With Bank of Credit and Commerce International (BCCI) already established in Panama, Venezuela and Colombia, the move into Brazil in 1983 was part of a long term policy to penetrate South American markets.

Country information

Brazil, officially the Federative Republic of Brazil, was the largest country in South America in the Latin America region, and in the Southern Hemisphere, sharing common borders with every South American country except Chile and Ecuador.

The countries that bordered Brazil were Argentina, Bolivia, Colombia, French Guiana, Guyana, Paraguay, Peru, Suriname, Uruguay, Venezuela.

In the east, Brazil shared a long coastline with the Atlantic Ocean, and the area of the country included the Arquipelago de Fernando de Noronha, Atol das Rocas, Ilha da Trindade, Ilhas Martin Vaz, and Penedos de Sao Pedro e Sao Paulo.

Brasilia was the new capital of Brazil from 1960, located in the interior.

The capital was moved from Rio de Janeiro to Brasilia to assert Brazil’s independence, exchanging a colonial capital on the coast for a new capital in the interior.

The city of Sao Paulo was the Brazil's commercial and financial centre.

Most of the Pantanal, the world's largest tropical wetland, extends through the west central part of the Brazil; shares Iguazú Falls, the world's largest waterfalls system, with Argentina.

History

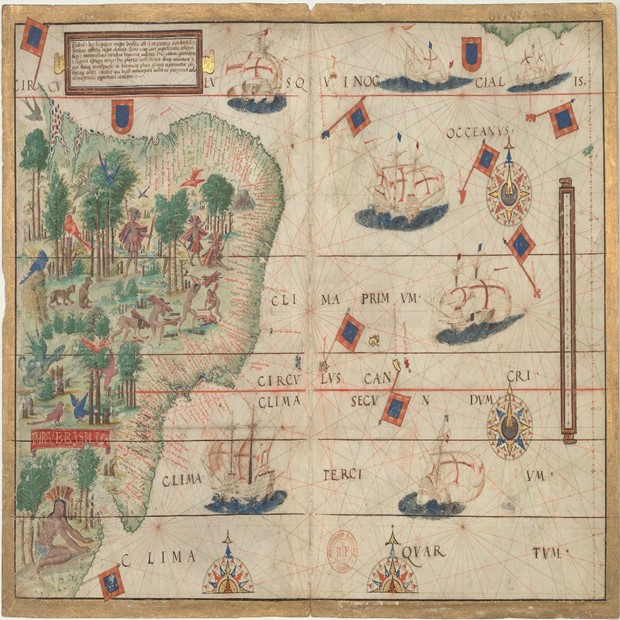

Indigenous peoples in Brazil comprised of many local tribes and nations before arrival of the Portuguese settlers in around 1500.

During the early 300 years of Brazil’s colonial history, the economic exploitation of the country was based first on timber production from brazilwood trees, which gave the territory its name.

The colonists were heavily dependent on captured indigenous labour during the initial phases of settlement and many tribes suffered extinction.

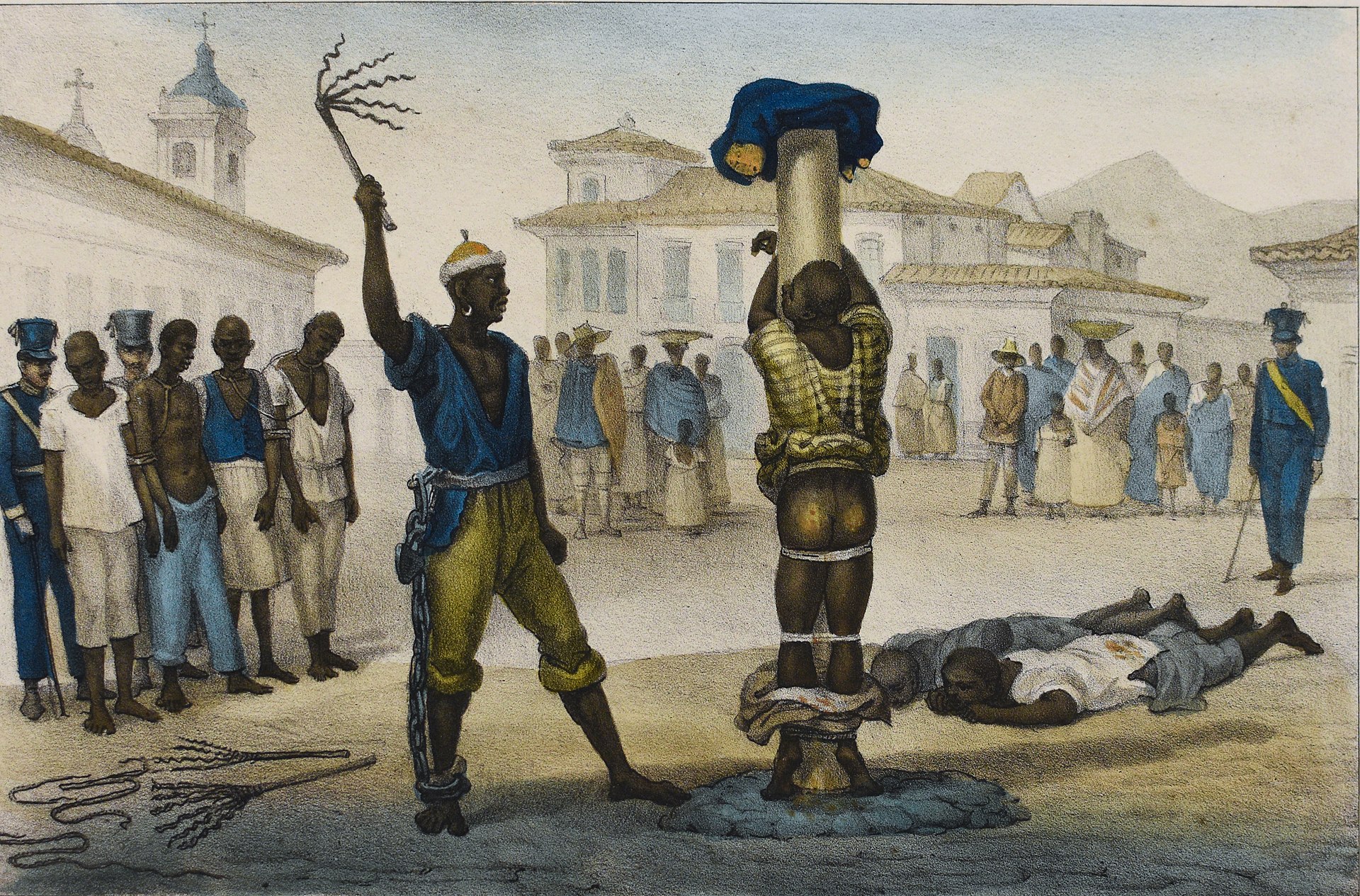

Slaves were brought from Africa to provide the work force of colonial Brazil’s growing export economy. The first sugarcane farms were established in the mid-16th century, with the use of slaves on large plantations to make sugar for export to Europe.

Nearly five million enslaved Africans, mainly from the Portuguese colony of Angola, were said to have been imported to Brazil during the Atlantic slave trade, more than any other country.

Within the Portuguese colonial structure, Christianity spread in Brazil. The Jesuits (the Society of Jesus) were very active because they were favoured by the Portuguese monarchy and the most influential group to convert the indigenous peoples to Catholicism, the official religion from 1500 to 1889.

Most of the Jesuits reportedly accepted, at least for practical reasons, the use of indigenous labour in their village missions to help run the Jesuit enterprise in Brazil.

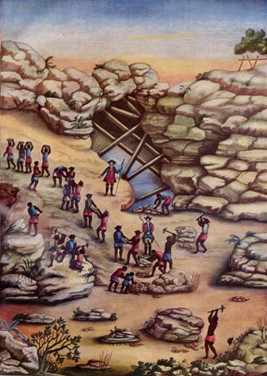

The discovery of gold in the early 18th century ushered in a gold rush, bringing in many new European settlers.

Apart from gold, diamond deposits were also found in 1729 in Brazil, around the village of Tijuco, now Diamantina.

In 1815, Brazil became a kingdom in union with Portugal as the United Kingdom of Portugal, Brazil and Algraves. Following more than three centuries under Portuguese rule, Brazil gained its independence in 1822.

In 1815, Brazil became a kingdom in union with Portugal as the United Kingdom of Portugal, Brazil and Algraves. Following more than three centuries under Portuguese rule, Brazil gained its independence in 1822.

Population and language

The population of Brazil was around 128 million when BCCI entered Brazil in 1982.

Nearly 47 % were white European descent, 43% mixed descent, 7% African slaves’ descent, 1% Indian descent, less than 0.5% Indigenous.

The official language was Portuguese, and most widely spoken language.

Less common languages included Spanish, German, Italian, Japanese, and English.

Economy and foreign trade

The Brazilian economy in the 1980s went through one of the most serious crises in its history, which resulted in the stagnation of gross domestic product and unprecedented inflation rates.

Brazil was a leading producer of agricultural produce and livestock, like soybeans, sugar, coffee, and beef.

Brazil was also rich in many natural resources and a leading producer of tin, iron ore and phosphate. The country had large deposits of diamonds, manganese, chromium, copper, bauxite (source of aluminium) and many other minerals.

In the 1980s:

Main exports; iron, sugar, soyabeans.

Main imports: refined petroleum, crude petroleum, vehicle parts.

BCCI in Brazil

Bank of Credit and Commerce International (BCCI) was already established in Panama, Venezula and Colombia in South America.

Despite the problems that Brazil economy faced in the 1980s, it was often called the United States of the 21st century.

Brazil was already the biggest country in the Latin America region with exports of US$25.79 billion and imports of US$27,972 billion in 1987.

Many experts believed that the economic difficulties and recession besetting Brazil were not primarily of the country's own making and could not escape some of the ills that affected its neighbouring countries. But Brazil was likely to be one of the first South American countries to emerge from the recession.

The oil price rise of the 1970s had hit Brazil very hard, causing a massive increase in the import bill. But strenuous efforts were made to reduce its dependence on imported oil and the government encouraging the development of domestic energy sources, notably hydro-electricity and the very large deposits of coal. The motor industry was also providing a major stimulus to the economy with many cars powered by alcohol, attracting large scale investment.

In international affairs, historically, Brazil had kept a low profile, but rapid industrialisation had already brought with it a more prominent role on the world stage. The country was now sitting midway between the developing world and the developed West.

Representative Office in Sao Paulo

With so many changes taking place in Brazil, it was an opportune time in 1983 time for Bank of Credit and Comerce International (BCCI) to establish a strong presence in the country.

BCCI decided as a first step to establish a representative office in Sao Paulo, Brazil's commercial and financial centre.

Av Paulista 1106- 3

Andar 01310

Sao Paulo

Telephone: (5511) 283 5677

Fax: (5511) 288 4347

Telex: 1130311 BCC B BR

The Sao Paulo representative office dealt with other financial institutions in Brazil to generate their foreign trade business for the BCCI network, while also looking for ways to secure a greater presence in Brazil.

BCCI considered that there was no better time to enter Brazil when many leading banks were shying away from the country due to Brazil’s sovereign loans.

Opening of bank in Brazil

On 15 July 1987, BCCI established Banco de Credito e Comercio de Investime to SA under a licence granted by Brazil's Central Bank, Banco Central do Brasil.

The local board of directors included:

- Mr Sergio Correa da Costa who was also the chairman. A writer and a diplomat, he had been the Brazilian Ambassador to the USA, United Nations, UK and Canada and represented Brazil in various international organisations such as the Organization of American States (OAS) and the he Food and Agriculture Organization (FAO).

- Mr Emane Galveas, who was the Minister of Finance (1980-85) and president of Banco Central do Brazil - the Central Bank (1968-1974 and 1978-1979).

- Mr Ashley Jenner who joined BCCI in November 1986, was also the country general manager. A UK citizen and a senior professional in the banking world, he was already acquainted with the country since 1967. He had 16 years’ experience with Bank of America in Brazil, Argentina and the USA.

The country's external market conditions were difficult, but BCCI was not involved in Brazil's massive sovereign debt and had no in Brazil. Internally, the market was large and sophisticated, and was seeking to increase the country’s foreign trade.

In describing the new bank's role in the Brazilian market, Mr Ashley Jenner, country manager and a director, said: "Although Banco de Credito e Comercio de Investimento SA is a non-bank financial intermediary, it will function very much like a foreign trade commercial bank. Its foreign exchange licence allows it to operate in both spot and forward exchange markets although the forward market is normally tied to foreign trade financing transactions. The bank will place special emphasis on export financing to non-traditional Brazilian markets in which BCCI has a strong presence, such as the Middle East, Africa and the Far East.”

BCCI's resources in Brazil were concentrated in two locations: the new bank's headquarters in Sao Paulo, Brazil’s commercial and business centre, and a branch in Rio de Janeiro, a port and sprawling commercial and manufacturing centre.

Sao Paulo branch was located at:

Av Paulista

1106-3Andar

Cerqueria Cesar

CEP: 01310

Sao Paulo

Telephone: (5511) 283 5677

Fax: (5511) 288 4347

Telex: 1130311 BCC B BR

Rio de Janerio branch was located at:

Rua Buenos Aries

68 – 5 Andar

CEP: 20.070

Rio de Jenerio

Telephone: (5521) 231 1944 / 232 0949 / 232 1134 / 232 5164

Fax: (5521) 242 2686

Telex: 39 378 BCCB BR

The operations Banco de Credito e Comercio de Investimento were initially a wholesale banking business with the emphasis on automation.

BCC’s domestic operations were mainly local currency working capital loans funded by placements of certificates of deposit with institutional investors and high net worth individuals. The bank will also offer an array of money market instruments providing for investment in government and private securities from one day and upwards.

Lending transactions were exclusively to corporations, in accordance with the regulations, with focus on trade linked short term operations.

Another major activity was the servicing of business of other BCCI’s international branches whose corporate customers were make investments in Barazil’s infrastructure.

Grant of multiple licences

In 1987, BCCI was among the first 22 banks to be granted multiple licences, allowing them to operate as commercial banks, investment banks, finance companies or conduct just about any other form of banking operation.

The new licence allowed for banks with multiple licences to have 14 offices throughout Brazil,

With the new licence Banco de Credito e Comercio de Investimento was in a position to make very significant headway. For the first time BCCI was be able to operate as a commercial bank and could claim the network or the specific expertise at trade finance that BCCI had in so many locations.

For few years Banco de Credito e Comercio de Investimento operated in Brazil as a wholesale bank active in foreign exchange.

The bank continued to operate from Sao Paulo as BCCI believed that the increased range of services would be best developed from these two locations.

With the multiple licences, the bank was able to also lend money for short periods of time, as little as one day, in sharp contrast to the minimum 60 days that was allowed. This opened up whole new sectors of the markets, very importantly, discounting trade bills and offer customers the core business of BCCI worldwide trade related finance.

Another important addition to the portfolio of services of Banco de Credito e Comercio de Investimento was maintaining current accounts. This was significant because it brought the bank into much closer contact with customers. The bank was able to also capitalise on contacts with high net worth individuals.

BCCI closure

On 5 July 1991 the Bank of England and other central bank regulators in the west decided to freeze BCCI Group's assets and abruptly shut down BCCI's operations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

BCCI representative office in Sao Paulo that did not provide any banking services would have ceased its activities after the announcement of BCCI's closure.

No information is available about the operations of Banco de Credito e Comercio de Investimento SA branches in Sao Paulo and Rio de Janeiro.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)