Uruguay was the smallest Hispanic country in South America but formed an increasingly important part of BCCI's regional network in Latin America, bordered by Brazil and Argentina.

Country information

Uruguay, officially the Oriental Republic of Uruguay or the Eastern Republic of Uruguay, was the second-smallest country in South America (referred to also as Latin America), bordered by Argentina to the west and Brazil to the east/north-east and lies along the Atlantic Ocean in the south.

.jpg)

The capital city was Montevideo, on the Atlantic coast, that was planned by the Portuguese, but it was the Spanish who founded the city in 1726.

History

Uruguay had long been inhabited by indigenous people who survived by hunt-ing, fishing and gathering.

Europeans discovered the country, but it was settled by the Portuguese in 1680. In 1726, the Spanish took control and founded Montevideo. Few Indig-enous people remained.

Indigenous peoples that survived Spanish colonial rule were reported to have been deliberately exterminated in the nineteenth century. This coincided with a relatively large influx of European immigrants and government efforts to promote Uruguay as the 'Switzerland of South America'.

Indigenous peoples that survived Spanish colonial rule were reported to have been deliberately exterminated in the nineteenth century. This coincided with a relatively large influx of European immigrants and government efforts to promote Uruguay as the 'Switzerland of South America'.

Following a four-way struggle between Portugal and Spain, and later Argentina and Brazil, Uruguay declared independence in 1825 and then secured independence in 1828.

Population and language

The total population in the 1980s was around three million.

As with neighbouring Argentina, most Uruguayans were descendants of 19th- and 20th-century white immigrants from Spain and Italy and, to a much lesser degree, from France and Britain who immigrated from Europe in the 19th and 20th centuries. There were some descendants of African slaves and few direct descendants of Uruguay’s indigenous peoples remained.

The official language was Spanish inherited from the colonial period.

English was common in the business world.

Economy

Sheep and cattle raising were two of Uruguay’s most important economic activities.

Wool and beef, as well as livestock, livestock products, and skins and hides, accounted for the largest share of Uruguay’s export income.

Uruguay imported most of its fuel, industrial raw materials, vehicles, and industrial machinery.

Uruguay’s main export partners included China, Brazil, USA, and Argentina, and for imports were Brazil, China, USA and Argentina.

To reduce the country’s dependence on external trade, successive governments encouraged domestic manufacturing and services. The government operated many corporations that produced electricity, refined imported petroleum, manufactured alcohol and cement, and processed meat and fish.

Uruguay’s important export partners included China, Brazil, USA, and Argentina, while important were Brazil, China, USA and Argentina.

BCCI in Uruguay

Uruguay was known as the Switzerland of Latin America. It had emerged as one of the region's principal financial centres, serving Argentina, Chile, Brazil and Paraguay. It had earned this reputation through a free monetary policy with no foreign exchange restrictions, full convertibility of the peso, and an absence of personal taxes on income, capital gains and inheritance.

Profits and dividends could be freely repatriated that carried a 20% tax.

Uruguay's laissez-faire policy had made the country a haven for foreign investment and had attracted large funds from neighbouring countries, where restrictions existed to varying degrees. This situation encouraged the emergence of a personalised banking service with a broad, international outlook.

With BCCI’s expansion in other Latin American countries, the moment for its expansion in Uruguay's markets had arrived.

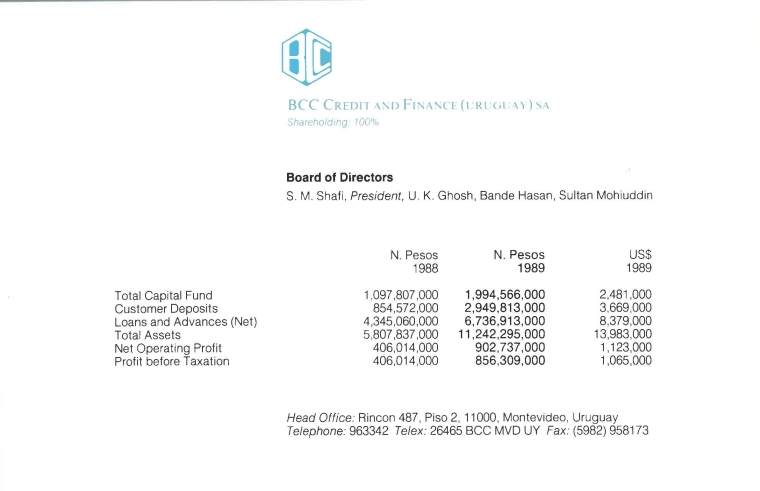

BCCI established a wholly owned subsidiary, BCC Credit and Finance (Uruguay) SA in the country capital, Montevideo.

The major manufactures include processed foods, beverages, chemical products, textiles, and tobacco products were concentrated in and around Montevideo.

BCC Credit and Finance (Uruguay) was located at:

Rincon 487

Piso 2, 1000

Montevideo

Telephone: (5982) 961 229 / 957 680 / 959 727

Fax: (5982) 958 173

Telex: BCC MVD UY 26465

BCC Credit and Finance (Uruguay) was guided initially by BCCI senior international officer and country manager, Mr S. A. Shabbir.

The bank was authorised to handle all commercial banking activities and, in conformity with BCCI group policy, concentrated on short-term self-liquidating trade finance.

At the request of the Central Bank, BCCI’s assisted in locating new markets for Uruguay's exports, in the Middle East and Africa. This called for an extraordinary vision and a thorough understanding of the patterns of world trade.

BCCI, with its global network, was in an increasingly strong position to help Uruguay to develop its trade links with other parts of the world, both in barter agreements and in more conventional ways.

For BCCI, full integration with the South American market was becoming closer all the time.

Financials

BCCI closure

On 5 July 1991 the Bank of England and other regulators in the west decided to abruptly freeze BCCI Group's assets and shut down BCCI's operating branches worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

BCC Credit and Finance (Uruguay) was taken over by the Central Bank (Banco Central Del Uruguay) and liquidator appointed while sale was also being negotiated. No further information is available.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)