Correspondent banking that involved relationships to conduct international transactions of BCC through other banks was centralised in the International Division. There was an emphasis to emerge as ‘provider’ of correspondent banking services from the conventional practice of ‘taker’ of correspondent banking services.

BCC used the banking services of other banks to facilitate international transactions and business of BCC clients dealing in countries where BCC did not have a branch or where it was not possible for the BCC branch to handle a transaction. The other banks acted as BCC's correspondents and executed and processed cross-border transactions of BCC clients that were directed to the banks.

BCC at the same time handled international business of other banks willing to use the services of BCC branches.

International Division

Correspondent banking relationships in BCC were initiated and maintained by the International Division in the Central Support Office (CSO) in London, United Kingdom, and later in Abu Dhabi, U.A.E. when CSO moved there.

In 1972 BCC started operations with branches in Abu Dhabi, United Arab Emirates, and London, United Kingdom. It was essential for BCC to establish relationships with other banks to service BCC's own clients dealing with countries where BCC did not have a presence.

BCC initially developed such relations on need basis however with the bank’s expanding network the International Division was set up in 1975 to perform one of the head office functions in the Central Support Office (CSO) in London and gradually and methodically built relationships with major banks in various countries to adequately service the requirements of branches of the BCC group of banks, subsidiaries and affiliates (BCC).

Through the correspondent banking relationships developed by International Division, the BCC Group also provided comprehensive correspondent banking services to a large number of international banks in countries like the USA, Latin America, Canada, Australia, Far East, Asia, Middle East, Africa, Europe, USSR and Comecon countries. The broad range of services for correspondent banks included clearing, handling of Letters of Credit/Bills, trade finance, funds transfers, Foreign Exchange and money market activities.

BCC also acted as arbitrator in disputes on settlement of international transactions between BCC branches, and between BCC branches and correspondent banks - a role that demanded great tact.

What is correspondent banking?

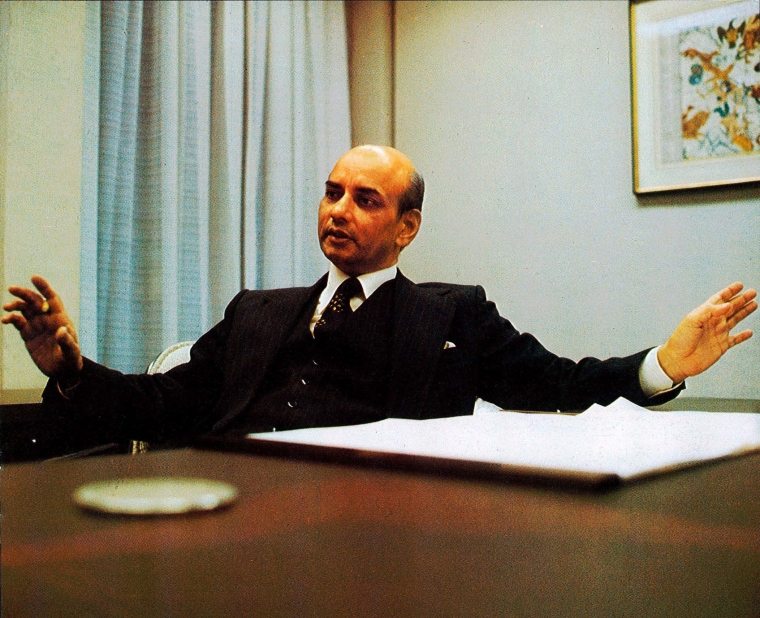

"An international bank cannot exist without relationships with other banks just as people need relationships with other people during the course of their daily lives. We have developed relationships with as many banks as possible. This relationship is both vital and close with those banks which have branches where we do not, and handle our business confirm letters of credit, transfer funds and so on." Mr Akhtar Anis, head of BCC International Division CSO London.

On the supplementary role of International Division, any BCC branch that had a problem about dealings with another bank or needing guidance on routing banking transactions through other banks were referred to the division.

_0.jpg)

Structure of International Division

The international division divided the countries of the world into different areas, with a senior officer, designated as Area Manager, responsible to manage countries under each area or more than one area.

These areas were broadly defined as: Europe, Middle East, South Asia, Far East, South (Latin) America, U.S.A. and Canada, and Africa sub-divided into French-speaking and English-speaking Africa.

Each Area Manager identified suitable banks with whom BCC could work for mutual benefit:

- To facilitate international transactions and foreign trade business of BCC’s own clients through other banks.

- The potential for BCC branches to handle international transactions and foreign trade business of other banks, like from the Middle East and the Third World.

Area Managers received officials from other banks visiting London, the world's leading financial centre, and also initiated relationships with the persons dealing with correspondent banking in other countries through correspondence, followed by telephone calls and, if required, calling on the banks in their countries to formalise the relationship. This usually resulted in a mutual agreement that allowed BCC and the correspondent bank to execute payments and transactions as one another's agent and may include extending lines of credit for confirmation of letters of credit and forex and money market and foreign exchange dealings.

The General Manager/Executive-in-Charge and senior area managers in BCCI International Division availed the opportunity from time to time to also attend IMF/World Bank and other international meetings to further existing relationships with correspondent banks and also identify new banks.

After relationships with banks were formalised, the International Division was responsible for maintaining BCC’s relationships with its correspondent banks. Area Managers liaised regularly with their counterparts in the correspondent banks and were responsible for ensuring smooth handling of the international transactions from BCC branches, building closer working relationship, and enhancing BCC's image in the financial markets.

When problems and issues arose in dealings with correspondent banks and needed to be resolved. Area Managers intervened when approached by BCC branches or the banks.

BCC as receiver or user of services of correspondent banks

In the early years, BCC was a net receiver of the services of correspondent banks. This meant that BCC branches relied a great deal on using the services of its correspondent banks to supplement BCC's own network. This was vital with the considerable increase in the volume and size of international trade transactions handled by BCC.

Area Managers lines of credit with correspondent banks and central banks upto which they took exposure risks on business sent by BCC branches, such as confirming letters of credit, issuing guarantees, entering into foreign exchange contracts and accepting placement of funds by BCC.

BCC as provider of services to correspondent banks

By the mid-1980s BCC had achieved a maturity and strength that offered a major opportunity to become a provider of services to correspondent banks through BCC’s network and a strong local presence. This represented a new phase in BCC's growth.

Area Managers also recommended lines of credit extended to correspondent banks and central banks upto which BCC took exposure risks involved in handling their business, say, confirming their letters of credit, issuing their guarantees, foreign exchange dealings and placement of funds with them.

- Correspondence banking: BCCI International Division Activity lists

- Business Highlights: 1988 - 1989 - 1990

- Notional income on business received from correspondent banks: 1990

- Business received / BCC passed on - 1990

- Business received / BCC passed on - 1989

- Business received / BCC passed on - 1988

International Division solicited business for BCC branches from an ever-increasing number of banks around the world. Because this activity was another source of income for BCC branches, there was a stronger market orientation to become a provider of services to many banks.

Other activities

International Division performed a number of other activities such as those reflected in the folowing Instruction Circulars issued by BCC:

- Monitoring utilisation of credit/confirmation lines extended to BCC by various foreign banks: March 1977

- Test key arrangements to authenticate cable and telex messages with BCC branches and banks: June 1983

- Accounts Opened with Correspondent Banks by Branches: March 1978

- Reciprocity of business with foreign banks: January 1977

- Visits by foreign banks: January 1981

- Due From/Due to Banks: February 1975

A pioneering concept

In 1986, BCC President, Mr Agha Hasan Abedi, launched a pioneering concept in marketing known External Market Place (EMP in short). The potential of EMP created the understanding that there was also a profitable external market in any country that could also be exploited by BCCI locally to generate additional business for BCCI on a global scale. The external market place included large volumes of a country' essential international business such as foreign trade of state-owned organisations, local companies, merchants and traders and projects outside the country.

EMP was thus an organised process and varied from traditional marketing whereby the BCCI staff already working in one location (internal market place) were able to generate external business from that location for the benefit of BCCI's branches in other locations. It was a manifestation of the Totality of BCC.

In correspondent banking, the concept of EMP was particularly important. The local banks regularly handled the country's international business that was sent to their foreign correspondent banks, before BCCI was established.

With the expansion of BCCI branches worldwide, and some local BCCI staff designated as CBRB Officers and responsible for Correspondent Banking Relationship Business (CBRB) as an extension of International Division, there were new and greater possibilities to persuade local banks to pass their international (external) business previously handled by their correspondent banks, to BCCI branches in other locations.

Dealing with Central Banks

The International Division dealt with Central Banks which an important part of its role. To get on a Central Bank's approved list meant that large public and private sector business could be placed with BCC without undue formality.

In many countries in Africa and Asia BCC acted as banker for their commodity exports and help finance their capital goods for government programmes. Central Banks relied on approved banks and correspondent banks for finance and to oil the wheels of international business.

Monitoring risk

The International Division recommended limits upto which BCC undertook foreign exchange risk for transactions for other banks, and funds that BCC placed (invested) with other banks.

International Division moves to Abu Dhabi, U.A.E.

During the BCC restructuring plan being discussed with BCC’s regulators, before it was controversially shutdown in 1991, the Central Support Office (CSO) in London responsible for the head office functions was moved to Abu Dhabi in 1990.

International Division was part of the move and thereafter operated from Abu Dhabi under Mr Chris Hollander who was the new head the division. Mr Hollander was a senior international banker who had joined BCC about a year before BCC's closure.

BCC closure

BCC was controversially shutdown on 5 July 1991.