Years before Hong Kong was returned by the British to the People's Republic of China in 1997, Mr Agha Hasan Abedi, President of Bank of Credit and Commerce International (BCCI) had already visualised Hong Kong developing even more in importance as the China’s gateway to the outside world.

Hong Kong had world-wide renown as an international centre of business and trade. The small British colony until it was handed over to the People’s Republic of China (China for short) in 1997 - its major island, peninsula and outlying islands covering a limited area with a large population played a key role in international markets. One of its strengths had been as a gateway to China, and a centre where international activity was ever more on the increase.

Country information

Hong Kong is a city-state that consists of the Kowloon Peninsula and New Territories, which border the southern China province of Guangdong, and several islands including Hong Kong Island and Lantau Island.

The capital city of Hong Kong was Hong Kong. The city of Victoria housed the capital before the territories were taken back by China in 1997 under an agreement made in 1994 with the United Kingdom, and it became a Special Administration Region of China.

History

China was defeated in the First Opium War (1839-1842) by western powers including the British opposing the ban on of opium imports imposed by China. China had to cede the territory of Hong Kong to British control, open five Chinese treaty ports to trade with foreigners and where British merchants and their families could reside and were subject to British, not Chinese laws.

To ensure continuing profits from the increased opium imports and the growing addiction of the China’s population that became a serious concern for China, the British entered the Second Opium War (1856 to 1860) forcing China this time to give up the Kowloon Peninsula following its defeat.

The British took more land from China in 1898 when they obtained a 99-year lease of the New Territories, one of the three parts of Hong Kong that stretched from Kowloon to the border of mainland China.

Originally a sparsely populated area of farming and fishing villages, the British territory of Hong Kong grew to become one of the world's most significant financial centres and free port handling a significant volume of exports and imports.

.svg.png)

It was not just British traders who were attracted to Hong Kong. Other European traders took advantage of the free port and ease of establishing businesses on the island. Chinese labourers from the mainland were attracted to work on the infrastructure and for the companies themselves.

Population and language

In 1974, when BCCI first established its presence in Hong Kong, the population was around 4.4 million.

The predominant language was and is Cantonese, a variety of Chinese spoken by most of the population. English was also widely spoken.

The official languages were Cantonese, English and Mandarin Chinese.

Economy

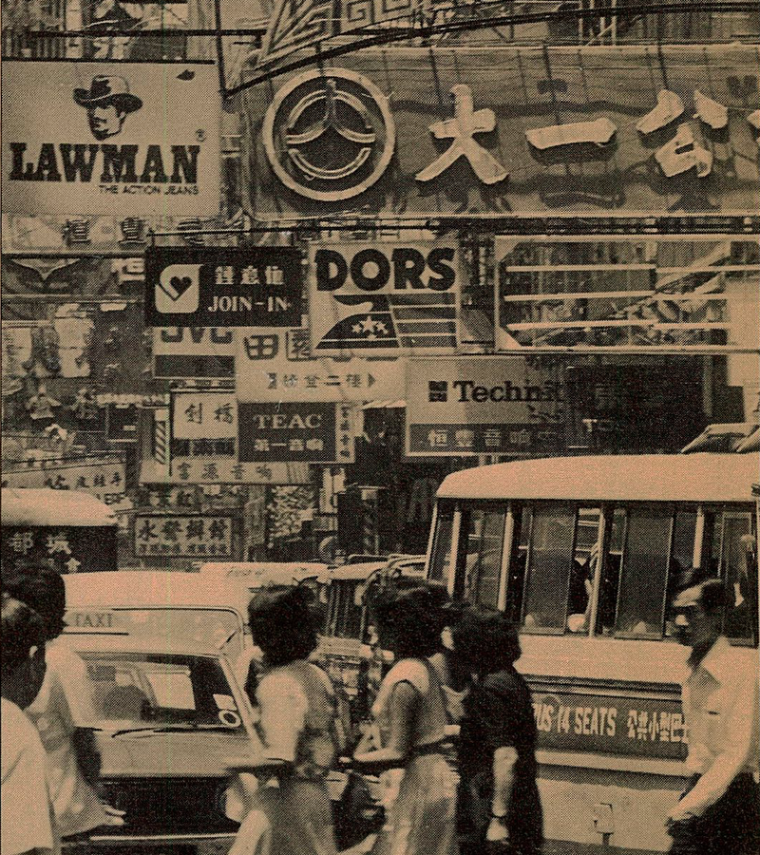

Hong Kong’s economy was dominated by international financial services and port services.

Over half of the export and import cargo handled by the ports in Hong Kong were transhipments of goods to other countries, in particular China.

Tourism was a major part of the economy. Hong Kong remained a popular destination for international tourists, receiving more visitors than Macau.

BCCI’s first presence in Hong Kong

BCCI’s presence in Hong Kong started with the operations of BCCI Finance International Limited (BCCI Finance, in short), with 99% shareholding held by BCC Holdings (Luxemburg) SA Luxembourg (the BCC Group). BCCI Finance was established as a merchant bank company, on 1 July 1974.

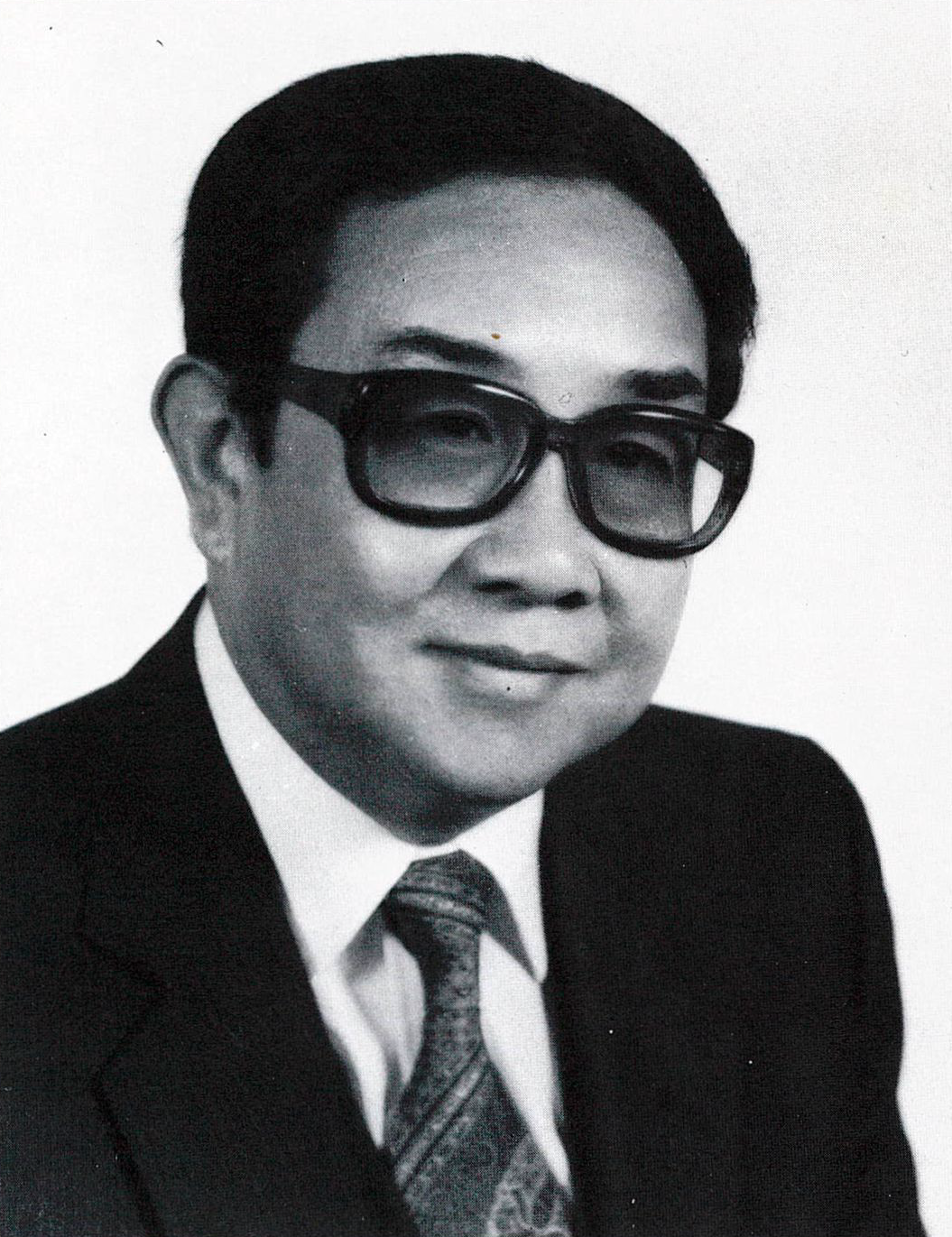

Mr Aslam Siddiqui, a senior BCCI executive and an experienced banker, headed the company as Managing Director, had arrived in Hong Kong that day with the task of setting up a new organisation, having previously only spent 24 hours in the territory, following an International Monetary Fund meeting in Tokyo in 1974.

.jpg) Mr Aslam Siddiqui was a junior officer in Habib Bank in Bombay when BCCI President, Mr Agha Hasan Abedi, was in the same bank as a management trainee officer. Both moved with Habib Bank to Pakistan after the partition of British India. Mr Siddiqui went on to serve in National Bank of Pakistan, Industrial Development Bank of Pakistan, as Managing Director of Commerce Bank in 1967 and after banks were nationalised in Pakistan, he took up the assignment with BCCI in Hong Kong.

Mr Aslam Siddiqui was a junior officer in Habib Bank in Bombay when BCCI President, Mr Agha Hasan Abedi, was in the same bank as a management trainee officer. Both moved with Habib Bank to Pakistan after the partition of British India. Mr Siddiqui went on to serve in National Bank of Pakistan, Industrial Development Bank of Pakistan, as Managing Director of Commerce Bank in 1967 and after banks were nationalised in Pakistan, he took up the assignment with BCCI in Hong Kong.

Mr Aslam Siddiqui joined BCCI in 1974 and left in 1982.

Since 1974, when BCCI Finance employed three officers, one secretary, two clerks and a receptionist, in the highly prestigious Citibank towers, the finance company developed as a quasi-merchant banking organisation with two offices: the head office and main office which was later situated in Alexandra House in Hong Kong with 6,000 square feet, and a branch in Mainland Kowloon.

BCCI Finance main office was located at:

1601 Alexandra House

16-20 Chater Road

Central HONG KONG

Tel: 5-263025

Telex 75483 BCCFI HX

BCCI Finance head office was finally relocated in separate premises at:

19-20 Connaught Road Central

Hong Kong

Tel: (852) 521 1601

Telex: 75483 BCCI Fl HX

_0.jpg)

Due to Hong Kong banking regulations, BCCI Finance company was unable to operate in the full sense as a bank. Chequing and savings accounts could not be opened, however term deposits could be accepted.

Originally, the BCCI Finance team found business in Hong Kong to be very sophisticated. Competition was fierce among the large number of foreign-owned banks and finance companies, and the marketplace was extremely well-informed.

The establishment of inter-bank market relationships proved difficult during the early days because BCCI Finance lacked a historical record and there was little response from the foreign banks. However, personal relationships developed with the Indian and Pakistan communities in Hong Kong attracted customers who operated in international markets and trade financing became the mainstay of the BCCI Finance.

BCCI built a reputation as an active lender as BCCI Finance participated in loan syndications for Korea, the Philippines, and Indonesia and correspondent banking relationships developed and grew, particularly with Indonesia, South Korea, Taiwan and Japan.

Additionally, portfolio management, investment advice and dealing activities in shares and bonds for BCCI clients became an important addition to this service-mix provided by BCCI Finance Hong Kong. While the Indian-Pakistan community provided 90 percent of the trade financing business, relationships also developed with the Chinese community.

In the 1970s around 115 foreign banks were active in the colony of Hong Kong, with approximately 200 finance companies. In an independent study of 160 finance companies in the early 1980s, BCCI Finance was listed ninth in size and among the first six in asset earnings ratios.

According to Mr Aslam Siddiqi, Managing Director, “From a business point of view, Hong Kong was a very stimulating and challenging society where competition is fierce. It is undoubtedly the most challenging environment that I have worked in. Coming from Pakistan, where markets are very protected and where a pre-conceived framework exists, it needs a dramatic re-adjustment to come to terms with the ever-changing canvas that makes up the Hong Kong picture. It is a totally free market where anything happening anywhere in the world has immediate impact. Hour by hour reassessments are necessary."

BCC Representative Office

Mr Aslam Siddiqui, Managing Director BCCI Finance, was also the Chief Representative responsible for overseeing BCCI’s country operations in the Far East and liaising with the regulators, primarily with the Hong Kong Banking Commission (later Hong Kong Monetary Authority).

The BCCI Representative Office was located at:

The BCCI Representative Office was located at:

23/F Admiralty Centre

Tower 1

18 Harcourt Road

Hong Kong

Tel: (852) 529 7031/6

Telex 62216 BCCHK HX

BCCI Far East Regional Office

BCCI established a Far East Regional Office in Hong Kong to handle additional functions that included monitoring and supporting BCCI's expanding operations and business development in several countries in the region.

BCCI Far East Regional Office was located at:

Admiralty Centre – Tower 1

21st Floor

18 Harcourt Road

Hong Kong

Tel: (852) 822 6228

Telex: 62216 BCCHK HX

Fax (852) 527 518/5

A dedicated China Division in the regional office focused on China’s economy, pursuing a banking licence, liaising and extending support to BCC representative offices in China, including Shenzhen branch after it was opened, and monitoring business generated for the BCC group network, in particular in Hong Kong involving the financing of foreign trade.

The regional office also had a very active Far East Regional Training Centre in Hong Kong.

New International Dimension for BCCI in Hong Kong

With the growing importance of Hong Kong as a gateway to China and the gradual move to open China’s economy it was even more appropriate that BCCI, possibly the only major bank to be truly international from its inception, should have a major banking presence in Hong Kong.

The activities of having a local bank of BCCI would be complemented by the BCCI Finance’s own operations which were selectively confined to the number of its clients. Together they would widen the coverage of the BCCI network in the region.

Hong Kong Metropolitan Bank was identified by BCCI Far East Regional Office in Hong Kong. The bank was established by the Bangkok Metropolitan Bank on 24 October 1960. Its founders were a group of ethnic Chinese based in Thailand.

In November 1972, a controlling interest in the bank was acquired by the Stelux Manufacturing Group. The Stelux Group, famous for their Bulova trademark watches, bought into the bank for investment purposes. At the same time, as Stelux took over, the Swiss Bank Corporation took a 30 percent shareholding in the Metro Bank.

Business in Metrobank started to grow steadily following Stelux Group's acquisition. Real estate and stock markets underwent a tremendous and fundamental change, which showered wealth and prosperity to an unprecedented degree on countless investors and speculators alike. It was also during this time that the bank began to expand its branch network.

BCCI acquires majority shareholding in Hong Kong Metropolitan Bank

In 1979, BCCI first bought a majority stake in the Hong Kong Metropolitan Bank, popularly then known as the Metrobank and already been engaged in retail banking for 17 years. Its customers, most from the ethnic Chinese community, were served by seven branches.

BCCI went on to acquire full ownership of Hong Kong Metropolitan Bank and it became a subsidiary of BCCI Holdings (Luxembourg) SA (the BCCI Group). The purchase of the Hong Kong bank fitted admirably with the aspiration of President’s to expand the BCCI's network of branches.

The Metrobank employed 143 people. Its head office and main branch and three additional branches were sited in Kowloon. There were three other branches on Hong Kong Island itself.

The bank mainly handled retail, personal and small business accounts. It also handled some large trade accounts and some foreign trade financing.

Hong Kong Metropolitan Bank Ltd Head office was located at:

Admiralty Centre

18 Harcourt Road, Tower 1

HONG KONG

Tel: 5 822 6228

Telex: 62216 MEHKG HX

This investment in a local bank in Hong Kong provided a new focal point for BCC’s activities in the Far East and South East Asia. There was already a BCCI Far East regional office in Hong Kong, and this office's co-ordinating function was strengthened by the addition of Metrobank which retained its independent identity, as did BCCI Finance International, while each complemented the other's activities.

BCCI took up the challenge of attracting business from overseas Chinese communities, of which the most important were in Thailand, Malaysia and Singapore. In time, marketing also included the western seaboard of Canada, and the USA were large Chinese communities.

An added benefit for the BCCI was the many Metrobank's clients with links with China. Another major factor was the proximity of the China mainland and its ever-increasing trading activity with the rest of the world, the majority in the developing countries with BCC branches.

Integration of Hong Kong Metropolitan Bank with BCCI systems and practices

The integration of the Metrobank into the BCC Group's systems and practices did not prove difficult. Its general manager, Mr Wong Kum Seng, was a former Singapore government official and banker, having worked previously with the Bank of America. The bank's systems were not that different from those of BCC - indeed, they shared a common tradition of UK banking standards considering that Hong Kong was a British Colony.

BCCI provided training at the Far East Regional Training Centre in Hong Kong to the local staff in Metrobank to take on additional responsibilities and understand the culture in BCCI. Some training took place in the BCCI London Regional Training and Development Centre, also known as BCCI London Training Academy. It was essential to upgrade their calibre and quality and preparing them for new challenges and fast evolution of BCCI.

BCCI also provided additional opportunities for the Metrobank staff to gain work experience world-wide in the BCCI Group and for Chinese executives to become familiar with the Group's operations.

Growth of Metrobank

The first task of the new Board of Hong Kong Metropolitan Bank was to create a stable base in its home market where keen competition existed between 103 local and foreign banking operations including Hong Kong and Shanghai Bank with over 700 branches claiming 50 percent of the total business.

The second task was to take full advantage of the international links provided in the BCCI Group network.

Hong Kong was a major importer of raw materials which were processed and then exported as manufactured goods. Substantial amounts of business were transacted between the Middle East and Hong Kong, and branches of the BCCI Group was able to feed the Metrobank with considerable business - contacts with Hong Kong exporters, import letters of credit and so on.

Other parts of Asia, like South Korea and Japan were becoming more involved in the Middle East. In many countries, overseas Chinese communities played an important part in business affairs. They were strongly encouraged by the active BCCI relationships team to build up links with, and benefit from, the BCCI Group.

With the increased sophistication of banking services introduced by BCC and the improved benefit package for employees, the nature of Metrobank’s work changed and varied resulting in an ever-increasing volume of business activities and gaining a strong foothold in the banking sector in Hong Kong.

San Francisco Agency

In 1981 Metrobank opened an Agency in San Francisco, California, USA, by autumn 1982 opened its twenty-first and twenty-second branches in Hong Kong. A twenty third branch was opened before the bank’s name was changed to Bank of Credit and Commerce Hong Kong Limited - BCC Hong Kong.

Some staff members of Hong Kong Metropolitan Bank

Mr Henry Wat was chief general manager and executive officer of Metrobank under BCC in 1983. He was a student at Queen's College, one of Hong Kong's oldest and most prestigious colleges before he began his banking career in 1948. He served in a number of leading international banks. Before he joined the Hong Kong Metropolitan Bank in June 1980, he was vice president and manager in a major US bank, with long experience in the South-east Asian marketplace.

.png)

Mr Yip Kam Ming joined Hong Kong Metropolitan Bank in 1960 as an office attendant, just a few months after the bank opened its office on Bonham Strand in Sheung Wan, then business centre of Hong Kong. Business was confined to banking services catering for the local Chiaochow clientele (Chiaochow is included in the territory of modern Vietnam).

Mr Yip recalled, "At that time, people did not accept the concept of banking, and preferred to hide their money in some secret place, or to stuff it into their pillows. As a result, business was so slow and quiet that we could put up a sign during lunch saying, 'Lunch hour, business closed!' The bank was a small one and no division of departments was necessary. We were a closely knit group of friendly people. In that era, the structure of company benefits was very different. Instead of having medical insurance coverage and the like, lunches and dinners were provided and we enjoyed about 20 months' salary a year."

Mr Yip was promoted to clerk and subsequently senior clerk in Metrobank in the span of a couple of years. The opening of the Causeway Bay Branch in 1974 created yet another promotional opportunity. Being a well experienced and dedicated staff member, he was transferred to fill the position of officer and later became one of the senior staff of the bank.

After Metrobank was acquired by BCCI, Mr Yip was promoted to assistant manager in July 1981.

Ms Jennifer Yu

In Hong Kong Metropolitan Bank, Jennifer Yu shared the responsibility for the Personnel and Training Department with Mrs Kezia Loong. She joined Metro Bank in 1980 just after it had become part of the BCC group. At that time there were 150 employees. The number grew to 500 and the need for a fully-fledged personnel department was necessary with responsibility for the welfare of indi-vidual members of the bank that includes salary, a very broad grading system, placement and career development.

Ms Jennifer Wu had previously worked on the administrative side of a large American bank. After Metrobank joined BCCI she found a huge contrast in style between the two. She recalled “One of the things we always emphasise to new applicants is the uniqueness of this organisation. But I sometimes wonder how far words can convey the full flavour of our culture. It's really something that needs to be felt. Sometimes people can feel uneasy at first with the way that we do things, with our apparent lack of structure and formality. But once they realise that this is a deliberate policy to promote self- knowledge and self-motivation, it can become the key to a very great happiness.

Hong Kong Metropolitan Bank’s Pacific Link

In 1981 the Hong Kong Metropolitan Bank established an Agency in San Francisco, California, USA to cover the Pacific coast of USA.

Chinese immigrants first came in large numbers to the USA in the 1850s, to escape the economic chaos in China and to try their luck at the California gold rush. When the Gold Rush ended, Chinese Americans were considered cheap labour. The state of California on the Pacific coast had the largest Chinese population who maintained their links with China through Hong Kong, both in terms remitting monies to their families, investing in Hong Kong and importing goods manufactured in Hong Kong and China for local consumption.

Mr Tony W Oei joined the newly opened Agency of Hong Kong Metropolitan Bank in San Francisco, California, USA. His grandfather was the founder of the China and South Sea Bank, which was one of the largest banks in China, but was nationalised by the Chinese government. As a student he majored in accountancy and his career followed this path while he was in Hong Kong in the 1960s.

Mr Tony Oei then moved to the USA in the 1970s and started a career in banking; he joined as Controller's Department, first with the Union Bank and later with the Bank of Montreal. He gained valuable experience in Money Management and Operations Department and Investment. He was made assistant controller of the Controller's Department and then controller and agent for the Bank of Montreal. In October 1980 he was promoted to assistant vice president controller and agent of this bank and subsequently joined Hong Kong Metropolitan Bank.

BCC Hong Kong: A New name for New Times

On 1 November 1983 the Hong Kong Metropolitan Bank became Bank of Credit and Commerce Limited Hong Kong with 99% shareholding held by BCCI Holdings (Luxembourg) SA Luxemburg (the BCC Group). It was a recognition of the growing importance of Hong Kong as part of the BCCI as a whole.

Henry Wat, vice chairman of BCC Hong Kong and former chief general manager and executive officer at Hong Kong Metropolitan Bank, had stated, "The change of name will enhance our customers' awareness of our relationship with the global BCC organisation. Since 1979 the growth and presence of our bank has greatly accelerated. It has reached a point where its activities have outgrown the image of a local bank."

The change of name of Hong Kong Metropolitan Bank (Metrobank) to BCC Hong Kong was accompanied by a well-orchestrated advertising campaign. All clients of the bank were informed of the change and reassured that it would only be to their advantage. All existing business was be carried on efficiently, without any administrative upheavals for clients.

Fifteen daily newspapers carried large advertisements, as did the main monthly financial publications in the region. At the same time, a 35-second television advertisement was shown on all three major channels.

BCCI family members in Metrobank’s 23 branches in Hong Kong and the Agency in San Francisco were a vital part in the campaign to put across through their personal dealings with customers the reasons for the change of name and greater opportunities involving foreign trade that the BCCI offered worldwide.

BCC Hong Kong after Hong Kong Metropolitan Bank

At the time the decision taken by central banks in the West to abruptly shutdown BCC on 5 July 1991, BCC Hong Kong was a highly visible bank in Hong Kong, with 26 branches and about 40,000 depositors who had entrusted it with $1.4 billion.

In addition, there were four offices of BCCI Finance and a BCCI Representative Office.

BCC Hong Kong was known for financing foreign trade and paying good interest rates on long-term deposits. While many of its depositors were Hong Kong Chinese, it also had a reputation for friendliness toward Third World depositors and borrowers.

State-owned Chinese banks and other important institutions in mainland China were major customers of BCC Hong Kong.

According to Hong Kong Registrar General Mr Noel Gleeson, who was in charge of steps to liquidate or sell the bank, BCC Hong Kong had “and certainly still has the nucleus of a good trade financing bank, They have a lot of Indian and Pakistani clients, Middle Eastern clients, Indonesians - a lot of Third World clients. And a lot of these people do business around the world through this bank.”

Regional Training and Development Centre - BCCI Far East Region

BCCI established a training and development centre in Hong Kong in the early 1980s. With the expansion of BCCI's global presence, the Hong Kong training centre went into skill training for branch managers first, followed by short sporadic courses in different types of bank transactions for employees in countries in the Far East. This was extended later to include the training of BCCI officers from other BCCI countries. The BCCI trainers in Hong Kong coordinated with the team in BCC International Management Development in central office London, they provided the training format and the Hong Kong team localised - customised the content.

BCCI Far East Regional Office monitored the marketing efforts of dedicated teams to solicit international business from other banks in the region for BCCI branches worldwide, including from banks in the People's Republic of China. Handling other banks' business was a source of additional income for BCCI. Officers were nominated from time to time to attend special correspondent banking business workshops in the Regional Training and Development Centre in Hong Kong.

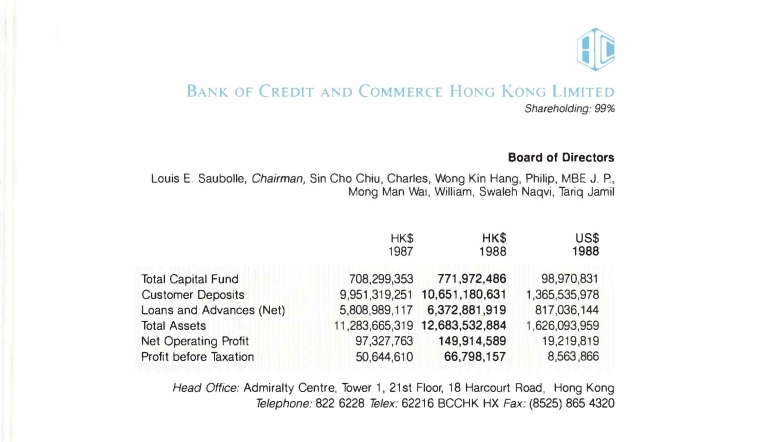

Financials 1988

BCCI closure

On 5 July 1991 the Bank of England with other central banks in the west (the college of BCCI's regulators) decided to abruptly freeze BCCI Group's assets and force the closure of BCCI's operating branches worldwide.

The priority of the governments and central banks in some countries was to protect their people and the local operations of BCCI continued in a different name after the assets and liabilities were acquired by private investors or another bank.

When the central banks in the west moved to abruptly shut down BCC, the Hong Kong government allowed BCC Hong Kong to remain open, saying that it appeared solvent and that there was no evidence that the local bank had engaged in fraud. The Hong Kong Banking Commissioner Mr David Carse said at the time that he did not know of any evidence of fraud by BCC Hong Kong. (Los Angeles Times, Aug. 10, 1991)

Government regulators around the globe, including the Hong Kong Banking Commission, had talked with BCCI group officials since 1990 about plans to restructure its worldwide operations into three independent banks, incorporated in the United Kingdom, Abu Dhabi, and Hong Kong. “The banking commission has been keeping a close watch on this bank (BCCHK) for almost a year now,” David Doo, a protest leader, said in an interview mentioned in the Los Angles Time (Aug. 10, 1991). “If there are any irregularities, they should have known long since.”

However, on 8 July 1991 the British Hong Kong regulators ordered BCC Hong Kong to close, on the grounds that, despite its separate legal and financial status, it might not be able to withstand the impact of the worldwide controversy engulfing the group as a whole. (Los Angeles Times, Aug. 10, 1991)

Negotiations for the sale of the BCC Hong Kong branch to an Indonesian group reportedly broke down after the Abu Dhabi UAE majority shareholders of BCCI refused a demand by the liquidators to provide unlimited guarantee.

Provisional government liquidator Mr Noel Gleeson said he expected an eventual payout to depositors in the Hong Kong bank to total 70 percent to 75 percent. The bank had an estimated $1.4 billion in deposits when it was closed in July 1991 (UPI ARCHIVES FEB. 19, 1992).

Creditors of BCC Hong Kong received full payment plus interest. This demonstrated that not only was BCC Hong Kong capable of repaying all its debt, but it also had HK$1 billion to pay for the liquidation bill. The inevitable question raised by creditors was whether it was justified to liquidate the solvent and financially sound bank.

The BCCI Group majority shareholders considered the abrupt action by western central banks to shut down BCCI in 1991 was unjustified when they already had detailed discussions with the Bank of England and other regulators on a restructuring plan and would have injected further capital, if required.

In a 24-page report not made public but sent to some 60 central bankers worldwide, the United Nations Center on Transnational Corporations said that by simply shutting down the 70-nation banking network that financed international trade of $18 billion a year, the economic damage fell hardest on countries like Nigeria, Bangladesh and Zambia, where B.C.C.I. was an important institution. (New York Times, Feb 5, 1992)