As a bank with a largely Arab and Third World identity, and BCC’s considerable knowledge of the region of Northern Africa known as the Maghreb with Arab-speaking countries of Morocco, Tunisia, Libya, Algeria and Mauritania, BCC had a Representative Office in Morocco - Rabat.

Country information

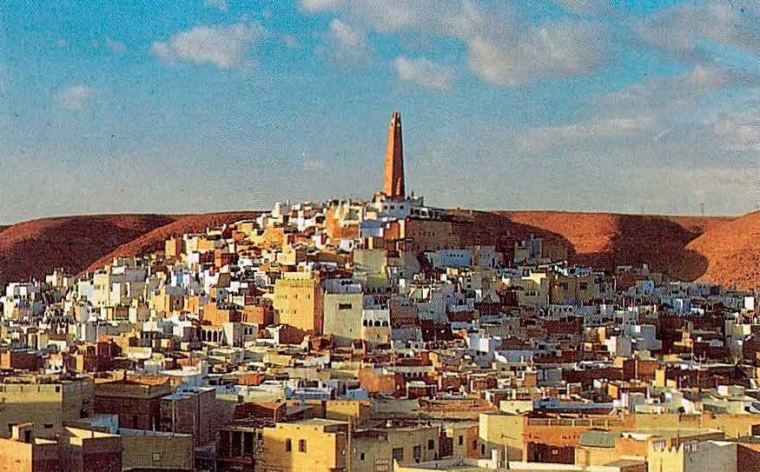

Morocco, officially the Kingdom of Morocco, is the westernmost country in the Maghreb region of North Africa, known as the Arab West. It overlooks the Mediterranean Sea to the north and the Atlantic Ocean to the west and had land borders with Algeria to the east, and the disputed territory of Western Sahara to the south.

History

Morocco was a French protectorate from 1912 to 1956 with its rich culture is a blend of Arab, Berber, European and African influences.

But after the Second World War (1939-1946), calls for independence grew stronger. From 1947 onwards, the Sultan of Morocco, Mohammed Ben Youssef began to distance himself from the French protectorate, championing the Arab League and supporting Istiqlal, the Independence Party.

Tensions continued to rise over the ensuing months, events then began to escalate until on 6 November 1955. France and the Sultan signed agreements, which led to the independence of Morocco.

Tensions continued to rise over the ensuing months, events then began to escalate until on 6 November 1955. France and the Sultan signed agreements, which led to the independence of Morocco.

Morocco officially gained independence on 2 March 1956.

Population and language

In the 1980s the population of Morocco was in the region of 19.5 million.

Morocco has two official languages, Arabic and Berber. French was considered Morocco's unofficial (but often debated) third language.

English was the second most spoken foreign language after French.

Economy

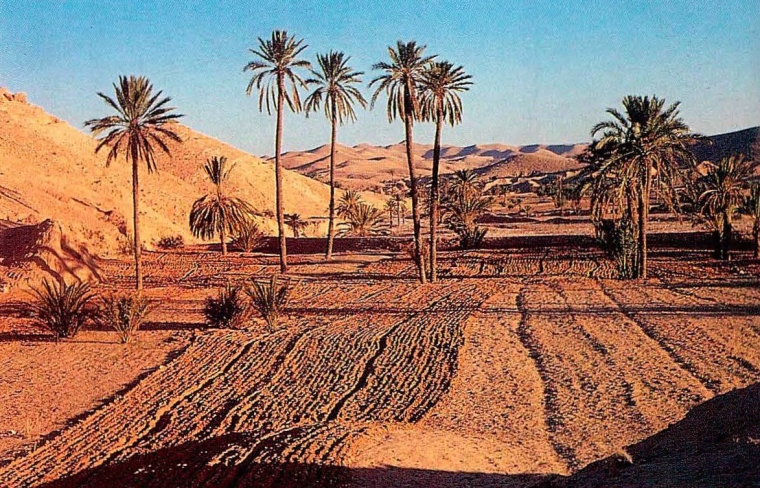

Morocco’s main mineral resources were phosphates that greatly the mining industry and mineral processing by the annexation of Sahrawi phosphate deposits, coal, oil (Morocco produced about 30,000 tons of crude oil), iron, manganese, lead, zinc., food processing, textiles.

Agriculture represented 18% of GNP and the services 50% of which tourism was a large part.

Morocco’s main exports were phosphates 32%, citrus 13%, textiles 18%, vegetables 6%. Main imports were raw materials, foodstuffs, equipment.

Main trading partners (& share of total) in 1980s: Exports - France 27%, Federal Germany 11%, Spain 7%. Imports - France 26%, Spain 10%, US 8%, Federal Germany 7%.

BCCI in Morocco

_0.jpg)

The Maghreb countries possessed rich resources of phosphates and oil Trade in the region - apart from Libya - had long been oriented towards France for historical reasons. But as the economic community of the Maghreb grew in importance, foreign banks were increasingly seeking a presence in the area.

BCCI decided to first establish a Representative Office in Rabat, the capital of Morocco in around the 1970s to build relationships and market for business from banks in Morocco and neighbouring countries of Maghreb. It did not provide any banking services.

Morocco Representative Office was located at:

5 Rue Moulay Slimane

Residence Moulay Ismail

Block A

Rabat

Tel: (2127) 30806

Cables: BANCRECOM

Telex: 31829 M BCC

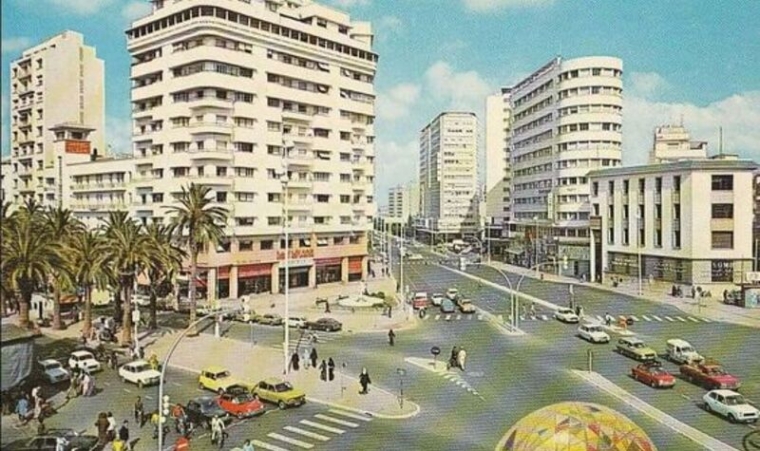

The BCCI Representative was more active in Casablanca, Morocco’s largest city and the economic and business centre of the country. The leading Moroccan companies and many largest corporations of Europe and USA, and head office of Moroccan banks were historically located in Casablanca.

BCCI enjoyed relationships with central banks and commercial banks in the Maghreb countries, in particular Morocco, through whom the bulk import business of large corporations and government bodies were being handled.

BCCI’s branches in Canada, New York, Tokyo and Seoul benefited substantially transactions from Morocco’s largest bank, Banque Marocaine du Commerce Exterieur.

Building relationships in the Maghreb

As the countries of the Maghreb gradually were coming closer together, so the banking climate was being liberalised. BCCI was able to offer advice and training on relevant subjects.

BCCI held a seminar in Tunis, Tunisia on 7, 8 and 9 June 1988 for central and local banks in the Maghreb countries - Tunisia, Libya, Algeria, Morocco and Mauritania.

The seminar was a gesture of gratitude on BCCI's part for business received. as well as a sign of friendship and long-term commitment to playing a major role in the financing of trade and the marketing of correspondent banking services from these countries. It also offered marketing benefits and the opportunity to build relationships at a deeper level with the banking community in the Maghreb.

The seminar held at the Oriental Palace Hotel, Tunis, the capital of Tunisia, was attended by 28 delegates from senior levels of banking, and covered three main subjects: foreign exchange, treasury operations and documentary credits.

The seminar was inaugurated by the governor of the Central Bank of Tunisia (Banque Centrale de Tunisie). He gave delegates an international overview and talked not only about the overall Maghreb dimension but also about the local perspective of each country. He spoke on several relevant matters, including the freeing of exchange controls.

Among the speakers at the seminar were Dr Ousep Mathen, from BCCI's treasury department in Abu Dhabi, United Arab Emirates, and Mr K. Q. Din from the London, UK training academy. On the closing day the participants were presented with certificates.

.jpg)

BCCI closure

Following an internal review in 1990 by the central management and majority shareholders of Bank of Credit and Commerce International to restructure the operations of the Group worldwide, the Representative Office of BCCI in Rabat, Morocco, was closed in that year.

On 5 July 1991 the Bank of England and other regulators in the west decided to freeze BCCI Group's assets and abruptly shut down BCCI's operations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCC continued in a different name after the assets and liabilities were acquired by private investors, another bank or the government.