When BCC took the decision in 1983 to open a branch in Macau, a former Portuguese colony, its important trading partners were China and Kong, where BCC already had a presence.

Country information

Macau, officially now known as Macau Special Administrative Region of the People's Republic of China (China for short), was a former Portuguese territory that reverted to Chinese sovereignty on 20 December 1999. Macau was taken on lease from China in 1557 as a trading post.

In 1887, Portugal by treaty received full sovereignty over Macau from China. Macau-Chinese relations were occasionally tense but never violent. Macau's historical status contrasts with that of Hong Kong, which was taken by the British from China in an unfair treaty and under the threat of violence.

Until 1999 it was a Portuguese territory taken on lease from China in 1557 as a trading post. In 1999 it was handed over to China as the British had handed over Hong Kong to China in 1997.

Macau, with its two islands, Taipa and Coloane, is located on a small peninsula and lies at the western shore of the great Pearl River Delta, opposite Hong Kong.

The Macau peninsula had an area of just two square miles. New roads linking the city of Macau with the islands of Taipa and Coloane increased the available land to six square miles. The Macau Territorial Plan, launched in 1979 as a land reclamation scheme, doubled this area and provided land for housing and industry.

%20(2).png)

The Portuguese set up bases of operations there for trade with China, especially Guangzhou, and for trade with Japan. Both Portuguese and Chinese merchants flocked to Macau, and it quickly became an important centre in the development of Portugal's trade with India, southern China, Japan, and Southeast Asia.

Macau also had a reputation, dating from the 1920s and 1930s, as a place of smuggling and gambling/ Macau's gambling houses were (and are) famous as a popular tourist destination.

With its historic street, residential, religious and public Portuguese and Chinese buildings, the historic centre of Macau provides a unique testimony to the meeting of aesthetic, cultural, architectural and technological influences from East and West.

In the 1980s, Macau was a quiet city with a distinct "small town" atmosphere. It was growing into a rich commercial and industrialised city.

Population and language

In the 1980s the population of Macau was in the region of 275,000.

Chinese-Cantonese was spoken by about 96 percent of the population, and Portuguese by about 4 percent). English was also expanding as a language in commerce and tourism.

Economy

Macau was built on international trade, gambling, and port services.

The territory's key exports were gaming and tourism. Gaming has been licensed in Macau since 1850 and attracts large numbers of gamblers from mainland China. The gaming industry dominates the local economy, providing over 70 percent of total employment.

Macau's experience in commerce and financial dealing and status as a free port, its low taxes, the absence of foreign exchange controls made it an attractive financial centre.

BCCI in Macau

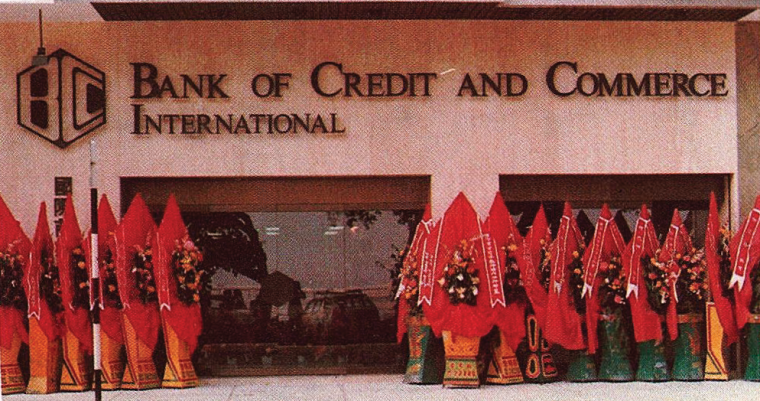

The official opening of BCCI Macau took place in October 1983 as a branch of Bank of Credit and Commerce International (Overseas) Ltd.

BCC was already working in an advisory capacity for the Macau government when it was granted a full commercial banking licence. It took around three months to complete formalities, select the building for the branch and have it fitted by BCC to reflect the distinct corporate look of BCC worldwide which involved the input of a Lebanese design consultant advising BCC central office London for this purpose.

BCC was aware through its privileged dealings with the Macau's monetary authority and BCC’s active presence in the People’s Republic of China, commonly referred to as China, that the rate of growth in Macau would increase, as the authorities in Macau and China were planning a joint economic expansion for the region. Macau was then likely to become closely associated with China's Special Economic Zone in Guangzhou. It was BCC’s view that by providing access to the potentially vast Chinese market, this move would increase Macau's appeal to investors and utilising banking services as Macau branch.

Even before the official opening in 1983, BCCI Far East Regional Office in Hong Kong had established a valuable relationship with local banks in addition to Macau's monetary authority. Top international banks like HSBC, Banque Nationale de Paris (BNP) Citibank and Standard Chartered Bank were also granted a full commercial banking licence at the same time as BCC and initially, BCC shared one room with the other banks.

BCC Macau operations

Using the BCC group international network, Macau branch was able to generate business in the former Portuguese colony and port city located off the coast of China, just south of Guangzhou and about 40 miles from Hong Kong. Macau was an important hub of trading and commerce for business with China, primarily with Guangzhou, Japan, the Philippines. Macau was a major importer of goods from China. Some of these were re-exported.

BCC branch was located at:

45/45 A Rua Da Praia Grande

PO Box 202

Macau

Tel: (853) 78588/ 78394/6

Fax: (853) 512683

Telex: 88544 BCCOM OM / 88654 BCCMA OM

The first manager of the new branch was Mr Asif Moyeen, who joined BCCI in around 1976 in the international cadre on returning from higher studies in the USA. After working primarily in a marketing role at BCCI branches in Dhaka and Chittagong, Bangladesh, he then assigned to BCCI Beijing Representative office in China. After a few years, having gained work experience of working in both China and Hong Kong, he was appointed Manager of the first BCC branch in Macau.

BCC’s operation in Macau was able to also penetrate markets in Portugal, Portuguese speaking countries in South America, and elsewhere. Given Macau's economic climate and its geographical location close to the Chinese major port of Guangzhou (internationally known as Canton) and Shenzhen an upcoming international financial centre, and Hong Kong an established international financial centre, further strengthened BCC Macau branch's sustained growth in business and profitability.

The main operations of BCC Macau branch, like branches of other international banks in Macau, involved handling customer accounts, mobilising multi-currency deposits, opening letters of credits to import goods and bill discounting, as well as interbank placements and borrowings, and foreign exchange dealings for clients and with the Macau Monetary Authority, through the branch’s own dealing room.

In a conversation in early 2019 with Asif Moyeen, the first branch manager, he recollected the Governor would often stop by at the branch during late evening walks on the Rua Da Praia Grande where BCC Macau was situated and the employees were still working. On a number of occasions the Governor would approach the branch for his personal requirement for BCC traveller cheques which offered accident insurance cover these were delivered to his home.

The other banks did not understand why BCC enjoyed a personal relationship with clients. According to Mr Moyeen it was only for one reason, BCC’s sense of serving with no conditions for which BCC was perceived in a different way and took BCC to another level.

Promoting Macau’s exports to Africa and the Middle East

In early 1983, prior to BCC being granted a commercial banking licence, BCC and the Instituto Emissor de Macau, Macau's monetary authority, signed an agreement by which BCC would help the IEM plan and promote Macau's exports to Africa and the Middle East.

The agreement with BCC came after a series of consultations between the IEM and the Economic Department of the government of Macau, which concluded that 'BCC, with its extensive network of branches in the Middle East and Africa, coupled with its profound knowledge of these potential markets, is in a position to provide advisory services to the government of Macau in promoting trade with these countries.'

Macau's history as a trading centre goes back a long way. The 16th century was an era of great exploration for the Portuguese. Vasco da Gama had made an historic voyage to India at the end of the previous century. Other explorers travelled further east and then turned north. Jorge Alvares first set foot in China in 1513. His visit was followed by the establishment of a number of trading centres in the region. In 1557 these were consolidated at Macau, which flourished for a long time with a virtual monopoly on trade between China, Japan and Europe.

In 1841 the British settled in Hong Kong, an island 40 miles north-east of Macau. Its deep water harbour attracted ocean-going vessels and trade gradually shifted to the British colony. The economic importance of Macau declined as Hong Kong became one of the world's major commercial centres.

Macau began to reassert itself in economic and commercial terms when Portugal and China established diplomatic relations in 1979, Macau was described as 'a Chinese Territory under Portuguese administration'. Macau enjoyed long-term political stability.

The Territory was administered by a Portuguese governor and a legislature until end 1999. The resolution of the problems of sovereignty and administration helped the government to create a favourable climate for investment and development. The territory is a now a special administrative region of the People’s Republic of China.

Macau's return to a high level of economic activity began in around 1973 with a boom in the textile industry. Other sectors followed suit. Tourism and construction entered a highly expansive phase. Altogether, during the 1970's the GNP rose by an average of 16% a year.

Although about 60% of the active population was then employed in services, manufacturing, which was geared mostly to export markets, was increasingly important. Highlights of Macau's growth were:

- a 38% increase in public income from 1980 to 1981

- a 36% increase in exports in 1980 and a 46% increase in 1981

- a doubling of the production value of manufacturing industry in the past two years

- a 20% increase in the number of visitors from 1980 to 1981.

The government's development policy centred on enlarging the Territory's basic infrastructure and completing a legislative framework, mainly in the areas of banking, insurance and foreign trade. The government was also keen to provide incentives for the installation and expansion of new industries and financial activities.

The EEC (now the European Union) and North America accounted for more than 60% of Macau's exports. But the authorities were also looking carefully at Third World markets. Along with the increase in exports, imports had also increased. These were mainly raw materials for the textile industry, foodstuffs, fuel and equipment. They illustrated the trend towards the expansion of economic activity and indicated a general improvement in living standards.

A feasibility study for an airport was underway and new port facilities, including a container terminal, were being built at Coloane Island. In 1981 the new University of East Asia opened on Taipa Island, with courses on economics, business management, arts and sciences.

BCC closure

On 5 July 1991 the Bank of England and other regulators in the west decided to abruptly freeze BCCI Group's assets and shut down BCCI's operating branches worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

BCCI branch in Macau was closed and taken over by the Central Bank on 12 July 1991 and Administrative Commissioners were appointed. No further information on the status of BCCI's operations in Macau is available.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)