Trinidad and Tobago presented yet another challenge. Sensing the opportunities in the country with BCCI’s presence in neighbouring countries, BCCI launched a merchant bank in Trinidad and Tobago in 1987.

Country information

Trinidad and Tobago, officially the Republic of Trinidad and Tobago, consist of two main islands - Trinidad and Tobago, and several smaller islands of south-eastern West Indies. The islands lie between Caribbean Sea and the North Atlantic Ocean, northeast of Venezuela.

Trinidad is the larger of the two main islands. In physical geography of the earth’s surface, the island of Tobago is viewed as an extension of the Venezuelan coastal range and the Northern Range of Trinidad.

History

At the time of European contact, Trinidad had been settled for at least 7000 years through successive movement of people from the vast area between the Amazon and Orinoco rivers in South America.

The island of Trinidad became a colony of Spain in 1498. In the late reforming Bourbon administration of Spain invited foreign planters to settle, in particular the French, bringing slave labourers, their capital and their expertise in tropical agriculture.

Plantations in the island were carved out of the bush; cotton, coffee and sugar cultivation began, with sugar clearly dominating exports and the makings of a sugar and slavery economy and society; the new capital, Port of Spain, became a busy small port by 1797.

The British had begun to take a keen interest in Trinidad, and in 1797 Trinidad became a British colony through military conquest, with a largely French-speaking population. British planters arrived later from the older colonies, often with their slaves, and British capital that helped to expand the sugar industry.

Tobago was annexed to Trinidad by the British in two stages between 1889 and 1898, to form Trinidad and Tobago.

Trinidad and Tobago obtained full independence from the British on 31 August 1962.

Trinidad and Tobago obtained full independence from the British on 31 August 1962.

Population and language

In 1987 when BCC decided to establish a presence in Trinidad and Tobago the population was 1,194,532.

The ethnic makeup of Trinidad is dominated by two groups, roughly equal in size: descendants of enslaved people, whose ancestors were brought in to work on cotton and sugar plantations beginning in the late 18th century, and Indo-Trinidadians, or East Indians, whose ancestors who migrated from the Indian sub-continent to work in the plantations, after the abolition of slavery in the mid-19th century. Other migrants included people from Portuguese Madeira, West Africa (as indentured workers not slaves), Venezuela, the smaller British Caribbean colonies, and Syria and Lebanon.

The official language of Trinidad and Tobago is English.

Economy

Sugar was the backbone of the colonial economy throughout the nineteenth century, but cocoa expanded rapidly towards its end, and overtook sugar as the colony’s leading export crop by about 1900.

Trinidad and Tobago gradually became a petroleum producer in the Caribbean after the discovery of oil in the mid-1880s and bountiful gas reserves.

Trinidad also had deposits of coal, gypsum, limestone, sand and gravel, iron ore, argillite, and fluorspar

Tourism was the most important sector of Tobago economy.

The major exports were petroleum and petroleum products, chemicals, steel products, fertiliser, sugar, cocoa, and coffee,

The major imports were machinery, transportation equipment, manufactured goods, food, live animals.

BCCI in Trinidad and Tobago

The position of Trinidad and Tobago in the Caribbean meant that it could act as a central economic force in the region. BCC was already established in the Caribbean and West Indies, and South America known also as Latin America.

In the 1980s the important banks reported to be operating in the Islands were:

- Barclays Bank International Limited, formerly Barclays Bank Trinidad and Tobago.

- Citicorp Merchant Bank Ltd, associated with Citibank

- Royal Bank of Trinidad and Tobago (RBTT), associated with the Royal Bank of Canada.

- Scotiabank Trinidad and Tobago Limited, associated with the Bank of Nova Scotia of Canada

- Republic Bank, associated with Barclays Bank at one time.

- Bank of Baroda Trinidad and Tobago Limited, subsidiary of Bank of Baroda of India.

BCCI was late in coming to Trinidad and Tobago. It is understood There were rumours that for many years there was about opposition by local banks with Western interests opposed to granting BCCI a licence to operate a bank in Trinidad and Tobago. However, BCC had built established goodwill among with the government officials and was seen as a global bank of the Third World serving many countries of the Third World, including other counties in established in countries in the Caribbean and West Indies like Bahamas, Barbados, Grand Cayman and Jamaica.

Opening in Port of Spain, the capital of Trinidad and Tobago

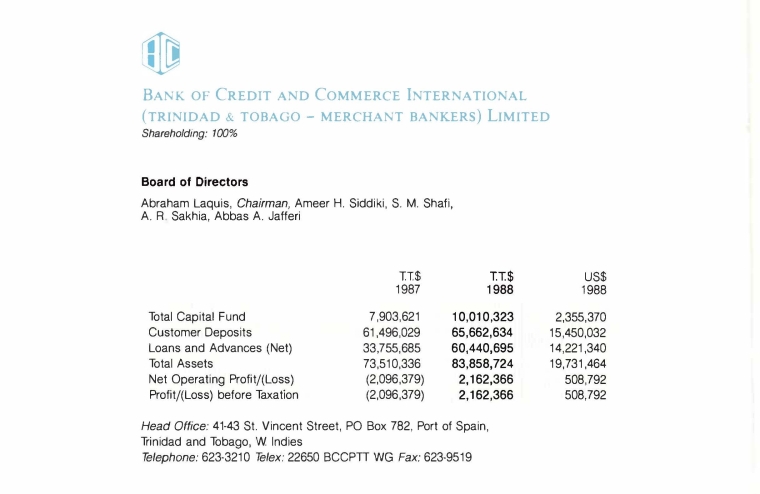

BCCI opened as Bank of Credit and Commerce International (Trinidad and Tobago - Merchant Bankers) Limited, in the Islands capital, Port of Spain on 23 April 1987, BCCI Trinidad and Tobago for short.

The opening was officially inaugurated by the Minister of Finance and the Economy, the Honourable Mr Trevor Sudama. The Parliamentary Speaker and other members of the government, as well as the Governor of the Central Bank and many leading businessmen, attended the ceremony.

Port of Spain branch was located at:

4143 St Vincent Street

P.O. Box 782

Port of Spain

Trinidad and Tobago

West Indies

Telephone: (1809) 623 3210/ 623 1994/ 623 0005/ 623 2559/ 623 9737

Fax: (1809) 623 9519

Telex: 22650 BCCPTTWG

Like other banks in Trinidad and Tobago, BCCI offered a comprehensive range of financial services. These included commercial lending, short-term trade finance, foreign exchange services, structured financing and leasing.

Financial highlights 1988

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west decided to abruptly freeze BCCI Group's assets and shut down BCCI's operating branches worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

The Central Bank of Trinidad & Tobago took over the branch of BCCI in the country. The local court appointed the Deposit Insurance Corporation (DIC) Trinidad & Tobago as liquidator on 22 August 1991. (The DIC was established by the Central Bank and Financial Institutions to manage a Fund to provide insurance protection for local depositors against the potential loss of their deposits.) No further information is available.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)