Bank of Credit and Commerce Niger SA opened in 1985 as wholly subsidiary of BCCI that testified to BCCI's long-term commitment to serving the needs of developing countries of the Third World.

Country information

Niger, officially the Republic of the Niger, is a landlocked country in West Africa named after the Niger River. It is bordered by Libya to the northeast, Chad to the east, Nigeria to the south, Benin and Burkina Faso to the southwest, Mali to the west, and Algeria to the northwest.

The country's name comes from the Niger river which flows through the west of the country.

Two thirds of the surface area is desert, from the sub-Saharan Sahel in the north to the semi-desert and savannah in the south.

Niger was one of the last African countries to be colonised by Europeans. France increased its military efforts to conquer Niger after the 1885 Berlin conference which carved Africa into regions for the colonial powers.

Niger became a colony of France in 1922, administered as part of French West Africa.

In 1946 Niger became an overseas territory of France with its own parliament and representation in the French national assembly. Niger gained its full independence on 3 August 1960.

There are four important towns in Niger. Niamey the capital and largest city, which has a cosmopolitan character, with European and African rural styles. Zinder an older town than Niamey which was the capital of Niger until 1926 with close links with Nigeria. Maradi situated in the heart of the peanut-growing region near the Nigerian frontier. The town is particularly renowned for its red goats, the skins of which are exported to Europe and the Americas. Agadez, on the southern edge of Sahara desert known as the gateway to the desert, which gained importance after the discovery of uranium ore.

The nearest port is at Cotonou in Benin, 1,000km away, and the river Niger has traditionally formed the country's main trading link with the outside world.

Along with seven other French speaking countries, the currency of Niger is the CFA franc, with a common central bank, the Central Bank of West African States (BCEAO).

Population and Language

The country had a rural population that was about 5.9 million in 1985, with about one-fifth living in urban towns.

Niger had ten official national languages, but the official language was French inherited from the colonial period.

Economy

_0.jpg)

Two thirds of the surface area is desert, from the sub-Saharan Sahel in the north to the semi-desert and savannah in the south.

Despite these disadvantages, the country is predominantly agricultural. Farming is concentrated in the narrow belt of more fertile land in the valley of the river Niger, where 90% of the population lives, and along the southern border with Nigeria.

The most important factor in the national economy is uranium, which is mined near the north-western town of Arlit and at Akouta. Niger was already the world's fifth largest producer of this vital resource. This was particularly significant because Niger was, in the 1980s considered the least developed country in the world, one of the poorest and most remote of the world's developing countries.

Government revenue was derived mainly from export of agricultural products and export of raw materials, especially uranium ore which was the key to Niger's future development.

Uranium was not the country's only mineral resource there were considerable reserves of coal, gold, iron ore, tin, phosphates, gypsum, tin, molybdenum, and oil. Since 1980 the use of locally mined coal instead of oil for power generation had allowed the government to reduce oil imports. There were also large deposits of oil, particularly along the border with Chad, and exploration licences were being granted.

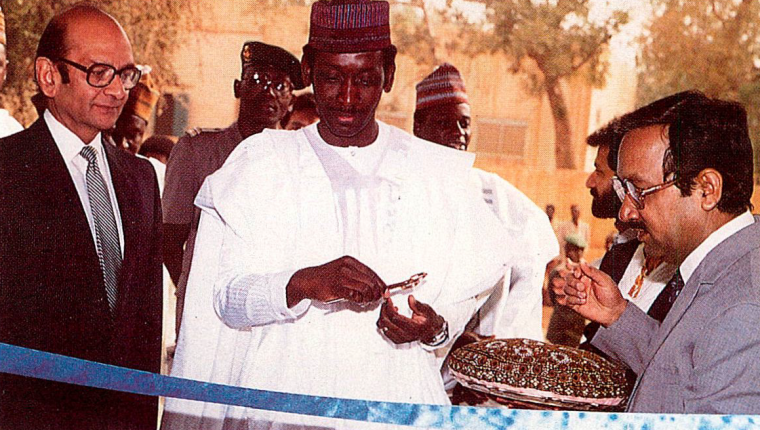

BCC Niger Niamey branch

The formal opening of Niamey branch in 1980 was inaugurated by Niger's Minister of Finance, Mr Boukary Adji.

Niamey branch was located at:

lmmcuble El Nasr

BP 12792, Niamey

Telephone: (227) 734287 / 734288 / 734289

Fax: (227) 733303

Telex: 5456 BCCNI

Mr Hameed Akhtar of BCC was the first country manager in Niger.

BCC's strengths were a willingness to be flexible and innovative, coupled with BCC's known expertise in short term lending and trade finance.

The government has adopted a policy of privatising certain industries and this is likely to encourage interest from overseas investors. BCC has a significant role to play in these changes.

In the first phase of development of business for BCC Niger a great deal of time was invested to create a local awareness of the bank in a country that was so remote. As aware grew, BCC Niamey started taking deposits and followed the BCC group policy of concentrating on short-term financing, particularly in imports and exports. The branch was also active in road building industry that was set for expansion in 1985.

With the growing volume of business in Niger, there were plans to open a second branch at Maradi but this did not materialise because BCC was abruptly shut down in 1991.

BCC Travellers Cheques

A notable success was an agreement that BCC Niamey branch reached with the Minister of Foreign Affairs whereby all official delegations going on foreign missions would use BCC travellers cheques.

Hajj pilgrims

With Niger’s large Muslim population BCC also undertook the sale of insurance-linked BCC travellers cheques to Hajj Pilgrims setting out to perform their Hajj pilgrimage.

.jpg)

From 1987 BCC Niamey branch had a BCC travellers cheques counter at the airport in the country’s capital after obtaining the necessary authorisations.

BCC was the only bank in Niger that made a special effort to cater for the needs of the Hajj Pilgrims and this was greatly appreciated by the Minister of Finance, and by the national manager of the Banque Centrale (central bank).

BCC Niamey benefited in being to communicate BCC’s presence in Niger and attract affluent people and businesses, including a large cross-section of the country’s population coming to the capital from the interior regions of Zinder and Maradi.

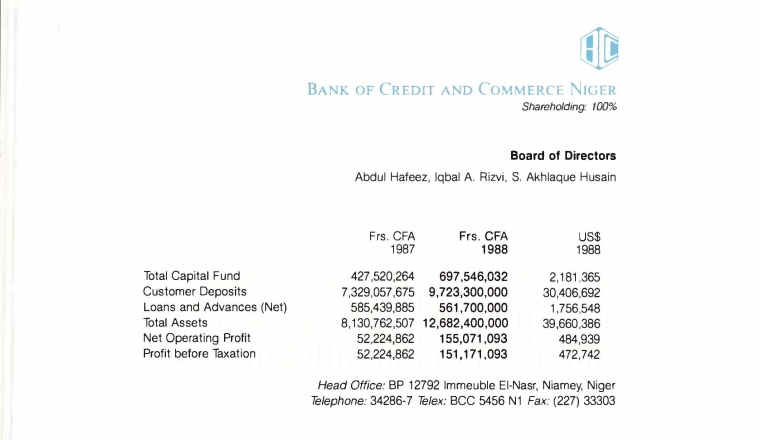

Financial Highlights

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west decided to freeze BCCI Group's assets and abruptly shut down BCCI's operations worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

"The central bank of the Monetary Union of West African States announced last week that BCCI branches in Niger, Togo, Senegal and Ivory Coast were financially sound and would reopen soon." (apnews abidjan: 1 August 1991).

The Niamey branch of BCC Niger (100% owned by BCCI) was closed from 8 July 1991 while the BCCI liquidators were negotiating to sell the bank. No further information is available.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)

Also read:

Acknowledgment:

- In-house magazine