Japan was one of the world's largest economies and its manufactured goods and projects abroad were important to BCCI’s vast network of branches in countries around the world handling foreign trade business and providing short-term trade-related financing and issuing local performance bonds and guarantees.

Country information

Japan, an island country located west of the Pacific Ocean in the Northern Hemisphere, its neighbouring countries include South Korea, China and Russia.

Tokyo was Japan’s capital, one of the world’s most populous cities.

Tokyo was Japan’s economic centre and the seat of both the government and the Emperor of Japan.

History

Japan was inhabited for many thousands of years.

A great civilisation developed from the 8th century and to the late 12th century. The seven centuries thereafter were a period of domination by military rulers resulting in near isolation from the outside world from the early 17th to the mid-19th century.

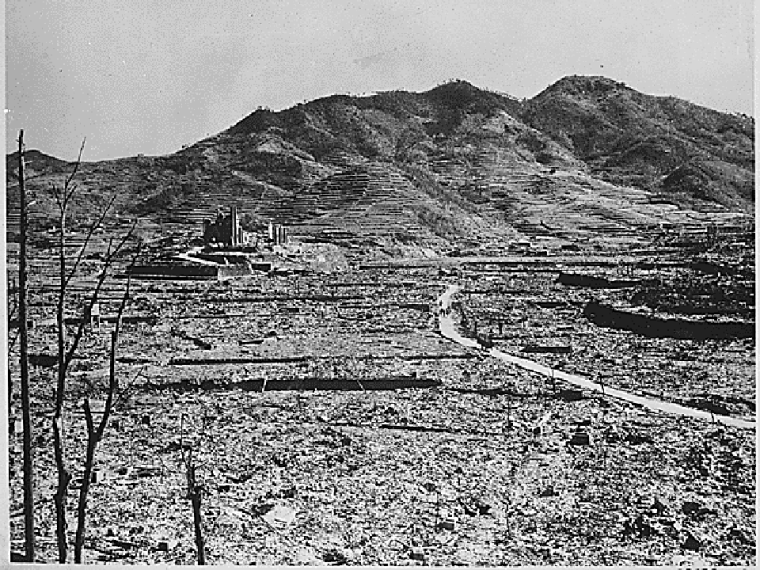

Japan opened its ports in 1854 and began to intensively modernise and industrialise. During the late 19th and early 20th centuries, Japan became a regional power and was involved in World War II (1939-1947). Japan was surrendered to the USA forces after two atom bombs dropped by the USA totally devasted the cities of Hiroshima and Nagasaki, killing between 90,000 and 146,000 people in Hiroshima, and 60,000 and 80,000 people in Nagasaki, mostly civilians, apart from the many thousands who survived and suffered the unimaginable life-long effects of the bombings. Tens of thousands later died of radiation exposure.

Since the war, Japan’s economic growth was that brought the country to the forefront as one of the world’s foremost manufacturing countries and traders of goods.

After World War II, Japan adopted a new constitution in 1946 that came into force in 1947, constitution stating that “sovereign power resided with the people”. The Emperor of Japan had a ceremonial role with no power related to government that was directed and controlled by the Cabinet headed by the elected Prime.

After World War II, Japan adopted a new constitution in 1946 that came into force in 1947, constitution stating that “sovereign power resided with the people”. The Emperor of Japan had a ceremonial role with no power related to government that was directed and controlled by the Cabinet headed by the elected Prime.

Population and language

In 1980 when BCCI was seeking to establish a representative office in Japan, the population of Japan was in the region of 116 million.

The Japanese people constituted the overwhelming majority of the country’s population.

The national language was Japanese.

English had taken a major role in Japan as a business and international link language.

Economy and foreign trade

Japan achieved extraordinarily rapid rate of economic growth in the first several decades after World War II that ended in 1947.

It had developed a highly diversified manufacturing and service economy and was one of the world’s largest exporters of motor vehicles, steel, and high technology manufactured goods (notably consumer electronics electronics).

Japan was also one of the world’s principal shipbuilders.

Foreign trade 1982:

Main exports: motor vehicles, machinery, non-electric, electrical machinery, iron and steel, chemicals, instruments textile yarns and fabrics, ships.

Main imports: crude oil, food, timber, metal ores, petroleum products, machinery, chemicals, natural gas, coal, non-ferrous metals.

BCCI in Japan

In the first decades after World War II, Japan’s financial system was significantly different from that of other developed countries in several respects, most notably in the major role played by banking and the relatively minor position of securities. However, these differences gradually disappeared as markets were being deregulated and internationalised.

The situation within Japan was a little complicated for Bank of Credit and Commerce International (BCCI) as banking licences were only being granted on a reciprocal basis. If a Japanese Banking Group established offices in Luxembourg, then BCCI may well be able to open in Japan.

In 1980 BCCI established a representative office and expected to have a fully-fledged banking branch in future.

The representative office was located at:

Shosen Mitsui Building 2nd Floor

1-1 Toranomon 2-Chome

Minato-Ku

Tokyo 105

Telephone: (813) 584 5217

Fax: (813) 582 1405

Telex: J 25930 TBCCI

By the 1980s the Japanese financial establishment had become a major international force: Japan’s banks had come to dominate international banking, while the Tokyo Stock Exchange emerged as one of the largest securities markets in the world, in terms of capitalisation.

Beginning in the mid-1980s, the laws regulating the financial system gradually were revised, and the operation of banks, securities, and insurance companies was liberalised.

BCCI closed its representative office and opened a branch of Bank of Credit and Commerce International SA (BCCI) in Tokyo.

The branch was located at:

Mitsui Osk Building

2-1-1 Toranomon Minato-Ku

Tokyo 105

Telephone: (813) 505 2551

Fax: (813) 582 1405

Telex: J 25930 TCCCI

BCCI’s policy towards Japanese market

_0.jpg)

Mr. Y. Niimi, a Japanese national, in the Central Marketing Division at Central Office in London, with special responsibilities for Japan, outlined BCCI's policy towards Japan’s massive market, in an interview published in BCCI In-house in 1981.

"As you know Japan is a country based on traditional principles and modern technology. Few Western organizations are able to fully comprehend the way modern Japan thinks. Japan is of course a fully developed country, to outsiders it may look like just another part of the Western World but in its heart Japan is definitely Eastern. It is perhaps for this reason that more Japanese companies are moving towards the BCC Group. They appreciate our technology, our motivation and most important our multinationality.

My role within BCC is to develop business, I have been here for one year having left a job with the Bank of America, and in that short space of time I have witnessed the BCCI Group's colossal growth. It is because our management structure is so essentially different from more traditional banks, because our managers can act fast, decisions can be made in a day, without the need for long committee meetings, it is for all these reasons that my work with the bank and Japanese companies is going so well. We do have committees but just to expedite and guide action not to delay it.

I work as a Liaison Officer between Japanese companies who require local currency finance, let us say in Nigeria or Kenya, and the BCC office in that country. The companies appreciate the personal approach that this highly multiracial organization can give them, they appreciate dealing with a fellow countryman, and as I have said before they like our style of service. Speed, efficiency and personal attention - this is what we are good at, this is why our Profitmen flourish.

The philosophy of my country and the philosophy of my bank, they are so similar that is why BCC is ideal for Japan. Although business is hard to get, the size and scope of it is so great that it is well worth working for.

To summarise all that I have said, BCC is training its people for the world of tomorrow, a fact that Japanese companies can appreciate. As the Third World grows, based on the principles of sound expertise and personal relationships then so will the BCC Group. Gradually through our service to Japanese companies we making in-roads to the country itself. It is a major future market place for us.''

EMP: A Global Marketing Thrust

Traditionally, BCCI country profits would come primarily from business generated by branches within that country. The representative offices in the country would normally solicit business for other parts of the BCCI group.

In 1986, the President of BCCI introduced the concept of the 'External Market Place' (EMP)) that expanded the vision of the marketplace to open up a wealth of new marketing opportunities. BCCI family members in every country were made conscious that every country was directing its international trade business, in particular, to banks abroad.

Under the EMP concept, BCCI Tokyo branch actively contacted local banks, central banks, and individuals in the country, to secure trade-related business for the BCCI network in other countries, and to also establish relationships with them.

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west de-cided to freeze BCCI Group's assets and abruptly shut down BCCI's operations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private in-vestors or another bank.

BCCI Tokyo branch was reportedly closed since 8 July 1991. The court appointed a Provision Liquidator after the decision of the western central banks on 5 July 1991 to abruptly shut down BCCI worldwide. No further information is available.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hard-est on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)