was standard to all travellers cheques.

No other bank or financial institution at the time had the vision or the courage to attempt to redefine the travellers cheques market in the way BCC had done. BCC had not accepted the limitations that others might have taken for granted.

Any market for a product or a service is created by the laws of supply and demand. These are not static, but are constantly evolving. By introducing the new scheme linking travellers cheques with free accident cover, BCC displayed highly innovative marketing skills to increase sales its own travellers cheques.

BCC travellers cheques as a marketing tool

The market was worth $18 - 40bn in 1981 and even by more conservative forecasts was projected to grow at about 15 per cent each year. At this rate, travellers cheques worth almost $44bn would be issued in 1982 and just over $50bn in 1983. By 1984, the banking community expected expect sales of $58bn and $67bn.

In BCC travellers cheques were a major customer-orientated operation. Unlike Thomas Cook, VISA and American Express, BCC had the added benefit of marketing its cheques directly to BCC clients banking with its large network of branches worldwide.

BCC travellers cheques achieved high sales in the United Kingdom with its international links and also in the Third World (Asia, Middle East, Africa and South America) where its competitors' sales had not been impressive.

There was a great potential in Europe for travellers cheques.

The thousands of employees, the members of the BCC family, serving in BCC did their own marketing, directed by the Central Support Organisation in BCC’s headquarters in London.

The slogan in the BCC branches was "Sell travellers cheques through BCC and sell BCC through travellers cheques".

BCC explored other avenues to increase sales of BCC travellers cheques

British Airways

The travellers cheques department of the BCC UK Regional Office established a special link-up with British Airways to sell BCC travellers cheques through the five major travel clubs run by them. The clubs relied on the strong connections that existed between the UK and the rest of the English speaking world.

The Australian Family Reunion Club was the first to be set up, in 1976, and now has some 60,000 members throughout the UK. The USA and Canadian Reunion Club, established the following year, also has 60,000 members, while the New Zealand Reunion Club had approximately 27,000. Two more clubs were established in 1981. Members could buy BCC travellers cheques on very favourable terms without payment of the normal 1 % commission.

BCC - official provider of travellers cheques to the 1986 Commonwealth Games

BCC was a major sponsor for the 13th Commonwealth Games held in Edinburgh, Scotland, between July 24 and August 2 1986. BCC signed an agreement with the authorities in March.

Around two thousand athletes competed for the coveted medals and nearly half a million visitors were reported to have visited the Games. In addition, the Games would have been seen around the world on television, with a potential audience of over 800 million people.

By becoming a major sponsor, BCC enjoyed prime advertising sites. Large wide banners displayed in the stadium promoted BCC's services. These would have been viewed by the athletes, large number of people visiting the Games and the worldwide television audience of millions.

For visitors to the Games BCC had a hospitality tent and a bureau de change prominently situated near the main entrance. These offered BCC marketing opportunities to publicise BCC services and generated sales of BCC travellers cheques.

BCC travellers cheques centres

Travellers cheques became an important product for BCC. They were easy to sell worldwide by its large network of branches and associated companies, and they were profitable and risk free. They frequently provided leads to other business and new clients for BCC.

As sales of BCC travellers gained a worthwhile share in various markets and BCC aspiring to be a market leader, Travellers Cheque Centres were established in Abu Dhabi (United Arab Emirates), Trinidad and Tobago, Kuwait, Muscat (Oman), Hong Kong (Far East), Indonesia and Canada. They acted as a focal point for the whole BCC travellers cheques operation in these areas.

At a specially convened conference on 19 January 1982, Mr Agha Hasan Abedi, President of BCC, called travellers cheques "a profitable instrument of relationship". He urged delegates to grasp the reality behind travellers cheques and to understand their importance for the whole Group.

"Travellers cheques", Mr Abedi said, "add a new dimension to my personality. They are a means of making a profit and at the same time a means of fulfilling my aspirations. There is great happiness in selling the largest possible volume of travellers cheques."

BCC Travellers Division

The BCC travellers cheques division was formed in September 1981 in the Central Support Organisation (CSO) at BCC’s headquarters in London.

BCC Travellers Cheques a resounding success in the first year

.jpg)

Sales of BCC Travellers Cheques in 1983, the first year of its operation, created a world record, according to VISA International.

As the sales volume increased, BCC travellers cheques operation became an important profitable activity.

Operations

The travellers cheques division in CSO London took care of inventory control, customer relations (i.e. supplying the branches with publicity material or special stationery that they might need) and refunds.

There was also an accounts department that looked after remittances from the branches and liaised with the investment department over the handling of the “float” representing funds held to cover payment of uncashed at any time in future.

Acknowledgement:

In-house Magazines