Bank of Credit and Commerce Cameroon was formally inaugurated shortly after its opening in 1982 by Cameroon's Minister of Finance, Mr Gilbert Ntang in front of 250 guests, that reflected the close collaboration built up between the government and Bank of Credit and Commerce International (BCCI).

Country information

Cameroon, officially the Republic of Cameroon was bordered on the west by Nigeria and the Gulf of Guinea, on the east by Chad and the Central African Republic and on the south by the DR Congo, Gabon and Equatorial Guinea, and the Atlantic Ocean on the southwest.

Yaoundé, spread over 7 hills, was the capital city of Cameroon.

History

There were two main groups of indigenous peoples in Cameroon: indigenous forest peoples (referred to as Pygmies), the traditional hunter-gatherers living mainly in the forests of the Southeast and Central regions.

European traders arrived in Cameroon the 15th century and the country became a source of slaves. In the 18th century, the city of Bimbia on Cameroon's shores on the Atlantic Ocean was a slave trade port, where historians have confirmed that at least 10 percent of enslaved Africans passed through, before being forced onto boats sailing to Europe and the Americas.

From 1884, Cameroon was a German colony. After World War 1 that ended in 1918, the country was divided between France and the United Kingdom as League of Nations mandates and in 1946 Cameroon became a protectorate of both countries.

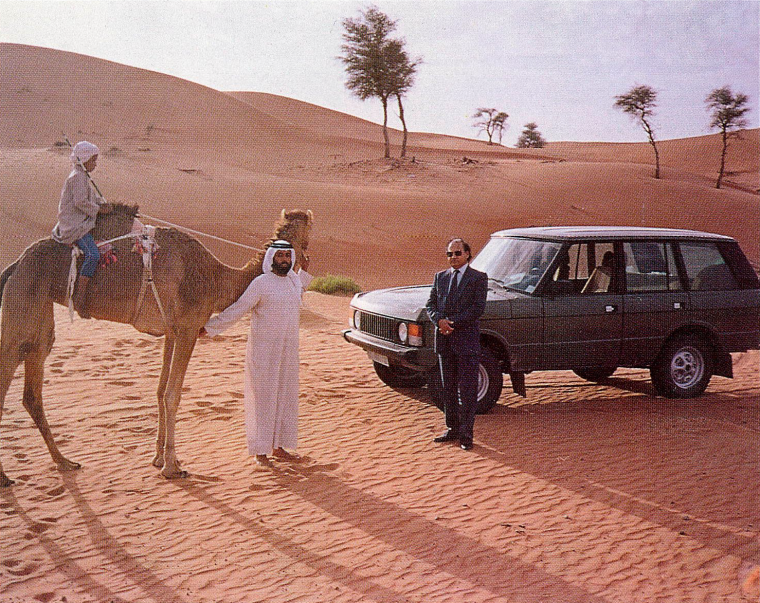

The northern part of Cameroon was subject to influence from the Muslim kingdoms in the Chad and Sahel.

The demand by the largest political party, the Union of the Peoples of Cameroon (UPC) that the French and British Cameroons be combined into a single independent country, and a rebellion with a loss of thousands of lives, led to Cameroon gaining full independence as the Republic of Cameroon on 1 January 1960.

The demand by the largest political party, the Union of the Peoples of Cameroon (UPC) that the French and British Cameroons be combined into a single independent country, and a rebellion with a loss of thousands of lives, led to Cameroon gaining full independence as the Republic of Cameroon on 1 January 1960.

Population and language

In the late 1980s when BCCI entered Cameroon, the country’s population was nearly nine million.

The official languages in Cameroon were French, and English, the official languages of former French Cameroons and British Cameroons.

Economy

.jpg) Cameroon enjoyed a stronger economy than many other countries in Africa. This was largely based on agriculture.

Cameroon enjoyed a stronger economy than many other countries in Africa. This was largely based on agriculture.

The two main crops were cocoa and coffee that accounted for 70% of exports and was overtaken by oil exports.

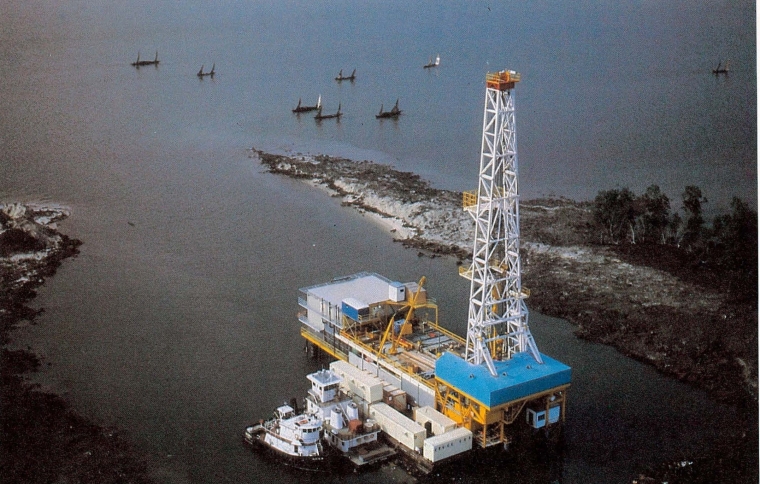

The first commercial discoveries of oil were made in 1972, but the country became an oil producer in 1977. Interest in the Cameroon grew from the 1980s with the expectations of increase in revenues from oil exports.

Cameroon was also rich in natural gas and was expected to be a major exporter by 1987.

There was a very big hydro-electrical potential and Cameroon had an estimated billion tons of under-mined bauxite deposits which was the main source of aluminium.

Foreign investment was increasing because of the favourable investment laws and business prospects in the country were well above average.

In 1982:

Main exports: cocoa, coffee, timber.

Main imports: machinery, transport equipment, fuels, oil products.

BCCI in Cameroon

The west African nation of Cameroon welcomed BCCI into its business community with the decree issued in November 1981 for the establishment of a joint-venture bank, Bank of Credit and Commerce Cameroon SA (BCC Cameroon), between the BCCI Holdings (Luxembourg) SA (the BCCI Group) owning two-thirds and the Government of Cameroon and its interests owning one-third.

The new bank had a capital of CFA 500 million (US $1 = 300 CFA) and the management was provided by BCCI.

When BCC Cameroon opened in 1982, there were already eight other banks in the country, with the banking sector dominated by the large French colonial banks.

However, BCCI’s Group having a larger geographical spread in the world offered BCC Cameroon greater opportunities to satisfy the international as well as the domestic banking requirements of Cameroonians, besides serving as a medium and a channel to reach more overseas investors to Cameroon.

BCC Cameroon had seven directors. Three were Cameroonian and four were from BCC. The Chairman was Mr Jean Kanga Zamb, who also represented the Ministry of Finance of Cameroon.

In the inaugural speech by Mr Ntang, he said: “The presence of the BCC group in our country confirms the soundness and efficiency of the government's policy in the banking sector. Our policy, which we have been pursuing since 1973, is a decisive turning point in the pursuit of our ambitions in the matter of progressive and sound mastership of the main reins of our development.”

At the formal inauguration of BCC Cameroon that took place later, the country's Minister of Finance expressed his satisfaction at the results already obtained in the first few months in 1982 by the two branches of BCC Cameroon in Doula on the coast, and Yaoundé, the capital that were already operating before the formal inauguration. They established new records of achievement for banking in Cameroon.

The Minister also said:

"These performance figures confirm that we were justified in trusting each other. Only ten years after its inception, BCC has been able to pull itself up to the level of the great international banks. The BCC operation in Cameroon perfectly meets the government's desire to provide the maximum support to the economy. I would like to offer my sincere congratulations and encouragements to all the BCC family who are contributing to the success of this new enterprise. I assure them that they will always find the support and comprehension they will need in their future activities, from the public authorities and more particularly from the Monetary Authority."

Mr Iqbal Rizvi, Regional General Manager from the BCCI Central Office, London, United Kingdom, and representing the BCCI President spoke of the historical importance of the inauguration. Addressing the Minister, he said "It symbolises our desire to serve more and more people. It has always been the wish of the BCCI Group to offer its services to such promising countries and we are grateful to be given the opportunity to serve here in Cameroon. Indeed our presence here falls within the government's expressed desire to widen the geographical zone of its banking partners".

In an interview on Radio Cameroon, Mr Rizvi emphasised the broader dimensions of the BCCI Group and spoke of BCCI's efforts to help uplift the peoples of the Third World intellectually arid socially. The Third World Foundation was an expression of this desire, working through publications and research projects and awarding an annual prize to individuals who contribute substantially to develop merit in the Third World. He added, "We want to see BCC Cameroon a strong and powerful bank not only in the principal cities, but also in other parts of the country. We would like to see BCC grow in Cameroon in terms of its coverage and the variety of services that it offers. We want to be able to respond fully to the needs of the government and the people. Our policy in Cameroon, as elsewhere, is the pursuit of excellence and the service of humanity".

BCC Cameroon operations

Initially, BCC Cameroon had two branches, one in the capital city of Yaoundé opened in July 1982, and the other opened earlier in the port of Douala in April 1982. A third branch was opened in May 1984 in Garoua in the north of Cameroon.

Mr S. A, Shabbir of BCC Abidjan branch in Cote d'Ivoire (Ivory Coast), was the first General Manager of the new bank in Cameroon. Mr Enow Tanjong, formerly technical adviser at the Presidency of the Cameroon Republic, was appointed Deputy General Manager. Before he joined BCC Cameroon, he was Chairman of the board of directors of the Chase Manhattan Bank when it was established in Cameroon in 1979. Mr Tanjong went on to become General Manager in 1985 and Mr M Noorani of BCC took his place as Deputy General Manager.

.jpg)

All the branches were involved in local and international banking operations and helping businesses and individuals with working loans, financing imports and exports and foreign exchange operations.

BCCI had a well-established role in the economy of Cameroon. In its early stages BCC Cameroon handled a sizeable volume of Cameroon's commodity imports.

Servicing of country remittance needs was the next step, followed by financing multinational companies and parastatals in government. In the 1980s export of cocoa (worth US $270 million a year) and coffee (US $279 million), accounted for 30% of the country's annual US $1280 million foreign earnings.

BCCI also had a considerable involvement in the bonding business.

Yaoundé

Yaoundé as the capital was the seat of government and the home of parastatals and foreign embassies, but the bulk of the country's trade was in the port of Douala. Thus, banking in Yaoundé required specialist skills and a deep understanding of the services that were needed in this market.

BCC Cameroon Yaounde branch was located at:

Kennedy Building

Avenue John F Kennedy

BP 1188

Yaounde

Telephone: (237) 222 986 / 232 773 / 232 733

Fax: (237) 230 015

Telex: 8558 KN BCC CAM / 8606 KN BCC CAM

.jpg)

The government was impressed with the speed and efficiency of the service it received and BCC Cameroon was soon handling a large proportion of all the government's remittances. In July 1983 the government began routing its foreign outward remittances through BCC Cameroon Yaounde. These subsequently formed an important part of the bank's activities.

BCCI's commitment to the Third World was reflected in microcosm in the service that the Yaounde branch provided for the Foreign Ministry. All the Ministry's remittances to its 30-odd embassies around the world were handled by BCC Cameroon.

The servicing of Cameroon's public debt also passed through the branch. With revenue from oil encouraging largescale development of the infrastructure, meeting the banking needs of multinational corporations was another important, and growing, source of business for Yaounde branch.

.jpg)

Cameroon's first television station opened in 1985, and BCC Cameroon secured several important new accounts of multinationals because of this development.

Yaoundé branch was also active in handling the oil business.

Douala - the major seaport and commercial centre

Much of Cameroon's growth in the 1980s was underpinned by the rapid development of oil exports through the seaport of Douala which was also the largest city in Cameroon.

BCC Cameroon Douala branch was located at:

SNAC Building

6 Boulevard de la liberty

BP 3264

Douala

Telephone: (237) 424 060 / 424 113 / 424 072

Fax: (237) 423 755

Telex: 5727 KN BCC CAM

Douala branch provided a substantial low-cost deposit base which was an important reason for the quite extraordinary profitability of BCC Cameroon.

.jpg)

Garoua - riverport city and centre of trade in the North East region

BCC Cameroon opened its branch in Garoua in 1984.

After the capital Yaoundé and the seaport commercial centre of Douala, Garoua was the third important city of Cameroon with a population of around 70,000 in the 1980s. It is located in the cotton belt and centre of trade of the agricultural surroundings and housed several textile processing facilities.

BCC Cameroon Garoua branch was located at:

BP 546

Garoua

North Cameroon

Telephone: (237) 271 819 / 271 988

Fax: (237) 271 958

Telex: 7629 BCC CAM KN

Garoua branch's prime customers were the companies involved in the cotton industry. These were both private companies and government agencies that exported all over the world mainly to the US, Asia, and Hong Kong.

With BCCI's reputation of providing a quick, reliable, and friendly service, the branch attracted professionals like engineers, and government officials working in the Garoua to open low-cost savings and current accounts with BCC Cameroon.

Shell, BP and Texaco, the oil multinationals had bases in Garoua and Garoua branch secured the accounts of multinationals, as well as of some major construction companies. These were also a source of low-cost deposits for BCC Cameroon.

Mr Iklhas Ilyas, a marketing officer in the Garoua branch said, "Marketing is at the very heart of this branch. Marketing is a constant search to find new and better ways of serving people. We try and create an atmosphere of professionalism in the branch and then add a moral dimension to this. The BCC culture is finding a home in this part of Africa."

Success in Cameroon

In an interview with BCCI's inhouse magazine in 1985, Mr Enow Tanjong, who was appointed the first Deputy General Manager of BCC Cameroon in 1982, and became General Manager, summed up the reasons that inspired the bank's success, in the following words:

Now, three years later, we are a little more accustomed to our success and know the source of inspiration that drives us and inspires all the members of the BCC Cameroon family. That inspiration comes from a spirit which seems to pervade the BCC group and has been adopted by BCC Cameroon. It is a spirit that moves this bank and inspires people working in it to regard it as their own.

This special 'something' is connected to BCC itself. Our people here have a different way of looking at banking and at work. We go out to the people. This was something very new in my country and our approach was welcomed immediately. We have been recruiting local people, although it has been difficult to find experienced bankers.

We have been giving a very structured on-the-job training programme to new recruits, and we are all quite satisfied with our success in this field. However, later this year we will be establishing a local training academy in Yaounde, and our recently recruited groups (nine in all) will be participating in the first course early next year.

Our international marketing programme is concentrating on the export market. My country is developing export markets in the US, Germany and Holland, and BCC's overseas representation will assist us in acting as a marketing vehicle for marketing Cameroonian products.

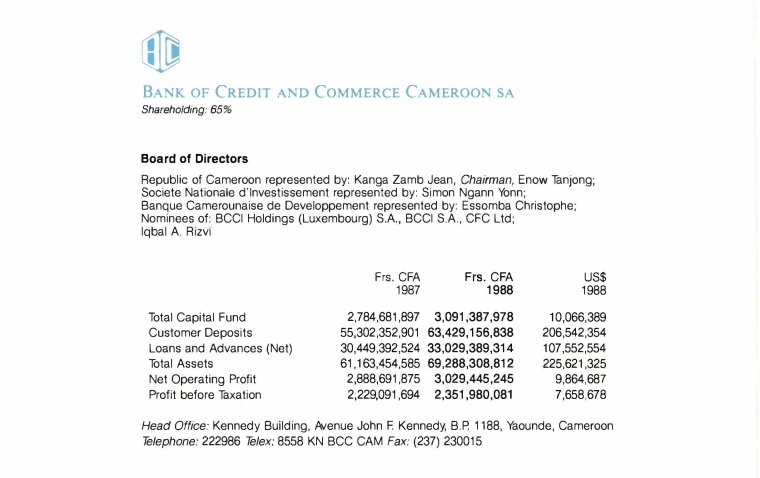

Financial Highlights

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west decided to freeze BCCI Group's assets and abruptly shut down BCCI's operations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

BCC Cameroon was reportedly purchased by Standard Chartered Cameroon in the third quarter of 1991.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)